Last week was a massive one for tech names like Meta Platforms, Inc. (NASDAQ: FB) and PayPal Holdings, Inc. (NASDAQ: PYPL), which saw their shares take an absolute beating…

However, it wasn’t all bad for tech stocks … Amazon.com, Inc. (NASDAQ: AMZN), Alphabet Inc. (NASDAQ: GOOG), and Snap Inc. (NYSE: SNAP) were all big earnings season winners.

It’s still unclear whether it’s time to buy the dip in growth stocks…

But that doesn’t mean we can’t find other opportunities in this market.

Bryce and I are being hyper-selective on what we’re taking.

But there’s always something we’re watching.

So … Let’s get into the watchlist!

But before that, I want to let you know about this cool new Tim Sykes presentation happening on Wednesday night. He’s making money while he sleeps! Wanna see how he does it? Click here NOW to learn more and reserve your spot in this NO-COST workshop!

Matt’s Picks

Here’s what I’m watching this week…

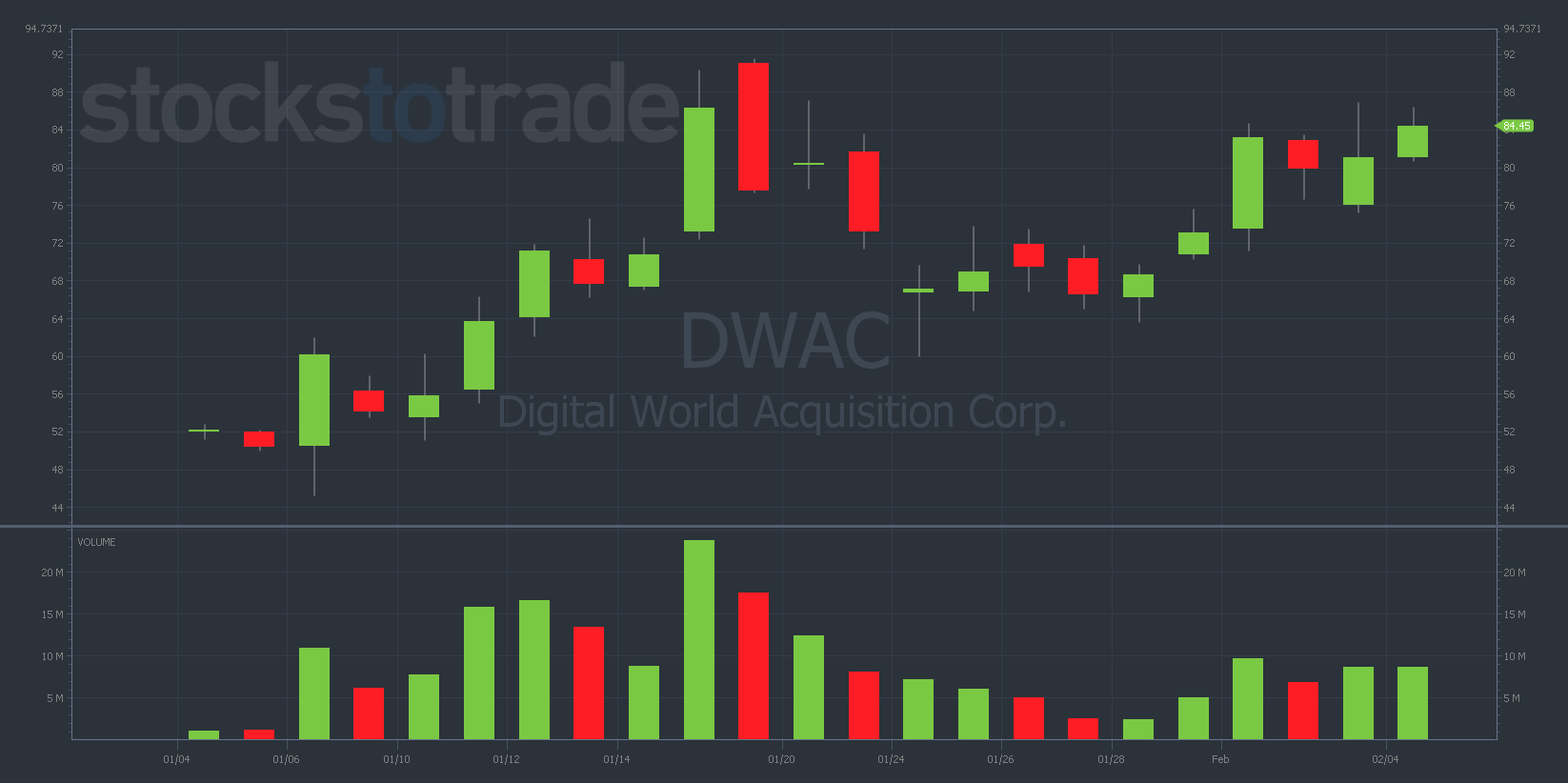

Digital World Acquisition Corp. (NASDAQ: DWAC)

DWAC has done wonders for a lot of traders over the past few months…

The hype behind this stock isn’t going away … And it has a beautiful technical setup that makes the stock pretty enticing.

It’s had a tough time breaking through and holding the $85 level, so I’d watch that before going long — unless you just want a quick scalp.

If it breaks through $85, DWAC has solid breakout potential.

Knightscope, Inc. (NASDAQ: KSCP)

KSCP had a big run-up to close January and is now bottoming out. That means I’m watching for a First Green Day soon…

It was the same thing I looked for with Vinco Ventures, Inc. (NASDAQ: BBIG) a couple of weeks ago. It didn’t work out exactly as I had hoped, but the setup was there.

