Howdy, traders. It’s Bryce here.

Let’s get this Labor Day weekend started! I hope everyone’s having a great time with their loved ones.

If you’re taking a moment to read this because your trading brain never sleeps, kudos to you. I see you. I appreciate you.

I recently put out a couple of short videos on what advice I’d give myself as a new trader and the right amount of risk to use per trade. Definitely check those out while you’re waiting on your barbecued eats this weekend.

The market indexes hit some very oversold territory on Thursday and saw a bounce back on Friday morning. But as the old saying goes, they took the stairs up and the elevator down as all three burrowed into red by the afternoon.

So, let’s all hope for a thunderous open on Tuesday. Here are the stocks I’ve got my eyes on…

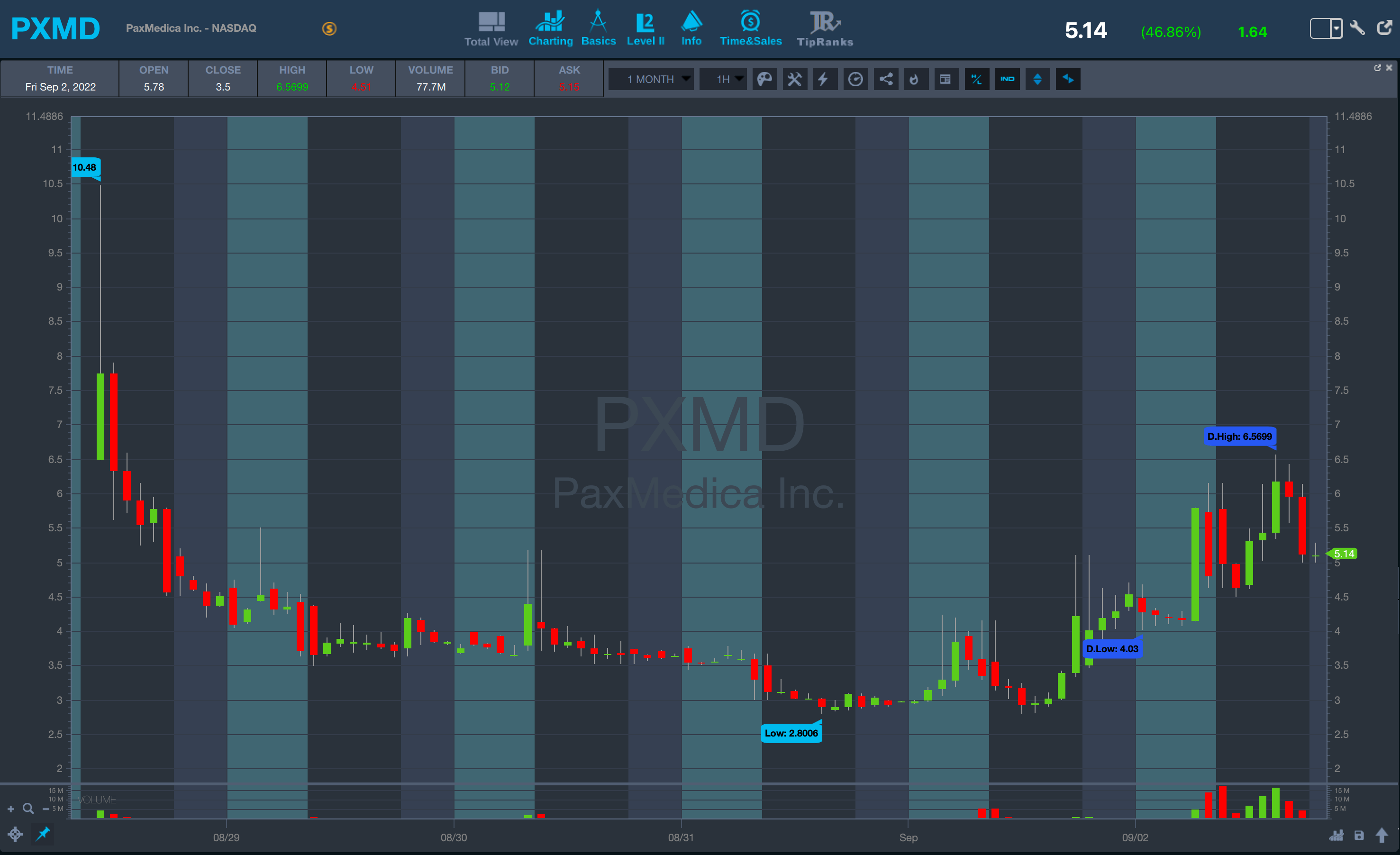

PaxMedica Inc. (NASDAQ: PXMD)

As the indexes dropped yesterday, PaxMedica rose from the ashes, jumping over 80% intraday.

The stock is a recent IPO that debuted on Friday, August 26th. IPOs have definitely been hot runners lately. But what specifically sent it soaring yesterday?

Word on the street is that insider purchases (by its chairman and another shareholder) were driving the uptrend.

