Hey traders, it’s Bryce here.

A lot of the best profit opportunities in this market, the price action can be fast.

For example, we watched a stock last week spike 490%* before noon. There was a perfect trade to make during the move … But you had to have eyes on it.

My mentor, Tim Sykes pulled a decent profit. So did some of the other traders in our community.

And it’s all because we know where to look!

Our Breaking News service alerted a possible trade opportunity right when this stock started to spike. Before the market even opened. See the chart below, every candle represents one trading minute:

The market opens on Monday, that’s our next opportunity to profit!

Here’s how traders can navigate the price action:

The Sykes 10:45 Rule

Sykes used the exact same pattern to profit on four different stocks this week.

- Airship AI Holdings Inc. (NASDAQ: AISP)

- DDC Enterprise Limited (NYSE: DDC)

- Longeveron Inc. (NASDAQ: LGVN)

- Kaival Brands Innovations Group Inc. (NASDAQ: KAVL)

Now, anyone who’s familiar with stock trading, you might know that volatility usually slows down in the middle of the trading day.

That’s not the case in this 2024 market!

Especially since Keith Gill resurfaced on social media in mid May. We’re seeing short squeezes cause stocks to rocket higher mid day.

Sykes posted a blog recently that explains his whole trade process on these short squeezes.

But I’ll give you a synopsis here …

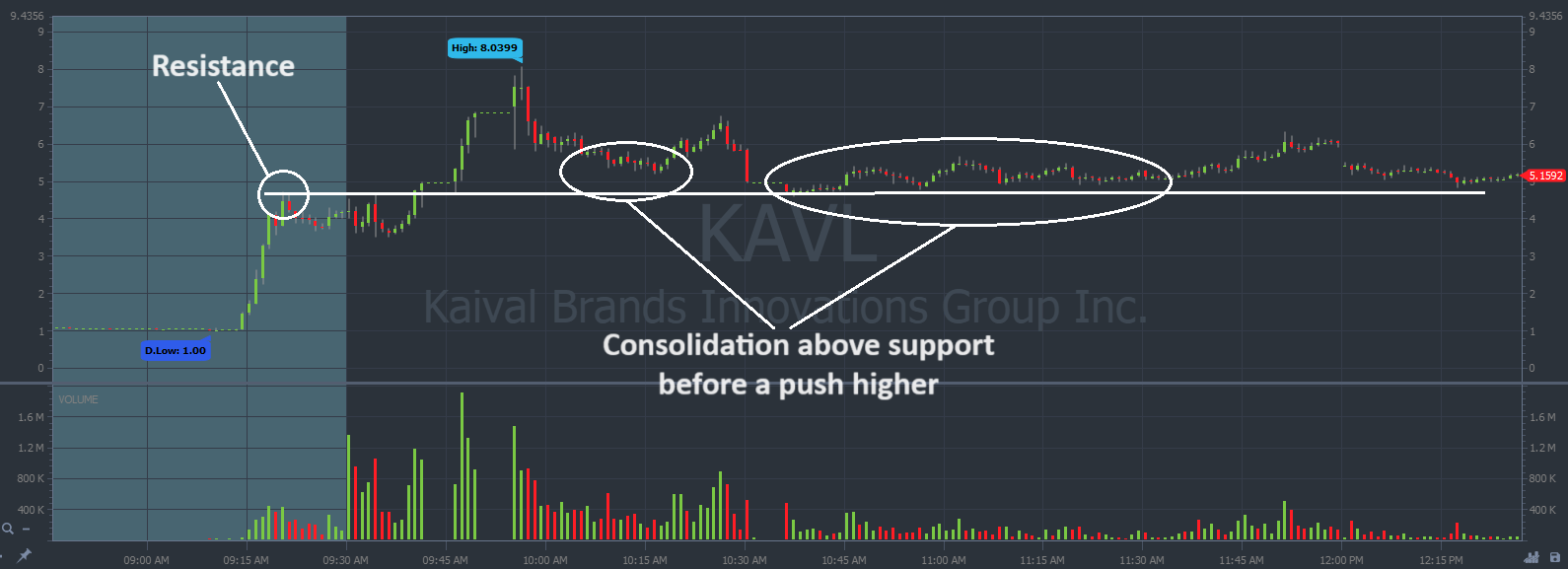

Essentially, we’re looking for volatile small-cap stocks that can show intraday consolidation after a morning spike.

The consolidation usually happens above support set by premarket resistance or resistance from a spike earlier in the day.

Using KAVL as an example, let’s take a look at the price action. Every candle represents one trading minute:

Remember, we’re not looking to buy and hold these stocks. They’re not investments.

Instead, we take advantage of the intraday price action. The goal is to buy above support and sell into strength.

Use Sykes’ AI-trading bot to learn this process at a quicker pace!

Our next profit opportunity is on Monday.

And since the market is closed on Wednesday in observance of Juneteenth, we can expect an extra emphasis on volatile moves.

There are fewer trading days next week … But trading degenerates will try to pull the same profits. That invites volatility.

Get ready!

Cheers,

Bryce Tuohey

*Past performance does not indicate future results