KSCP looks awfully similar…

That doesn’t mean it’ll pan out. But the First Green Day is a powerful setup that, when executed properly, can deliver awesome results over a period of a few days.

Bryce’s Picks

Hey everyone! Here’s what I’ve got my eye on right now…

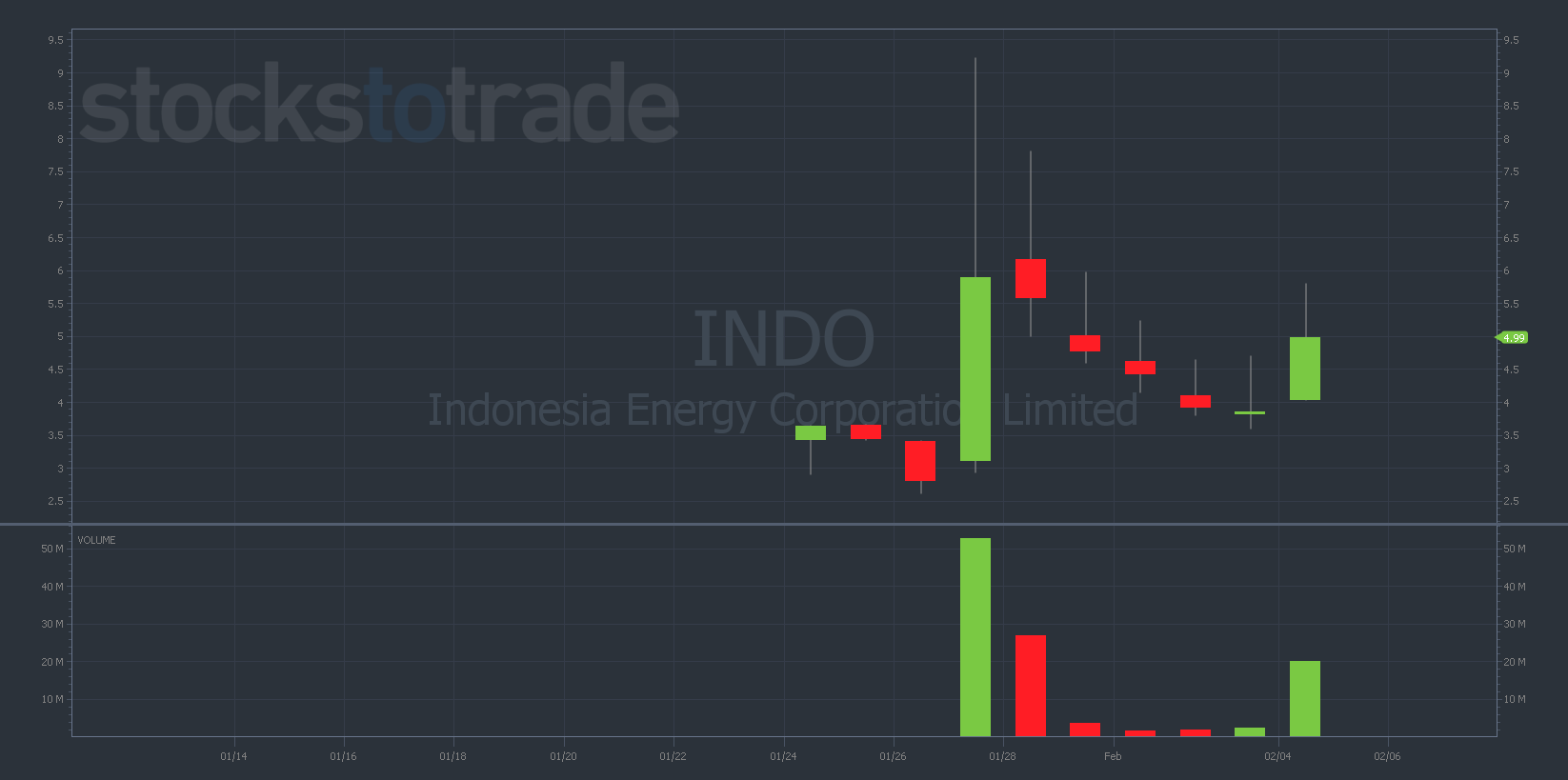

Indonesia Energy Corporation Limited (NYSE: INDO)

SCAMEX (NYSE American aka American Stock Exchange) stocks usually scare me. But INDO has delivered nicely over the past month…

It’s had a few really nice days — including a 44% run on Friday.

INDO struggled to hold VWAP after its big run on Friday, which worries me a bit for this week. But it seems to offer scalping opportunities every single day…

Those are the kind of long plays I’ve looked for lately, so that’s why this stock intrigues me. I like to be in and out of long positions pretty quickly with liquidity so weak right now.

The setup is there for some pops. Just be careful … There could be some fakeouts.

Redbox Entertainment Inc. (NASDAQ: RDBX)

Movie time, anybody?

RDBX went bonkers on Friday, running 29%. It had a big jump in premarket trading … And once RDBX broke that level in the afternoon, it was up, up, and away!

This stock tanked over 60% last week after an 8-K filing to the SEC about its slowing business spooked the market. Sometimes a stock being oversold is enough of a catalyst for it to start running…

This stock sucks. It probably deserves to be down this much. But we’re playing volatility and momentum here.

As long as the market thinks RDBX is still oversold, there’s a chance to get in there and make a trade. And if not, it could be a short opportunity!

Conclusion

It is SO important for you to remember that there are always plays out there…

Things have changed, but you now have an opportunity to learn new tickers, strategies, and setups. That will help a ton in the long run.

Never trade with fear. Be curious — but trade with conviction!