Hey traders, it’s Bryce here.

Friday is almost upon us:

Some of the biggest profit opportunities for small-account traders come from stocks that gap up over the weekend. It starts on Friday and they push higher by Monday.

For example, my mentor, Tim Sykes, snagged a 23% profit from ParaZero Technologies Ltd. (NASDAQ: PRZO) last weekend. The stock gapped up after confirmed rumors of an Iranian retaliatory strike against Israel.

This stock spiked 460% when Hamas attacked Israel back on October 7, 2023. It’s an Israeli drone company. And the history of spiking made it an obvious watch as tensions rose between Israel and Iran last Friday.

Take a look at the chart below that shows the 65% spike and gap up from Friday to Monday.

Every candle represents three minutes. From left to right, the shaded columns show a little bit of aftermarket hours on Thursday, the premarket hours on Friday, regular hours on Friday, aftermarket hours on Friday, and so on:

PRZO chart multi-day, 3-minute candles Source: StocksToTrade

To get a full view of the move I had to include premarket and aftermarket hours using StocksToTrade. Don’t short change yourself with basic charts from Robinhood. They’re withholding valuable market information from you!

Now, back to our profit opportunities.

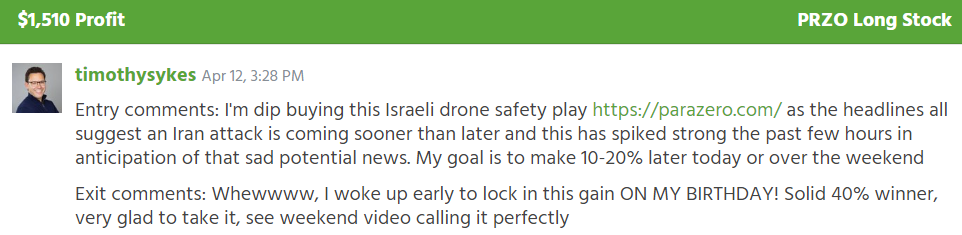

Take a look at Sykes’ trade notes below, he started with a stake of $6,565:

Source: Profit.ly

We use a specific weekend trade pattern to catch moves like this.

It’s the same trading process every week. All of Sykes’ millionaire students follow this process. Myself and Matt included.

Here Are The Details

We see big opportunities like PRZO on Fridays because there’s a greater chance for bullish volatility.

- Short positions are nervous about an incalculable gap up on Monday.

- They buy back shares to exit the short positions.

- Long-biased traders are looking to capitalize on the same gap ups.

- They buy shares hoping to snag some weekend profits.

All of the buying usually leads to bullish momentum that we can capitalize off of as small-account traders.

But we can’t buy and hold at random.

Take a look at the yearly PRZO chart below, these spikes are unsustainable.

Every candle represents one trading day:

PRZO chart multi-year, 1-day candles Source: StocksToTrade

We can take profits during key points, but we have to wait for the price action to match a specific pattern.

Understand, there’s no such thing as a 100% guarantee in the stock market. Anyone who tells you otherwise is lying.

This trading pattern CAN fail.

That’s another reason why we use patterns to trade. The pattern alerts us if the trade turns sour. And that’s our signal to get out.

Above all things: Protect your overall account.

Trading, for me, is about consistent profits over a lifetime. It’s not about one big $1 million trade.

It took me over 5,000 trades to reach +$1 million in trading profits. And I still take it one trade at a time.

Even the trade that pushed me over the $1 million milestone. It wasn’t anything crazy. Sykes and I got the whole thing on video, LIVE. Take a look below:

It Starts On Friday Morning

These weekend runners start to move on Friday.

Sometimes even during premarket hours.

Traders who have eyes on it early have the most opportunity to profit off of this setup.

That’s why my buddy and fellow millionaire trader, Matt Monaco, is holding a live stream this afternoon at 4 P.M. Eastern. We have to prepare before Friday.

When the market opens at 9:30 A.M. Eastern, everyone else will have to play catchup. But traders like Matt and myself are sitting pretty.

Learn this process TODAY to prepare for Friday & weekend profit opportunities.

Cheers,

Bryce Tuohey

How to Find the Biggest Breakouts in the Market

Do you recall HOLO gaining $1,565 in 12 hours… or when BMR gained 784% in 2 hours?

Those were “Dark Breakouts” and unfortunately, most investors don’t see them until it’s too late.

Want to know the secret to spotting (and trading) these breakouts?

Ignore the stocks most investors are focused on and…