Hey traders, it’s Matt here.

Is it true??

Is the market finally approaching interest-rate cuts??

I’ll believe it when I see it, lol.

I’m not a negative Nelly … I’m just trying to be realistic.

Traders who try to predict the future often get burned.

But … With that said, the entire market is talking about rate cuts as if it’s a certainty this time around.

Take a look at some of the headlines below from last week:

If the FED decides to cut rates this week, it will be the first time since the rate hikes began in early 2022.

This is a HUGE catalyst for the market.

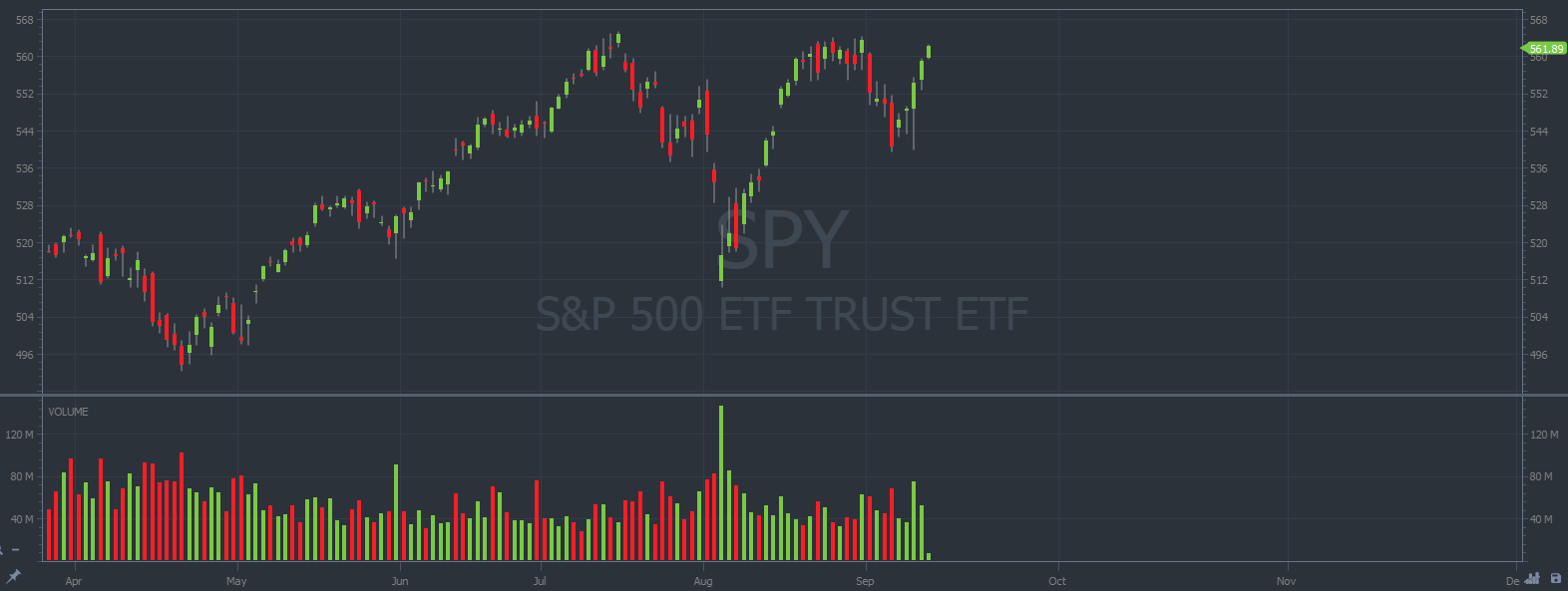

A market that’s already volatile and trading near all-time highs … Take a look at the S&P 500 ETF Trust (NYSE: SPY) below, every candle represents one trading day:

SPY chart multi-month, 1-day candles Source: StocksToTrade

Now, nothing is a 100% guarantee in the market.

There are three different scenarios to expect this week …

- The FED doesn’t cut rates (that would be spicy, lol).

- The FED cuts rates by 0.25%.

- The FED cuts rates by 0.50%.

And depending on which catalyst the market already priced in … The reaction to these three possibilities could be wildly different.

Don’t get confused!

>> This Is Our Plan To Capitalize On FED Volatility This Week <<

Plus, you need to make sure you’re watching the right stocks. I included a watchlist in today’s blog post.

The hottest stocks as we approach a possible interest-rate cut this week:

Market Volatility

I’m most interested in market volatility.

Traders need volatility to profit.

And a possible interest-rate cut could create A LOT of volatility.

There aren’t any specific stocks that are tied to a possible interest-rate cut, but there are volatile stocks still in play that could benefit indirectly from the volatility.

At the top of my list is Applied Blockchain Inc. (NASDAQ: APLD). The stock started to spike after the market learned of NVIDIA Corporation’s (NASDAQ: NVDA) investment in the company.

It already launched 100%* … And the price is consolidating below the breakout level.

I like this play because NVDA is a huge name in the market. Any stock that NVDA is interested in is bound to garner a lot of attention.

Plus, APLD isn’t the first NVDA investment to spike higher …

SoundHound AI Inc. (NASDAQ: SOUN) spiked 350%* over several days after the market learned that NVDA invested in it earlier this year.

