Hey traders, it’s Bryce here.

We have to start Monday with a watchlist full of the hottest stocks.

Usually the stock market cools down during the summer months. But that’s not the case in 2024!

My mentor, Tim Sykes, touches on this fact in his newest video:

- The AI momentum continues to push stocks higher in the market

- NVIDIA Corporation (NASDAQ: NVDA) surged to new heights again in May.

- The meme-stock volatility is back, thanks to Keith Gill.

Last week we watched a lot of stocks spike higher. But only a handful are still in play right now.

See, we can’t just buy the hottest stocks at random and hope for profits. The biggest spikers don’t run indefinitely. Eventually the price pulls back. There’s a science to profit off these moves.

The goal is to play the most popular trading patterns on the strongest stocks. These trade patterns can repeat because people are predictable during times of high stress.

Like when they’ve got a couple thousand dollars in one of these volatile stocks.

And right now there are two stocks I’m watching that could show us A+ trade setups on Monday.

My Watchlist

These are the two hottest stocks from Friday …

There’s no guarantee the price will continue higher (there are never any guarantees in the stock market). But these charts show us A LOT of good volatility and the prices are still up from Friday’s spikes.

Thus, on Monday morning, we’re likely to see more volatility that could match our trading framework.

#1: Novo Integrated Sciences Inc. (NASDAQ: NVOS)

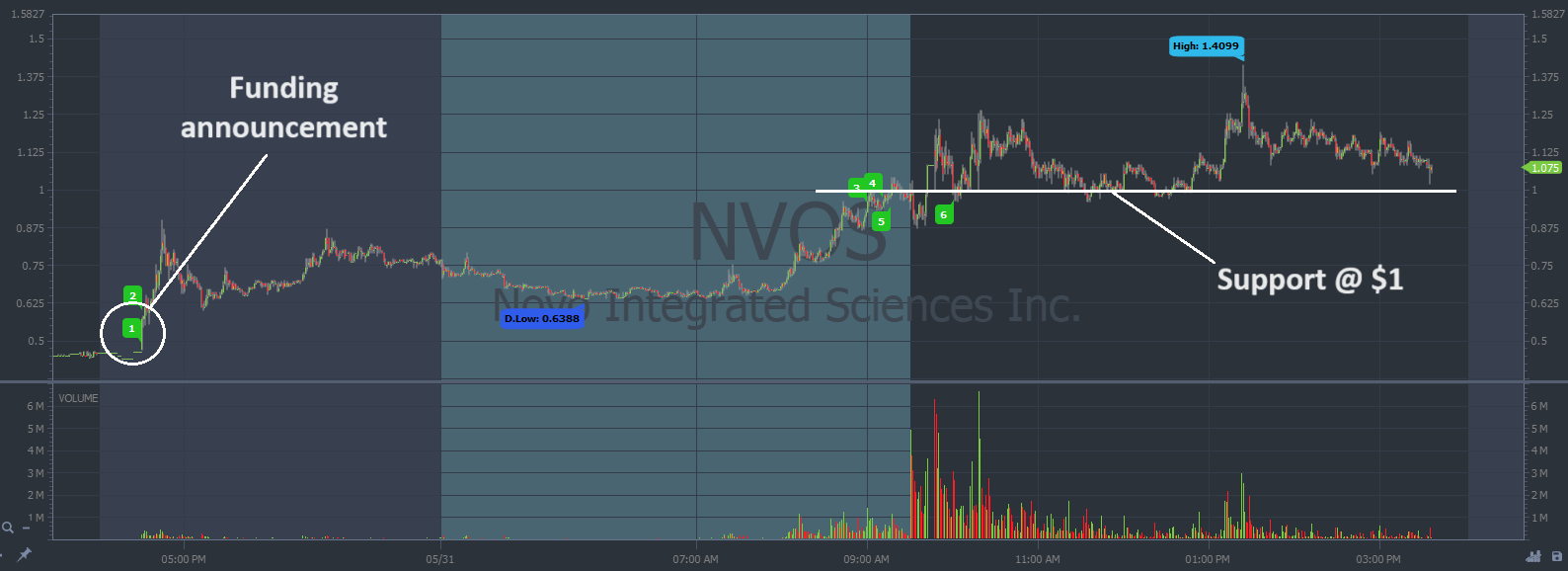

On Thursday, May 30 during after hours, NVOS announced it would receive total funding proceeds of $78 million.

The stock immediately started to spike. And thanks to the strength of this 2024 market, the spike continued during pre-market hours on Friday and into regular-trading hours.

The total move measures 210%* thus far.

Take a look at the chart below, every candle represents one trading minute:

NVOS chart multi-day, 1-minute candles Source: StocksToTrade

Pay attention to the support level at $1.

In case you weren’t aware, stocks bounce between key levels of support and resistance that usually occur around psychologically significant numbers … Like $1.

Traders use these levels to build positions on volatile stocks. There’s a video below with more details:

We’re watching for NVOS to bounce off of $1 and push toward the highs from Friday.

The stock has a decent catalyst and already showed textbook strength through after-hours and pre-market into regular-trading hours. That’s a huge sign of bullish sentiment.

#2: Brand Engagement Network Inc. (NASDAQ: BNAI)

Talk about a multi-day runner …

BNAI started to spike on Wednesday, May 29 after the company announced a $4.9 million private placement during premarket hours.

The stock surged higher, consolidated on Thursday, and then rocketed past the breakout level on Friday.

Take a look at the 560%* spike below, every candle represents one trading minute:

BNAI chart multi-day, 1-minute candles Source: StocksToTrade

Again, pay attention to key support and resistance levels.

This is a multi-day runner that closed near the highs on Friday. There’s a HIGH possibility that we see more volatility on Monday.

New traders:

Don’t risk your hard earned cash on these plays. Enter the ticker symbol in the XGPT-AI chat bot on Monday morning. The bot will scan the market and spit out a potential trade plan that follows our trading framework.

>> Use AI to plan smart trades <<

It would be a shame to lose money on a stock spiking +500%* …

Get ready for Monday’s price action!

Cheers,

Bryce Tuohey

*Past performance does not indicate future results