Hey traders, it’s Bryce here.

In case you hadn’t noticed … The market took a HUGE dive on Monday, August 5.

It started last Friday, the July jobs report showed less-than-expected job growth and showed a spike in unemployment. It raised concerns that the U.S. is heading toward a recession amid sticky inflation and high interest rates.

The U.S. market drop on Friday was drastic … But the real panic came on Monday when the Japanese market opened and had its first chance to react to the weak U.S. job data.

When Japan’s market opened on Monday morning, it was only Sunday night for the U.S. stock market …

Below is one of Japan’s more popular indices, the Nikkei, every candle represents one trading day:

Nikkei chart multi-month, 1-day candles Source:

And when the U.S. market opened on Monday, the bearish price action continued again.

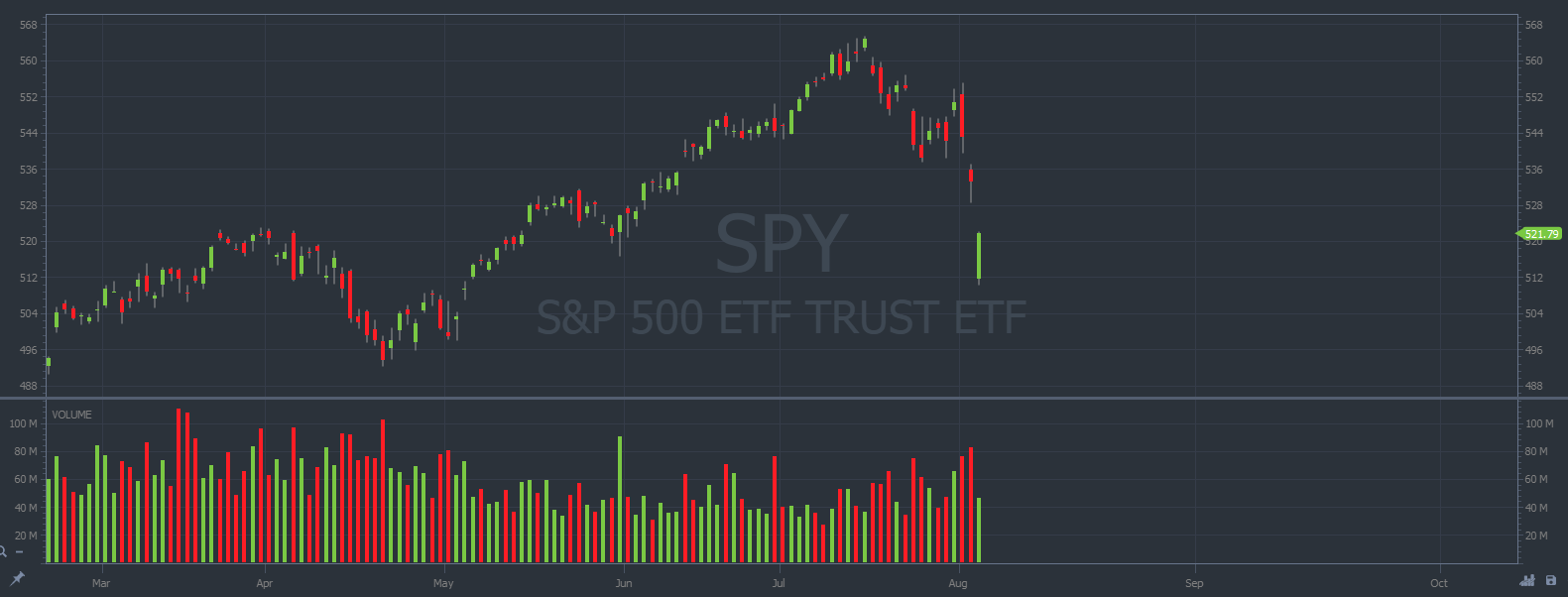

Here’s a chart of the S&P 500 ETF Trust (NYSE: SPY), every candle represents one trading day:

SPY chart multi-month, 1-day candles Source: StocksToTrade

The selloff was pretty extreme. There’s a lot of fear in the market right now.

But … There have also been solid opportunities to profit thanks to this volatility.

Top Trade Setups Right Now

After the market dips drastically, some stocks will rally. At the very least, due to a short term price correction.

