Hey traders, it’s Bryce here.

He’s done it again!

Every Friday, my mentor, Tim Sykes, looks for a very specific pattern in the market …

And last weekend he pulled a whopper!

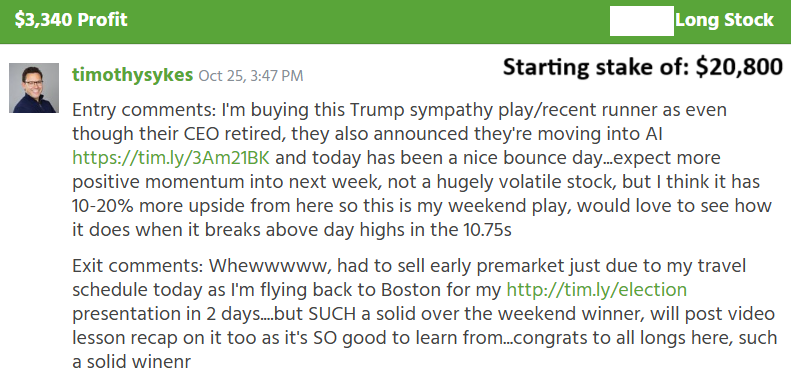

See his trade notes below:

Source: Profit.ly

Traders who understand this price action will recognize these opportunities without a problem.

But new traders might not have enough experience to truly capitalize.

That’s why, today, I’ll show you the EXACT position that Sykes used to profit from this hot election stock.

Take notes!

The election isn’t until next week … Theoretically this stock could follow the exact same weekend pattern into next Monday!

The Next Trade Opportunity

A lot of new traders aren’t willing to wait until Friday for this setup … They want to profit TODAY.

Heads up: The market doesn’t care what you want.

It would be great if we could all make $1 million in the market every day. But it’s not that easy. We can only profit as much as the market is willing to give us!

That’s why, for new traders who are just starting out, this weekend pattern is one of the best setups!

There isn’t any pressure to overtrade.

- You probably work a day job.

- Maybe you have a family to raise during the day.

- Maybe you got to school …

Whatever the reason, most people can’t drop everything to trade all day long.

I can relate, Matt and I started trading during college. We had to juggle classes, homework, and the biggest runners in the market 😅.

Take it from me, one good trade a week can make all the difference for your account!

Work your day job, take care of your family …

>> And look for this price action at 3 P.M. Eastern on Friday <<

Sykes’ position from last week’s election runner, Phunware Inc. (NASDAQ: PHUN) is overlaid on the chart below. From Friday to Monday, every candle represents one trading minute:

PHUN chart multi-day, 1-minute candles Source: StocksToTrade

The Thought Process:

The weekend pattern starts with a volatile stock that’s spiking higher on Friday.

We already knew that PHUN was volatile because of its relationship to Donald Trump. The company helped Trump in his former election race, and ever since then it’s shown us volatility relating to the former President.

The recent AI news from October 16 was another key factor: The company announced its intent to develop a generative AI platform.

This stock has a foot in the two hottest sectors in the market: AI and the U.S. election.

When the price spiked on Friday, Sykes waited until the chart showed consolidation into the close.

The consolidation is a hint that buyers are waiting below the current price level, keeping it propped up.

Over the weekend, when the market is closed, other traders may see the bullish momentum and buy shares. That leads to a Monday spike.

That’s the basic idea of the trade. But it’s most important that you understand the underlying price action and proper entry levels.

There’s a science to this! Follow the rules.

Watch for this price action on Friday.

And watch for PHUN’s volatility to grow as we approach November 5!

Cheers,

Bryce Tuohey

*Past performance does not indicate future results

The Most Critical Step To Becoming A Wildly Successful Trader

There’s only one thing you need to do in order to become a wildly successful trader. It’s the same thing all 40+ of my Millionaire students did at the start of their careers.

I can’t guarantee it will make you rich. But if you get this wrong, you can kiss your trading dreams GOODBYE…