Happy Sunday, everyone. It’s Matt here.

The closer we get to Ethereum’s (ETH) big event, the more speculation you can expect to see.

So how will this impact crypto? And what should you do if you own ETH already?

There’s a chance that traders’ expectations for what will happen and what will actually happen are far apart. That could definitely have an impact on the price action.

So let’s talk about what you can expect, and get you some good crypto tickers to watch this week!

What Happens After Ethereum Merges?

There’s a ton of anticipation right now surrounding Ethereum’s transition from a proof-of-work (PoW) model to a proof-of-stake (PoS) model.

With good reason. It’s a huge deal. And we covered it some in this post.

But the transition comes with some caveats, and they could make all the difference in price action once The Merge is complete.

For one thing, it won’t be an instant process. The Merge will pave the way for future progress when it comes to lowering gas fees and speeding up the network, but it won’t happen immediately.

Ethereum has made that very clear, but a lot of hype pieces haven’t. A lot of traders don’t do their due diligence though and aren’t a patient lot, so when they find out how long progress will take, they might sell their stake.

So where’s the opportunity? Speed and price efficiency will come in time, but there’s another potential catalyst: new large-scale investors.

The Merge will be a first-of-its-kind event. If all goes according to plan, it could open doors to new use cases and investor interest. That could definitely keep price action in an uptrend.

My Crypto Picks for This Week

Filecoin (FIL)

This is my top watch. It was set up for a serious breakout, but it, unfortunately, pulled back with the rest of the risk assets at the end of this week. It had a strong range going between $8 and $9, but on Friday, it pulled back below $7.

This needs to reclaim its former range and hold a breakout above $9 to get into it. From there, it would have a lot of upside potential.

Storj (STORJ)

This is a sympathy play on FIL, so it depends on FIL doing well to also do well. Its price is more attractive to people who like penny stocks given that it’s at about the $0.50 range.

It would need to hold a break above $0.75 for a meaningful trend change. Over $1 to be safer.

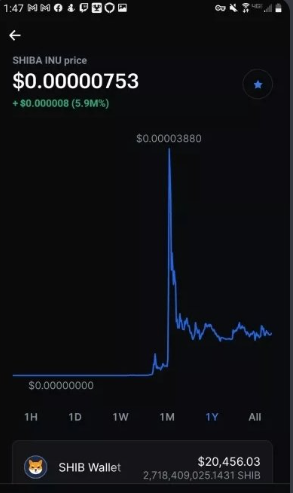

Ethereum (ETH)

ETH ran up around 100% since its bottom in June, thanks to the buzz going around about The Merge. So it’s certainly overextended now and we’re in tricky territory. At the end of this week, (BTC) pulled back, as did the Nasdaq, and ETH.

ETH would need to break past the $2,000 key level to signal further possible momentum to the upside. Next resistance is at $2,500 and $3,000.

Conclusion

This is the month to uplevel your crypto knowledge so you can be ready for takeoff again.

We’ve got a $5 sneak peek membership you can use to discover our review sessions, email recaps, and experience VIP customer care.

My buddy Kyle Williams (multi-millionaire trader) and I also give in-depth talks on the state of the markets based on high-level research you won’t find for $5 anywhere else. Join us in the War Room today!