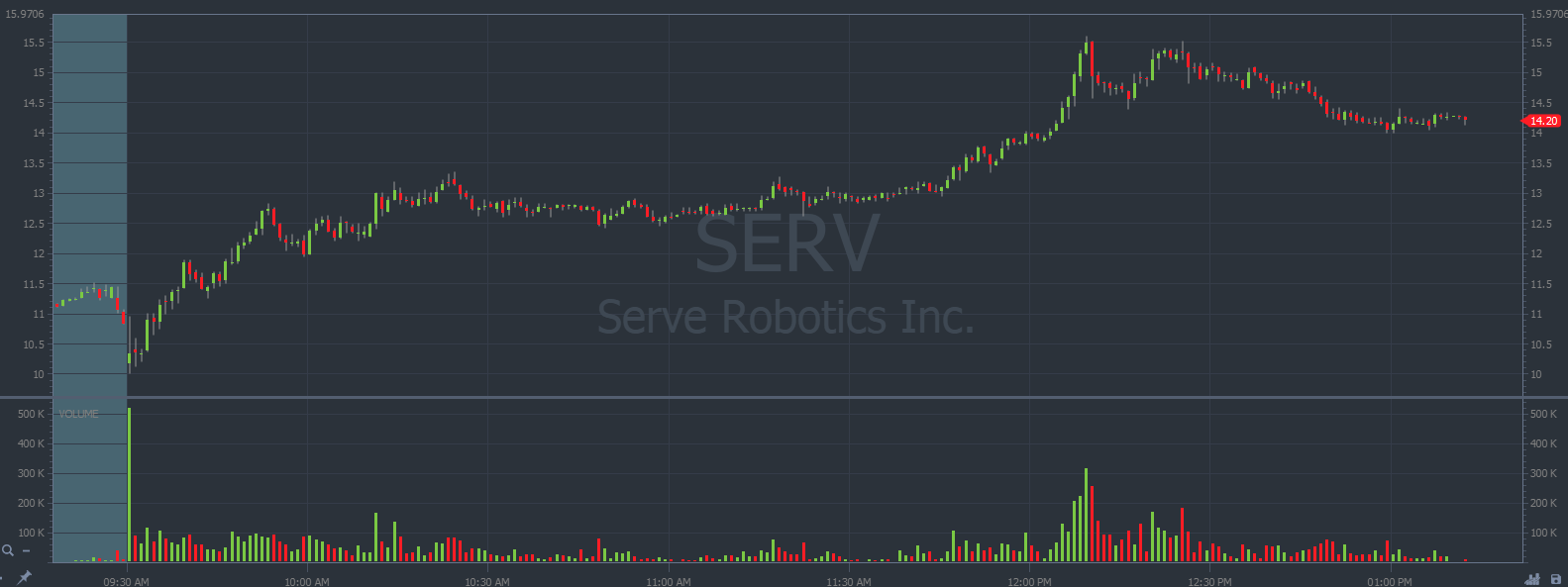

We already saw a 50% bounce from Serve Robotics Inc. (NASDAQ: SERV) yesterday. Take a look at the intraday chart below, every candle represents one trading minute:

SERV chart intraday, 1-minute candles Source: StocksToTrade

Find the next big trade opportunity!

The SERV share price rallied on Monday morning. Then it consolidated around $13 and surged even higher later in the day. It was a solid trade setup for anyone who paid attention!

Don’t worry, there are more profit opportunities ahead. Even if the market continues lower …

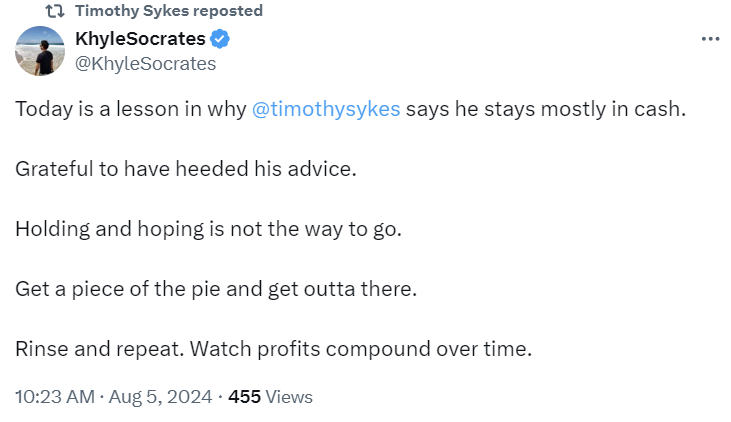

Take a look at the post below for a lesson in market profits right now.

Khyle is a trader in our community:

Nobody knows what will happen from here. The market could rally or it could fall lower. It’s not my job to predict the market movements!

Instead, I react to the volatile price action that we can already see …

For Example:

I already knew that SERV was a volatile stock.

It started spiking on July 19 after the market learned that NVDA bought a $3.7 million stake in it. And the price is still up in early August.

Traders can follow these volatile runners until the price action matches one of our patterns.

Don’t take random shots in the dark. There are real patterns that we can use to trade these runners. These volatile stocks like to follow a specific framework.

And the newest traders in 2024 are using AI to track the best setups …

AI can follow our basic trade patterns! And as traders, we can follow AI until we grow self-sufficient.

>> This is the AI bot that we’re using to find setups right now <<

Remember, we react to price action.

We don’t predict it.

So, try not to stress about the market … Sit back. Take it all in. And wait for the next stock to fit our trading framework.

Cheers,

Bryce Tuohey

*Past performance does not indicate future results