Howdy traders, it’s Bryce here.

Investors are getting tricked right now …

But I’m focused on my treats.

Welcome to October, the market still shows a decent amount of fear. Last Friday the S&P 500 ETF Trust (NYSE: SPY) ended in the red. This morning it gapped lower and continued the downward momentum.

Where we go from here: Nobody knows.

You can either get caught up in the larger market horror … Or you can focus on low-priced runners.

It’s only Tuesday morning and yesterday we already saw a 50% trade opportunity on IceCure Medical Ltd. (NASDAQ: ICCM).

If you missed it, don’t worry. I’ll show you the pattern to use and how to catch future spikers.

Let’s get to it …

Support and Resistance

I’m not buying stocks at random.

There’s a specific process to follow for profits, and it includes important tools like support and resistance.

But we can’t look at ANY stock and trade the support and resistance levels.

We need to be watching the RIGHT stocks.

ICCM was an obvious trade because it fits our criteria for a strong spiker …

- Past spiker

- More than 400% on December 20, 2022

- Hot sector

- Biotech

- Recent news

- Independent study supports ICCM’s breast cancer outpatient procedure

- More than a 20% spike in premarket

- More than 120%

- Intraday trading volume above 1 million shares

- 102 million

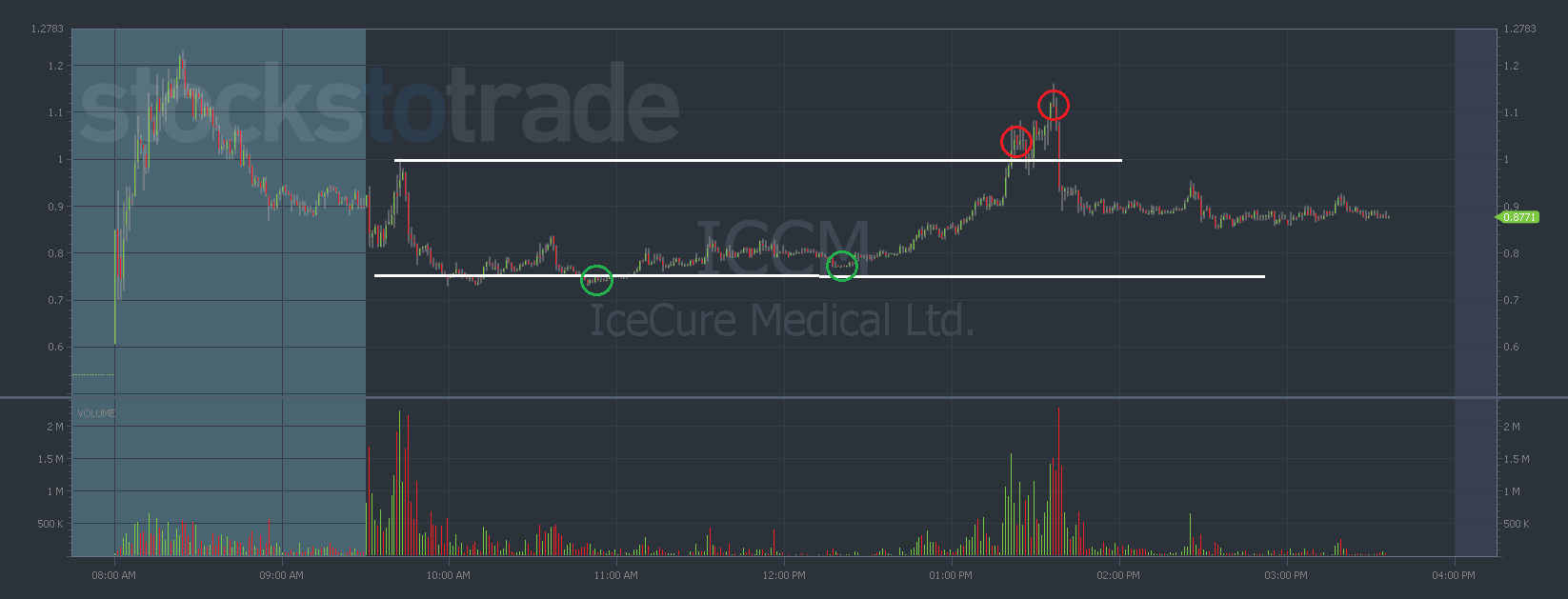

Once you’ve got eyes on ICCM, it’s just a matter of playing off the support and selling into resistance.

Once the market opened, the stock showed some initial volatility and then started to consolidate around $0.75.

That consolidation is key. That’s where we want to build a position, and if the play fails, that’s where we want to cut our position.

The goal is to sell into resistance …

ICCM chart 1-day, 1-minute candles (Source: StocksToTrade)

But it’s harder than it looks.

Especially when it comes to today’s runners …

Today’s Opportunities

Volatile stocks like to follow the same patterns, but they don’t look the exact same.

This is an inexact science. And like a snowflake, every stock’s chart looks a little different.

How will you know which stocks are hot today?

How will you know which patterns to trade?

That’s where the live streams come in handy …

Take it from me: To consistently succeed in this niche, you need a ton of market experience. And market experience can be costly in the beginning. New traders tend to lose more than they win.

A trading live stream helps us gain experience without the market exposure.

We’re holding live streams all day long …

There are small-account traders like us gearing up to profit today.

This is your chance to see what it’s REALLY like!