Hey traders, it’s Bryce here.

On Monday, fellow trader and lead trainer with StocksToTrade, Tim Bohen, dropped a watchlist for this week on YouTube.

He holds daily livestreams for StocksToTrade users, and every Monday he posts a FREE watchlist on Youtube.

This week he mentioned two stocks to keep an eye on …

- The first is a legendary meme squeeze that’s still in play. And there’s a June 21 deadline on the horizon …

- The second is a less-known squeeze that spiked 240%* last week. And it’s consolidating near the highs right now …

The meme sector returned in a BIG way after Keith Gill resurfaced on social media in mid May.

Now, most people that you ask about these meme stocks, they have one of two responses:

- “That’s dangerous volatility and I’ll never touch it.”

- “To the mooooooon!”

For savvy traders like Tim Bohen and myself, there’s a third option that we use to find profits:

- Play the short term volatility using popular stock patterns.

There’s still time to trade the two squeezes that Bohen outlined in his weekly watchlist! The prices are consolidating below key breakout levels.

Keep an eye out for this specific price action …

Top 2 Squeezes

I included Bohen’s watchlist video below:

The two top stocks that we’re watching right now are as follows:

- GameStop Corporation (NYSE: GME)

- China Liberal Education Holdings Limited (NASDAQ: CLEU)

They’re both short squeezes. Meaning, as long-biased traders, we’re trying to capitalize on the bullish momentum caused by short sellers blowing up.

The stocks are crap! We’re just here for the volatility.

Interested in more fundamental plays? Follow the next big AI evolution.

We can trade volatile short squeezes because people are predictable during times of high stress. Like when they’ve got a couple thousand dollars in a stock spiking +100%. That predictability manifests in the market as trading patterns.

For more specific examples, let’s take a look at each of these stocks individually:

GameStop Corporation (NYSE: GME)

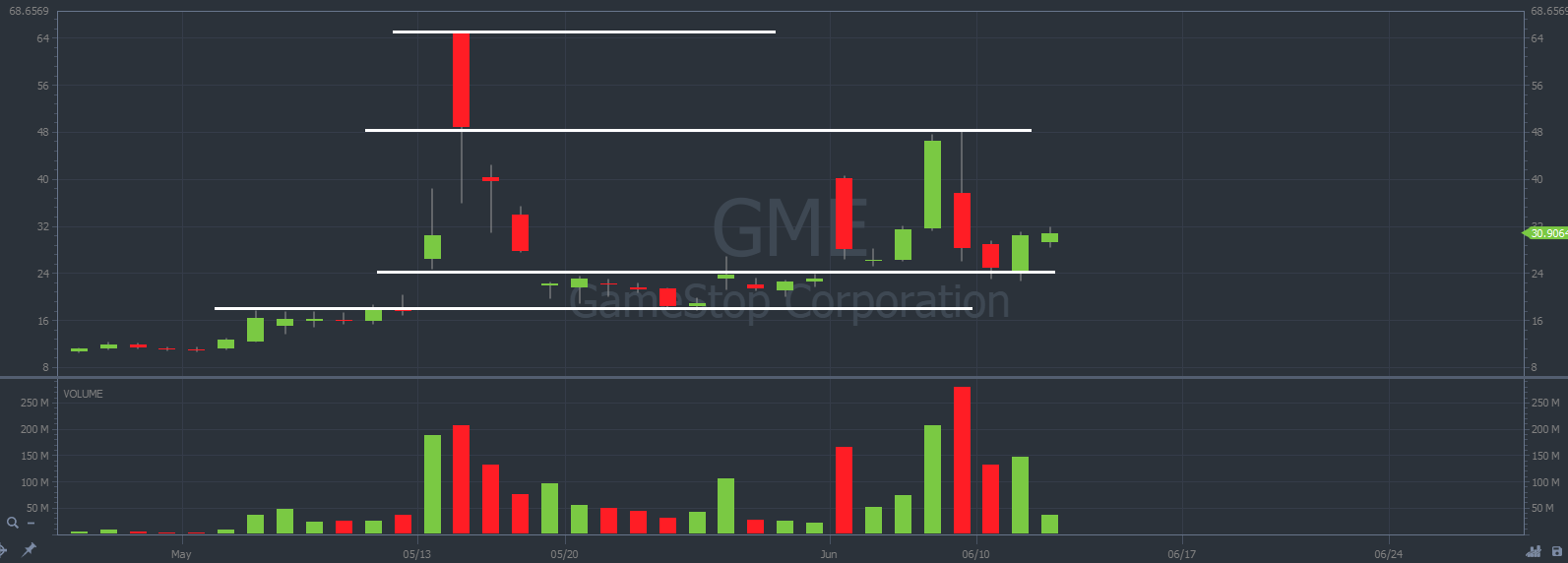

I drew support and resistance lines on the chart below.

Every candle represents one trading day:

GME chart multi-month, 1-day candles Source: StocksToTrade

Remember that resistance can become support and vice versa!

Now, there are quite a few bagholders from the last two months that are sitting above the current GME share price.

But technically, we don’t need GME to make new highs to find profitable trades. The intraday volatility between these support and resistance levels can offer great opportunities.

>> Try this trading pattern <<

Plus, we’re almost assured volatility from this stock.

It’s been in play ever since Keith Gill (meme-stock legend) resurfaced on Sunday, May 12.

