Hey traders, it’s Bryce here.

In case you hadn’t heard, the meme-stock lord, Keith Gill returned to his YouTube livestreams on Friday, June 7.

My mentor, Tim Sykes, wrote up a comprehensive play by play:

There are three main stocks that the meme sector is most interested in, thanks to Gill.

- GameStop Corporation (NYSE: GME)

- AMC Entertainment Holdings Inc. (NYSE: AMC)

- Faraday Future Intelligent Electric (NASDAQ: FFIE)

Today, we’re going to focus on their individual price action to identify key areas that a trader could build a position.

The market reaction to Gill’s Friday stream was muted.

But things could change over the weekend …

At the very least, these meme stocks are at the front of everyone’s mind. And that vast market popularity can encourage A LOT of volatility.

We don’t necessarily need these stocks to make new highs … We just need them to follow our trading framework.

Let’s get to it:

Meme Runners

GME and AMC are veteran meme stocks.

FFIE is a new runner that spiked after Gill first resurfaced on Sunday, May 12. FFIE spiked 9,600%* that week …

Currently, we’re using past price action to plan possible upcoming trades.

Let’s Start With GME

Take a look at the chart below, every candle represents one trading hour.

These are some of the major support and resistance lines that we can see on the long-term chart for GME.

GME chart multi-day, 1-hour candles Source: StocksToTrade

Things are looking rather dire for this meme stock. It’s buried under some major resistance lines with quite a few bagholders sitting above the current share price.

There are resistance lines at the spike peaks as well. I didn’t draw those in so as to not clutter the chart.

But again, we can find profit opportunities on these stocks even if they don’t make new highs. The intraday volatility can give us everything that we need.

One of the most popular patterns to watch on GME right now is the weak open red-to-green move. There’s a full tutorial from Tim Bohen below:

Now AMC

Take a look at the chart below, every candle represents one trading hour:

AMC chart multi-day, 1-hour candles Source: StocksToTrade

AMC is also buried under resistance.

But … The most recent spike in early June didn’t push as high as GME’s did.

Plus, the share prices for AMC are cheaper.

If the bullish momentum comes back for AMC, we could see it push above the most recent highs set at $6.88 from after hours on June 6.

The stock might not spike above May’s highs, but shares that push past the June highs could close the gap between $6.88 and the resistance from late May that sits around the $9 level.

Keep an eye out for weak open red-to-green plays in the meantime.

If AMC pushes toward June 6 highs, it’s time to plan a ‘breakout trade’.

And FFIE

Take a look at the chart below, every candle represents one trading hour:

FFIE chart multi-day, 1-hour candles Source: StocksToTrade

The FFIE chart reminds me more of AMC than when it’s compared to GME.

And specifically, I’m interested in the resistance levels at $1 and $2.

Similar to AMC, if FFIE can surge above the $1 level, we could see it fill the gap between $1 and $2. That’s a key opportunity to snag profits from meme volatility.

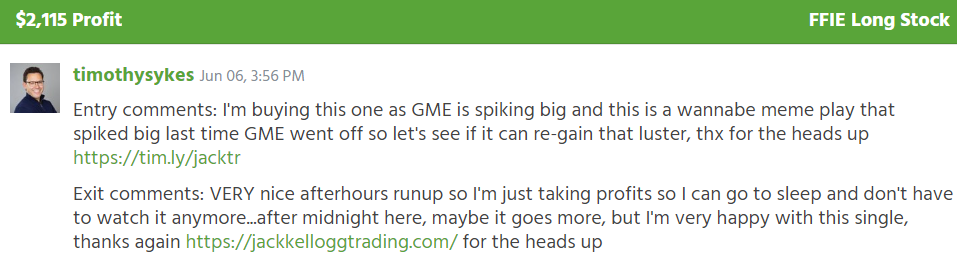

My mentor, Tim Sykes traded this stock on Thursday, June 6 for intraday profits. His trade notes are below, with a starting stake of $24,300:

Source: Profit.ly

We CAN trade the intraday volatility and have success . Even if the stock never makes new highs.

Sykes’ trade is proof of that.

But, it’s easier said than done. Make sure to use the AI-trading bot to ensure you’re setting your sights on the right setups.

It all seems simple when the market is closed … but once the stocks start to move, those without proper instruction are likely to get lost.

The AI-trading bot can solve that issue.

Use ALL of the tools at your disposal in this market.

AI is the future. Those who ignore this industry shift will get left behind. Stay ahead of the curve!

Cheers,

Bryce Tuohey

*Past performance does not indicate future results