Howdy traders, it’s Bryce here.

Nobody remembers the stock their friend obscurely drops in conversation.

Because those are random picks your buddy is gambling with.

If you want REAL trading opportunities, you’ve got to face this one fact …

Profitable trading requires a bit more commitment to the process.

I’m going to show you in today’s post, there was a prime trade opportunity that anyone could have snagged if only they took this seriously.

It’s a pattern you can mimic on other stocks too.

And understand, there are trade opportunities like this every day.

If you don’t show up, you’re missing out.

Forget about random stock picks from your friends.

Here’s how to trade like a professional …

A Top Setup

First of all, understand there are a lot of different ways to profit in the stock market.

Traders use patterns to plan trades. And there are countless patterns to choose from.

However … some are more simple than others.

And I’ve always believed in the KISS method …

- Keep

- It

- Simple

- Stupid

Why would I involve the MACD, bollinger bands, or VWAP? Instead, I could trade patterns that don’t melt my brain with data.

The Next Trillion Dollar Chipmaker After NVDA (Not AI)

Is this little known chipmaker the next NVDA?

It has nothing to do with AI, but this company’s patented chip could generate NVDA sized gains in the coming months…

Companies like Microsoft, Intel, and Google are all quietly racing to be at the forefront of this new phenomenon…

But unfortunately for them…

This one small company holds the key to this revolution…

Something like a double bottom on a hot runner with news.

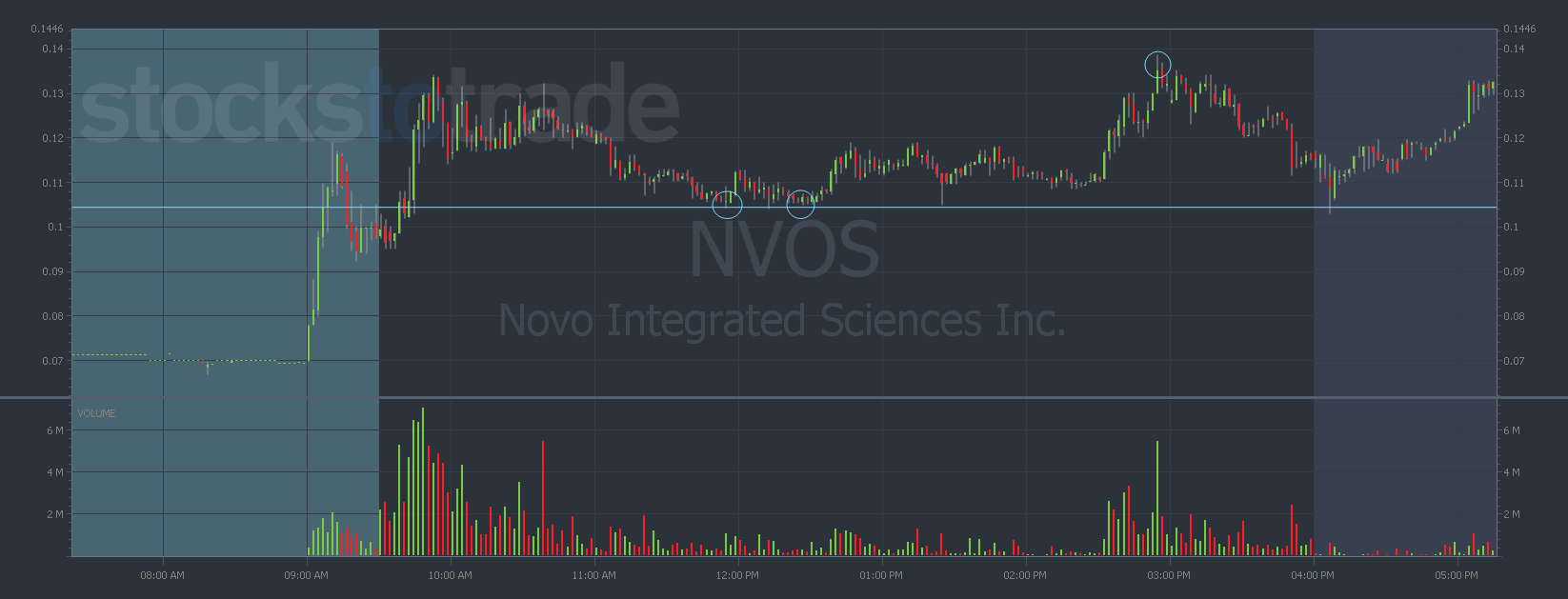

I present, Novo Integrated Sciences Inc. (NASDAQ: NVOS).

On Tuesday the company announced a partnership with Farm 7 Group Inc. to establish a joint venture for the Kenya Agricultural Cooperative Project. The project secured contracts for delivering around 1.6 million metric tons of commodities annually, with an estimated revenue potential of up to $350 million.

The joint venture agreement spans 30 years, stipulating that 75% of net profits will go to Farm 7 Group and 25% ($87.5 million) to Novo.

A new project and a partnership are both bullish catalysts for penny stocks. And as a result, by Wednesday morning the price spiked more than 240%.

It gave us a tremendous double-bottom opportunity too.

Let’s take a look at Tuesday’s price action …

NVOS Spike

It started with a morning spike.

That’s how I know what stocks to trade …

I only watch tickers that are already spiking at least 20%. If it can move 20% it can push even further.

Before noon the price spiked more than 80%. Then it mellowed out and put in a double bottom at a clear support line.

I circled the two bounces below and included the support line. I’ll mention the third circle later …

NVOS chart 1-day, 2-minute candles Source: StocksToTrade

The second bounce is the potential point to buy.

- The stock has hot news

- It already spiked 80% that morning

- And it could push even further.

But let’s keep in mind, some trades fail.

If the trade were to fall apart, we’d simply sell our shares once the price crossed below the support line.

But if the trade is a success, we want it to climb toward the high of the day. That’s the third circle on the chart. A momentary breakout.

On NVOS, the spike after the mid-day double bottom was more than 30%.

If a trader held their position overnight, in the morning it would have returned over 130%.

Look at the chart below, I circled Wednesday morning’s highs (after and pre-market hours are shown on this chart in between regular trading days) …

NVOS chart 2-days, 2-minute candles Source: StocksToTrade

It’s riskier to hold overnight, but you get my point.

New Trade Opportunities

There are new opportunities every day in my niche …

I’m always looking for volatile stocks that spike with news.

And if the float is below 10 million shares, that’s even better.

The low supply of shares contributes to bullish volatility when the demand increases. It’s basic economics.

There are a lot of things new traders NEED to know before they can effectively navigate these volatile runners.

Don’t get discouraged. There are real opportunities in this market.

But if you don’t know the right information, you’re missing out.

Or worse … you’re making dangerous trades.

I know because I used to be the guy taking stock picks from his friend.

And I never made any money worth writing home about. Not until I paid attention to my trading knowledge.

If you want to know the path I took …

>> It all started right here <<

See you in the chat.