Howdy traders, it’s Bryce here.

Happy Saturday.

And happy market highs!

We did it! Pat yourself on the back. You were stellar. I mean, truly extraordinary.

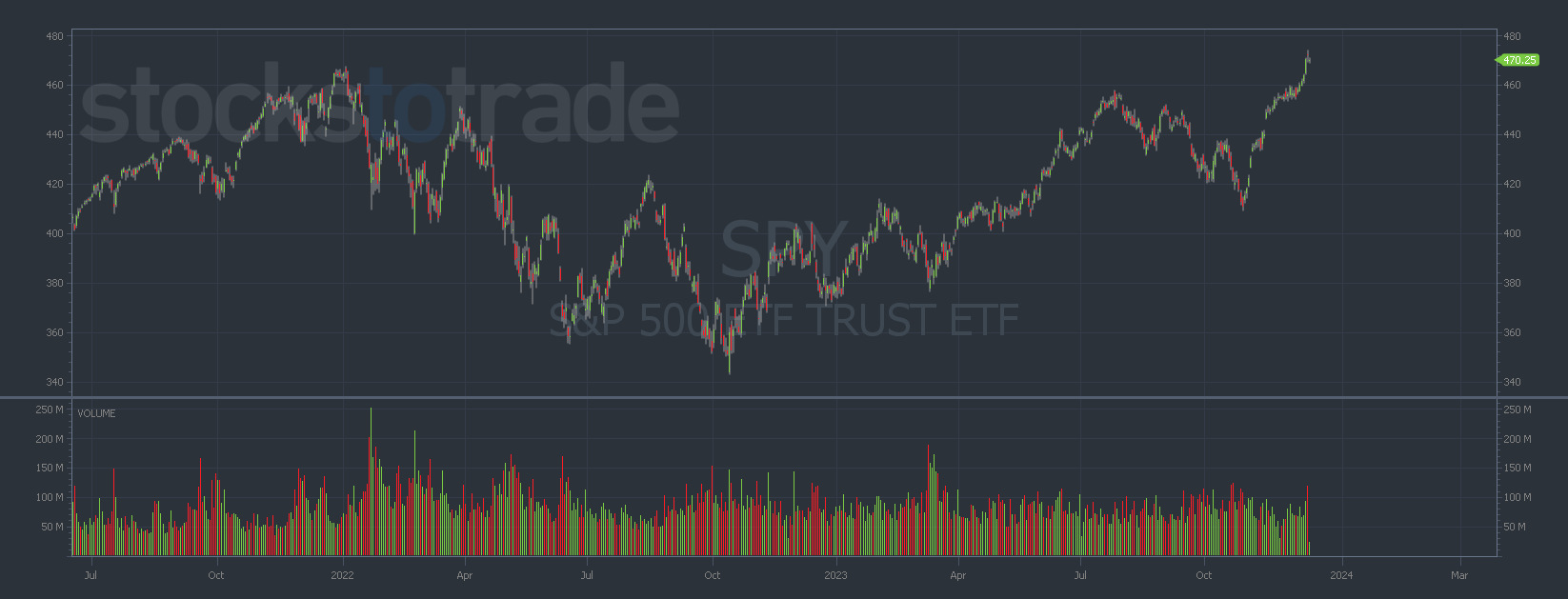

After a sketchy 2022 fraught with recessionary fears that lingered into 2023 … Major indices pushed to all-time highs last week.

Take a look at the S&P 500 ETF Trust (NYSE: SPY) below.

SPY chart multi-year, 1-day candles Source: StocksToTrade

How far we go from here is anyone’s guess. But here’s what I know for sure:

The profit opportunities are ripe and juicy on account of this bullish momentum.

And I can spot these plays from a mile away. We’ve been talking about them for weeks now.

- Biotech

- Recent and hot news

- Below $5

- Spiking at least 20%

- Low float

- High trading volume

It’s like clockwork.

I almost feel bad that we talk about the same things every day. But then I realize …

These are the facts. This is what’s working RIGHT NOW.

Monday morning is our next opportunity to snag some profits. And things will likely get out of hand.

That’s what I love about this niche, the volatility is next level. I remember Tim Sykes once called it, “the true Wild West”. And he’s right. You won’t find this kind of insanity in any other industry.

If we play it right, we can make out hand over fist. But make sure you’re following the right plays.

Keep reading for my Monday watchlist.

Monday Watchlist

There’s a handful of biotech stocks I’m watching.

If I were you, I’d write these down.

But first, understand that each of these stocks is at a different place in the spike.

We can’t expect to play the same pattern on each stock at the same time. If it were that easy, everyone would be a millionaire.

As it turns out, the best things in life don’t usually come easy. If you made it this far, I assume you know a little bit about what I’m saying. Trading is hard. And it’s even more difficult for those wandering without a path or a guide.

The Next Trillion Dollar Chipmaker After NVDA (Not AI)

Is this little known chipmaker the next NVDA?

It has nothing to do with AI, but this company’s patented chip could generate NVDA sized gains in the coming months…

Companies like Microsoft, Intel, and Google are all quietly racing to be at the forefront of this new phenomenon…

But unfortunately for them…

This one small company holds the key to this revolution…

That’s why I’m here.

We’re interested in the following biotech stocks because they fulfill most factors of the checklist I shared in the introduction.

And from a multi-day perspective, some of these tickers are consolidating and/or moving toward the breakout level.

This is my list …

- Verrica Pharmaceuticals Inc. (NASDAQ: VRCA)

- Cardio Diagnostics Holdings Inc. (NASDAQ: CDIO)

- Nkarta Inc. (NASDAQ: NKTX)

- C4 Therapeutics Inc. (NASDAQ: CCCC)

- Intensity Therapeutics Inc. (NASDAQ: INTS)

- ReShape Lifesciences Inc. (NASDAQ: RSLS)

- Shattuck Labs Inc. (NASDAQ: STTK)

- Aileron Therapeutics Inc. (NASDAQ: ALRN)

I know it’s a lot of stocks.

This niche is on fire right now.

Don’t worry. You don’t have to understand the catalysts to trade them, necessarily.

It’s a dangerous habit to get into. Every professional does research before trading a stock. But for Monday, IF YOU FOLLOW ALONG, everything will be fine.

The Rules …

We use a specific process to trade.

My mentor, Tim Sykes, developed it over two decades ago. And the rules help keep our accounts safe.

First of all: Cut your losses quickly.

If a trade starts to go against you. Just exit the position. These stocks have been spiking for decades. And they’ll continue to spike. The market will always be here. So don’t get frustrated if one trade doesn’t go well.

Secondly: Only pay attention to the best plays.

There are a lot of stocks moving every day. And depending on Monday’s price action, some of the stocks I shared above likely won’t offer the BIG opportunities we want. Watching a crappy small play could distract us from the real winner.

Third: Trade like a sniper.

We only enter a position when we see the price action match one of our patterns. CCCC spiked 600% last week. But it wasn’t a straight shot to the top. I don’t want to get stuck on the wrong side of this volatility. Instead, I pick my trades carefully and sit in cash the rest of the time.

I can’t share the patterns I’m using on Monday because I have to see the price action first.

Anyone who tells you they’ve got a surefire trade plan is lying. Or they’re delusional.

Anything can happen at any time. That’s why it’s safest to REACT to the price action instead of predicting it.

Tim Sykes and his other millionaire students are holding live streams this weekend to prepare. And if you want the best chance at profits, you should follow along when the market goes live on Monday.

They hold live streams while the market is open too …

Bookmark it so that you can join again on Monday.

You don’t want to miss this momentum!

Cheers.