Take a look at the daily chart below of SOUN:

SOUN chart multi-month, 1-day candles Source: StocksToTrade

Then, Serve Robotics Inc. (NASDAQ: SERV) spiked 810%* over multiple days with the same catalyst:

SERV chart multi-month, 1-day candles Source: StocksToTrade

APLD is the newest NVDA investment stock, and it’s poised to shoot higher this coming week.

Bullish momentum from a rate cut would help propel the price even further!

Watchlist Stock #2:

Every Friday, we look for the same price action.

The incoming weekend can inspire a specific trade pattern on the market’s hottest stocks.

Last week, on Thursday afternoon, my mentor Tim Sykes held a LIVE tutorial to ensure that students were prepared to trade Friday’s runner.

And as the market closed on Friday, Sykes followed the Friday strategy and bought shares of Azul S.A. (NYSE: AZUL).

See his notes below:

Source: Profit.ly

You might not have been prepared to buy shares on Friday, but Monday’s price action could give us more trade opportunities!

Keep an eye on this #1 runner from Friday.

Watchlist Stock #3:

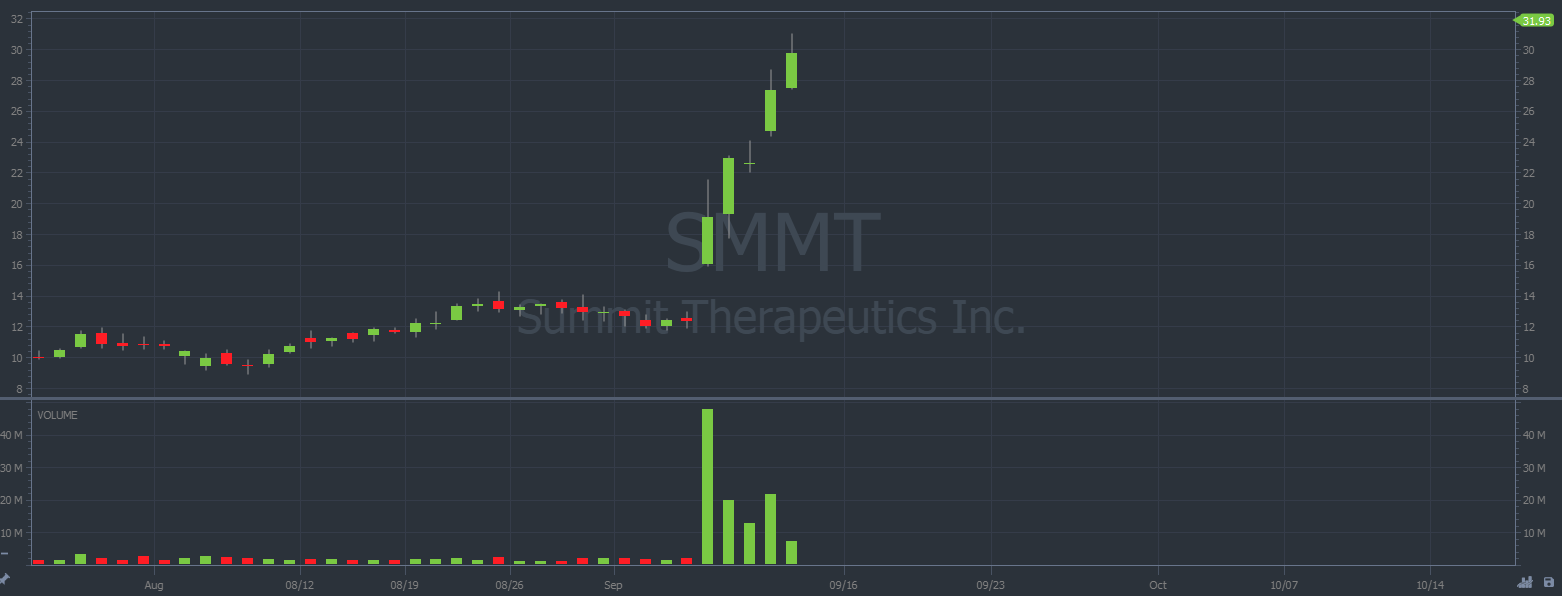

Last week, on Monday, we started watching Summit Therapeutics Inc. (NASDAQ: SMMT).

The company had just announced that its lung-cancer treatment, Ivonescimab Monotherapy, showed greater efficacy (by 49%) when compared to the previous leading treatment, Pembrolizumab Monotherapy.

And by Friday, the price spiked 160%*.

Take a look at the price action thus far, every candle represents one trading day:

SMMT chart multi-month, 1-day candles Source: StocksToTrade

The move makes sense … SMMT unveiled a new lung cancer treatment with drastically improved data.

Plus, the stock already had a history of running. It spiked 380%* in May, earlier this year. Past spikers can spike again …

This is a real stock with a real catalyst.

And we’re approaching an intensely bullish catalyst for the overall market.

Get ready for interest-rate volatility!

Add these plays to your watchlist …

>> Check Out Our Larger Plan To Profit Off Of These Interest-Rate Cuts <<

Cheers,

Matt Monaco

*Past performance does not indicate future results