A.I. Gamechanger Says “$2.50 Stock Set to Breakout Overnight”

A 106% gain on CYCC…

A 158% gain on SPWR…

A whopping 7,700% gain on FFIE*…

These are just a few of the stock winners my patent-pending AI stock-picking system, XGPT, spotted this year.

And It just flashed “buy” on a new company no one is talking about right now. It trades at just $2.50, and XGPT says it’s about to breakout overnight with 84% confidence.

I recently revealed the name and ticker during an in-depth interview about the very best stocks to own right now.

On Friday, June 7, he gave an anticlimactic livestream on YouTube.

And on June 21, his multi-million dollar options contracts will expire …

- Will Gill offload his contracts before then?

- Will he exercise the contracts and buy GME shares?

- Does he even have enough money to exercise them?

We haven’t seen the last of this volatility.

And where there’s volatility, there are profit opportunities.

China Liberal Education Holdings Limited (NASDAQ: CLEU)

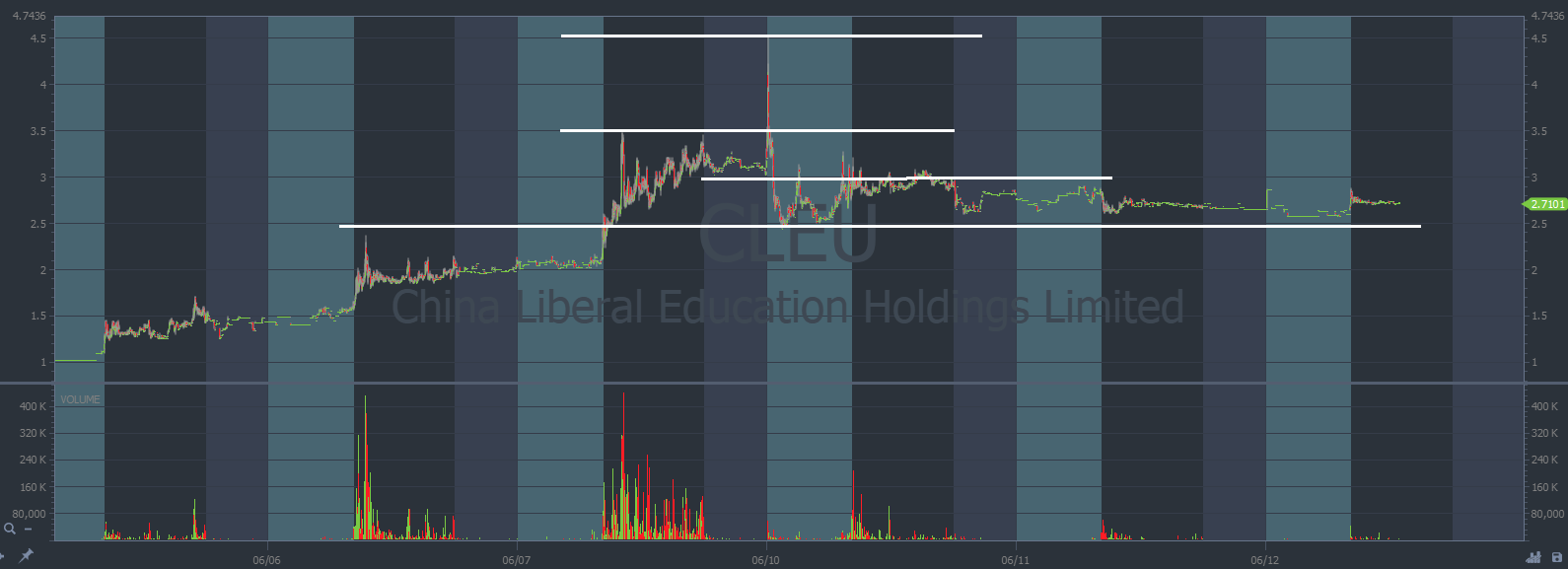

Again, I drew in some important support and resistance lines.

On the chart below, every candle represents one trading minute:

CLEU chart multi-day, 1-minute candles Source: StocksToTrade

There’s textbook consolidation above the $2.50 level right now.

And unlike GME, CLEU is still trading within striking distance of the breakout level ($3.50 during regular trading hours, $4.50 from pre-market hours on June 10).

Another reason CLEU could push higher: The float is only 3 million shares.

Stocks with a float below 10 million shares are considered to have a ‘low supply’ of shares. And a low supply helps prices spike higher when demand increases. At the very least … it ensures an extra emphasis on volatility.

Now remember, GME and CLEU are trash companies.

No matter the bullish trajectory … We’re just trying to play the short-term volatile price action.

For those interested in more fundamental plays, keep reading!

The Next AI Evolution Is Here!

According to Morgan Stanley, there’s a $10 trillion opportunity that piggybacks the already red hot AI momentum in 2024.

The market spiked higher on Wednesday after we learned of slowing inflation. NVIDIA Corporation (NASDAQ: NVDA) spiked higher too …

That bullish momentum bodes well for the new AI sector taking over the market.

TODAY is maybe the last opportunity traders have to recognize this opportunity before the market completely explodes!

Take a look at Tim Bohen is going LIVE tonight at 8 P.M. Eastern to discuss the trade angle.

Make sure to RSVP for the market brief tonight:

We have to prepare for this sector rush before the starting bell rings!

When the market opens at 9:30 A.M. Eastern this Friday … It’s every trader for themselves.

Cheers,

Bryce Tuohey

*Past performance does not indicate future results