PXMD closed at $5.17 yesterday, up 47.71% on the day. On Tuesday, look for a break of its intraday high of $6.57 for a possible fresh breakout.

ShiftPixy (NASDAQ: PIXY)

Much like the gig economy this stock’s platform supports, PIXY’s a bit of a wild one. Here’s what it’s got going for it: it’s a former runner and it bounced off support twice on Friday.

PIXY ran up to around $40 on Thursday after news of a reverse stock merger got out. But on Friday, it promptly erased the previous day’s gains and sank below the closing price.

PIXY closed at $14.01 on Wednesday and touched $14.00 on Friday. That’s clearly a support level it needs to hold. At the upper end of that range is the $20 resistance level.

As the markets dug into red, PIXY closed at $13.60 on Friday, down 33.92% on the day. Now it needs to reclaim that $14 support level, and fast, if it’s gonna bounce on Tuesday. Only positive PR news can save it now! Or a chat pump.

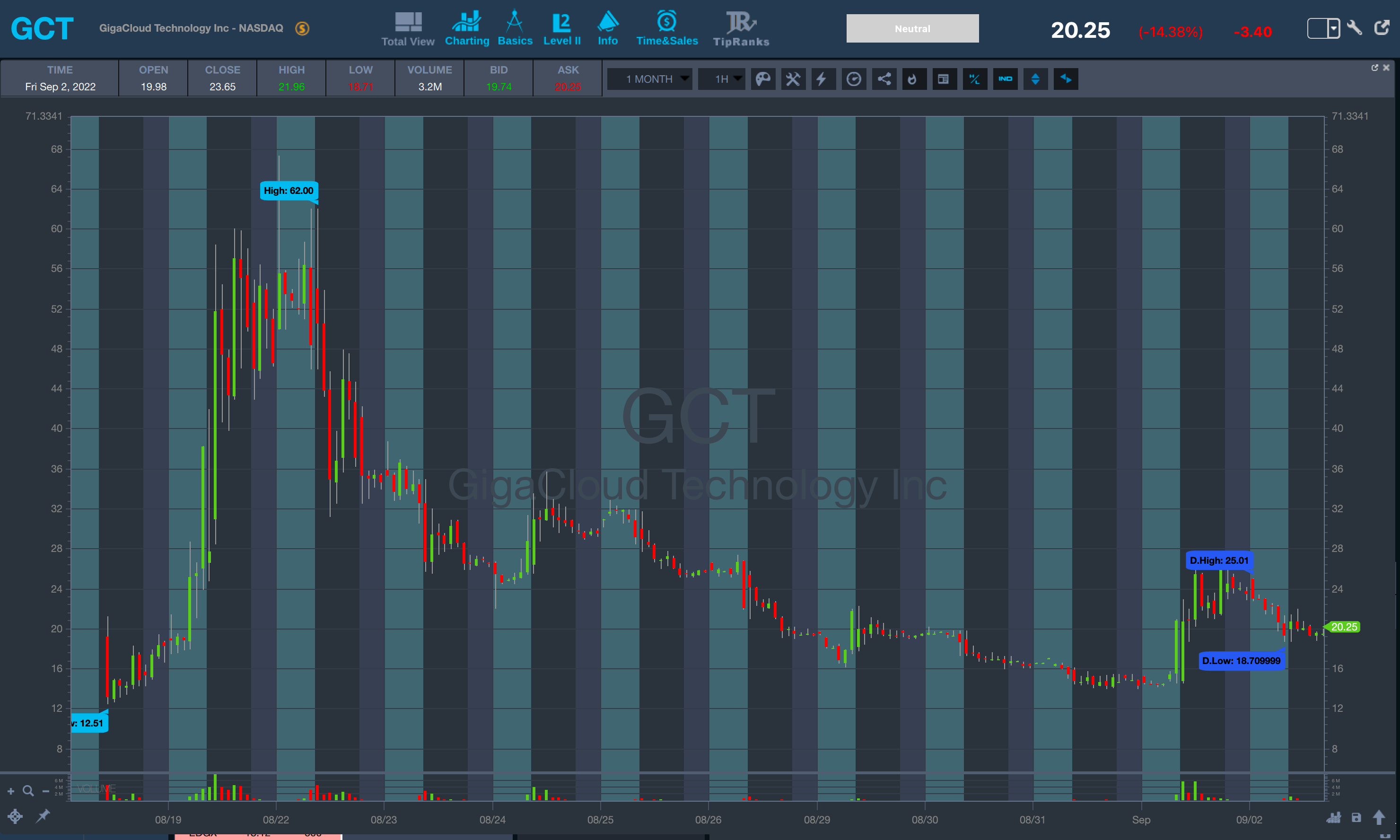

GigaCloud Technology Inc. (NASDAQ: GCT)

GigaCloud Technology has an interesting chart … it’s another IPO play that debuted back on August 18th, closing at $15.69. The next day, August 19th, it closed at $48.01 after hitting an intraday high of $62.

