Hey traders, it’s Matt here.

In case you hadn’t already heard from Bryce, the market is closed on Wednesday, June 19 in observance of Juneteenth.

And when there are fewer trading days in a regular week, it invites more volatility.

That volatility can translate to HUGE profit opportunities for small-account traders.

Specifically, I’m interested in potential swing-trade opportunities on Tuesday afternoon.

- My goal this week is to find a bullish stock on Tuesday …

- Buy shares above support …

- And sell into strength when the market opens on Thursday.

The news that causes the stock to spike on Tuesday will likely circulate while the market is closed on Wednesday. And THAT can create a follow-up spike on Thursday.

I don’t know which stock will make the move … I can’t see the future, LOL.

But … When I see it, I’ll know it.

Here’s what it looks like:

Swing-Trade Setup

The price action will look similar to Tim Sykes’ weekend pattern.

Every Friday, in anticipation of the weekend, Tim Sykes and I scan the market using this pattern to take advantage of Monday gap ups:

In recent weeks, Sykes has used this pattern to profit off runners like:

- Replimune Group Inc. (NASDAQ: REPL) on Friday June 7.

- Genprex Inc. (NASDAQ: GNPX) on Friday May 31.

The only difference is that this time, we’re looking for the same price action on a Tuesday.

Now … As you might have guessed, this trading process is easier said than done. It takes some experience before a trader can navigate this price action with self sufficiency.

That’s why new traders in our community lean on AI.

- The pattern that we use to trade is always the same.

- All we had to do was teach it to an AI-trading bot.

On Tuesday afternoon, the AI bot (XGPT) will alert the hottest stocks in the market capable of spiking higher on Thursday.

The AI also provides key entry and exit levels so that new traders don’t have to stab blindly in the dark.

I’ve got an example from last week:

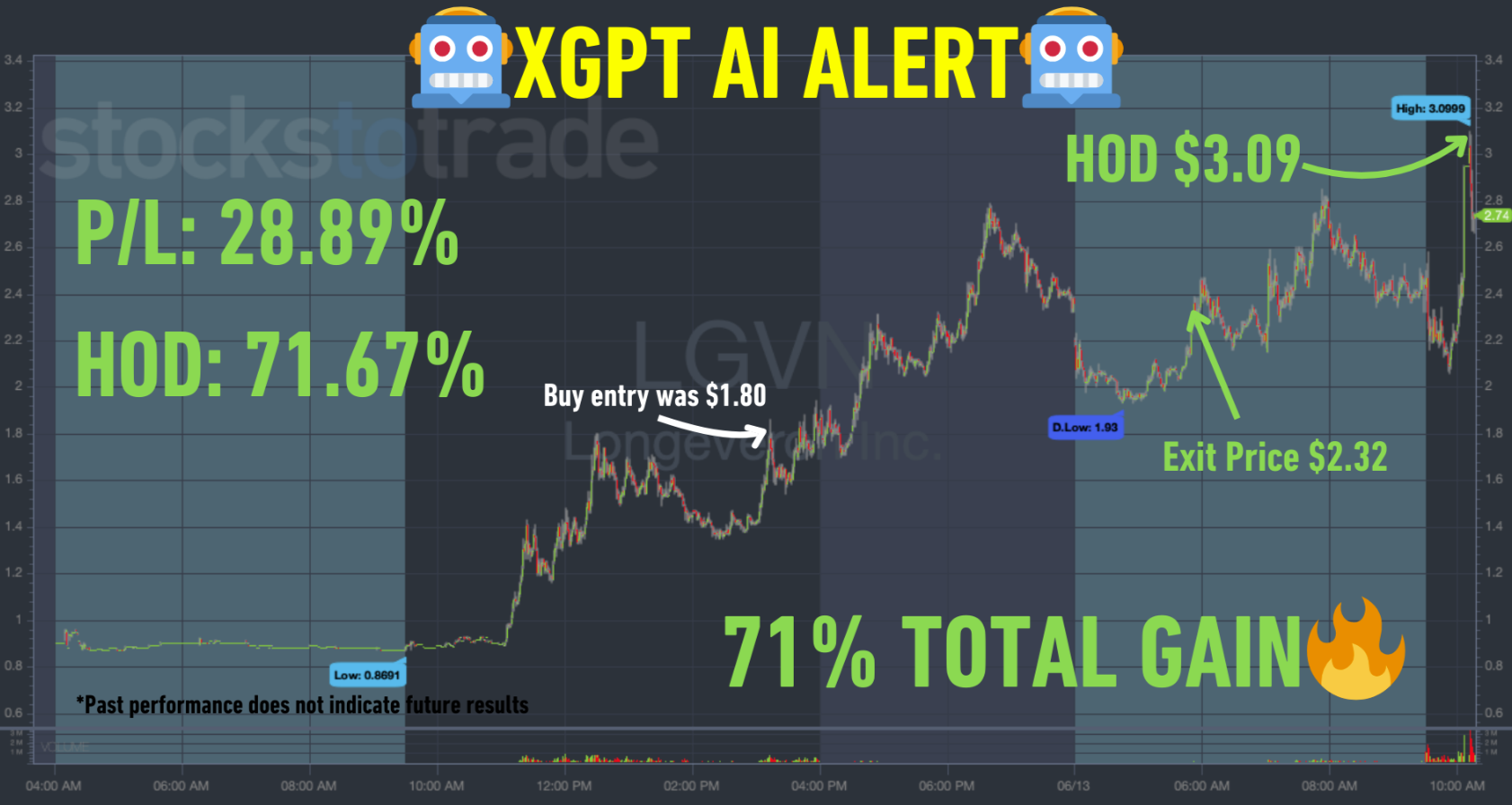

On Wednesday we got a trade alert for Longeveron Inc. (NASDAQ: LGVN). The alert included potential entry and exit levels.

And sure enough, the stock spiked higher on Thursday morning. It followed the plan perfectly. Take a look at the chart below, every candle represents one trading minute:

Get ready for Tuesday’s runners … And Thursday’s gap ups.

>> Here’s where we find the AI trade alerts this week <<

Follow the rules outlined by the AI and you’ll be just fine!

Cheers,

Matt Monaco

*Past performance does not indicate future results