Always remember that IPOs are notoriously volatile trading instruments. Our Conservative-Trader-in-Chief, Tim Bohen, prefers not to touch IPOs until they’ve broken past their previous highs.

I think that’s wise advice, but I’m looking at a different play. On the 5-day chart, Friday’s price action saw GCT consolidating sideways around the $20 level, after a 50% retracement from Thursday’s pop to around $25, with strong support down at the $15 level.

Friday’s intraday high was $21.96. On Tuesday, look for a break of $22 for another possible run to the $25 resistance level.

Conclusion

The best traders watch, learn, and practice during all market conditions. That’s how they become professionals.

Some plays will be so simple, they’ll feel like you’re printing money. But others will require a little more finesse, patience, and advice from trusted traders.

You can win in any market, you just need to learn how to play the game. Let Matt and I show you how it’s done.

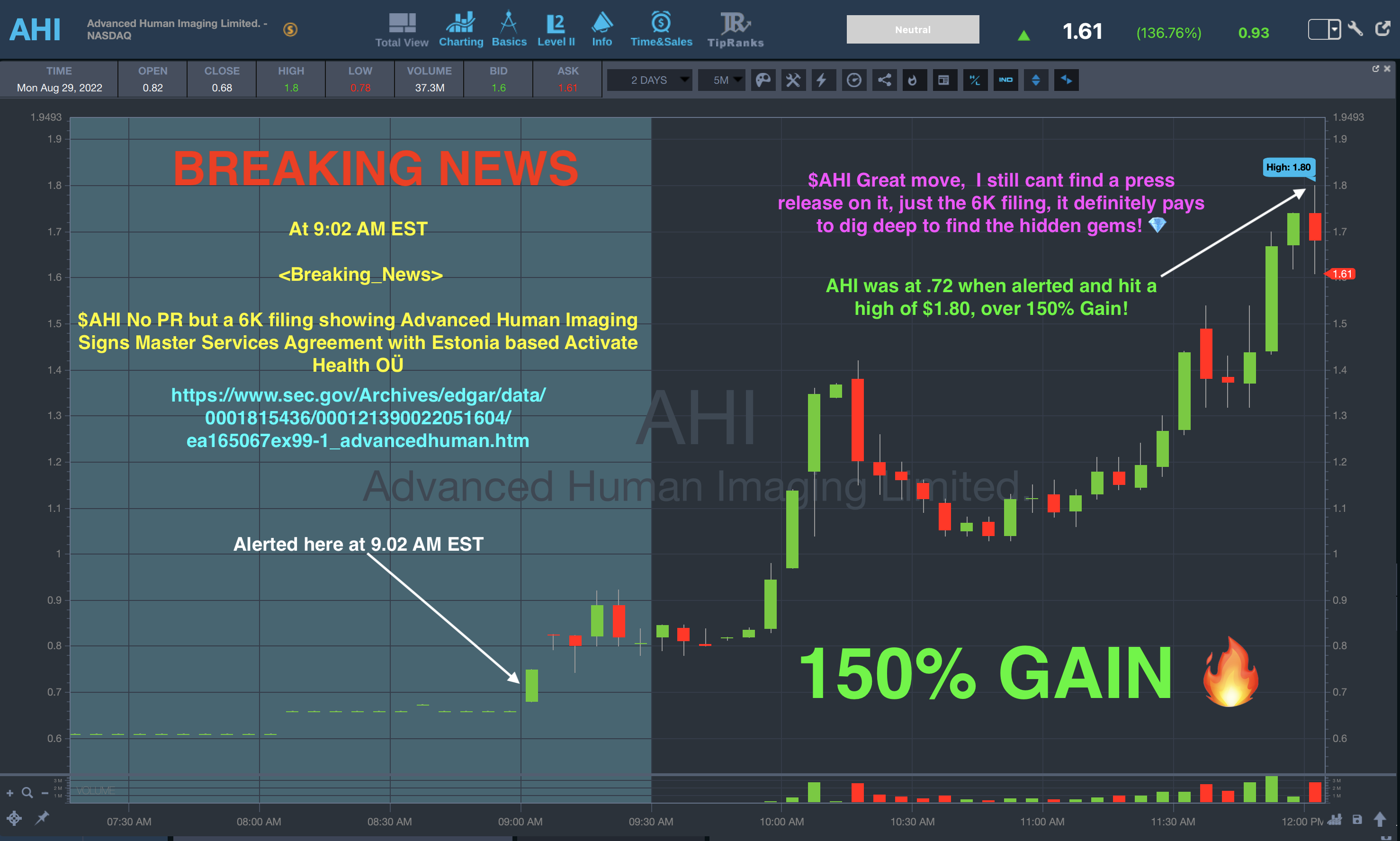

Want to be alerted to hot trade ideas before anywhere else?

Breaking News Chat is the alert service that traders can’t get enough of. Two former financial analysts scour the stock market and news for stocks that could potentially spike and alert the room allowing you the chance to get in on the action.

Check out the alert for AHI on August 29th:

This is a tool you’ll want in your trading toolbox.