Hey traders, it’s Bryce here.

We have to focus on the hottest profit setups in the market. That’s how we protect our trade accounts from unnecessary risk.

Unfortunately, some of the best opportunities come from stocks moving as a result of global tension.

It’s never my goal to promote violence or root for destruction.

But in the past we’ve seen some insane stock moves as a result of conflict. A prime example is the 1,000% stock run from Houston American Energy Corporation (AMEX: HUSA) after Russia invaded Ukraine in 2022.

Take a look at the chart below:

HUSA chart multi-month, 1-day candles Source: StocksToTrade

We saw similar moves when Hamas struck Israel on October 7, 2023.

And yesterday, on Friday, April 12 we learned that Israel is preparing for a possible attack from Iran.

Geopolitical tension can cause huge price swings for oil & gas stocks because oil is a hot commodity in these regions. Russia produces a lot of oil. As does Iran.

On Friday we watched oil & gas stocks spike +100%. And it’s highly possible this momentum continues into Monday.

My Oil & Gas Watchlist

Understand that these stocks aren’t running with individual catalysts. They’re sector-momentum plays.

And technically, the sector could cool off any day. We don’t know how long these stocks will spike.

That’s why it’s so important to recognize this momentum early.

Friday was day one. Most people won’t hear about this oil & gas momentum until later in the week. We’ve got a head start right now.

Take a look below. I listed the oil & gas sector’s biggest runners from Friday.

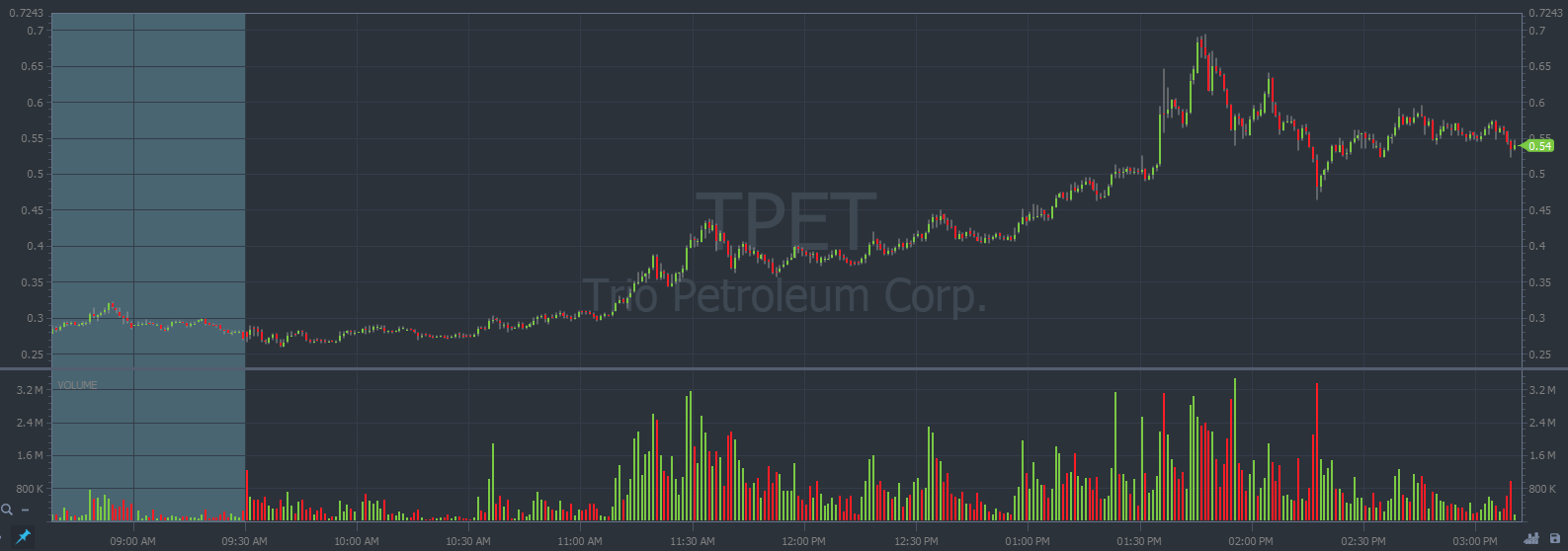

Trio Petroleum Corp. (AMEX: TPET) spiked 200%.

On the chart below every candle represents one minute:

TPET chart intraday, 1-minute candles Source: StocksToTrade

Indonesia Energy Corporation Limited (AMEX: INDO) spiked 110%.

There’s another one-minute chart below:

INDO chart intraday, 1-minute candles Source: StocksToTrade

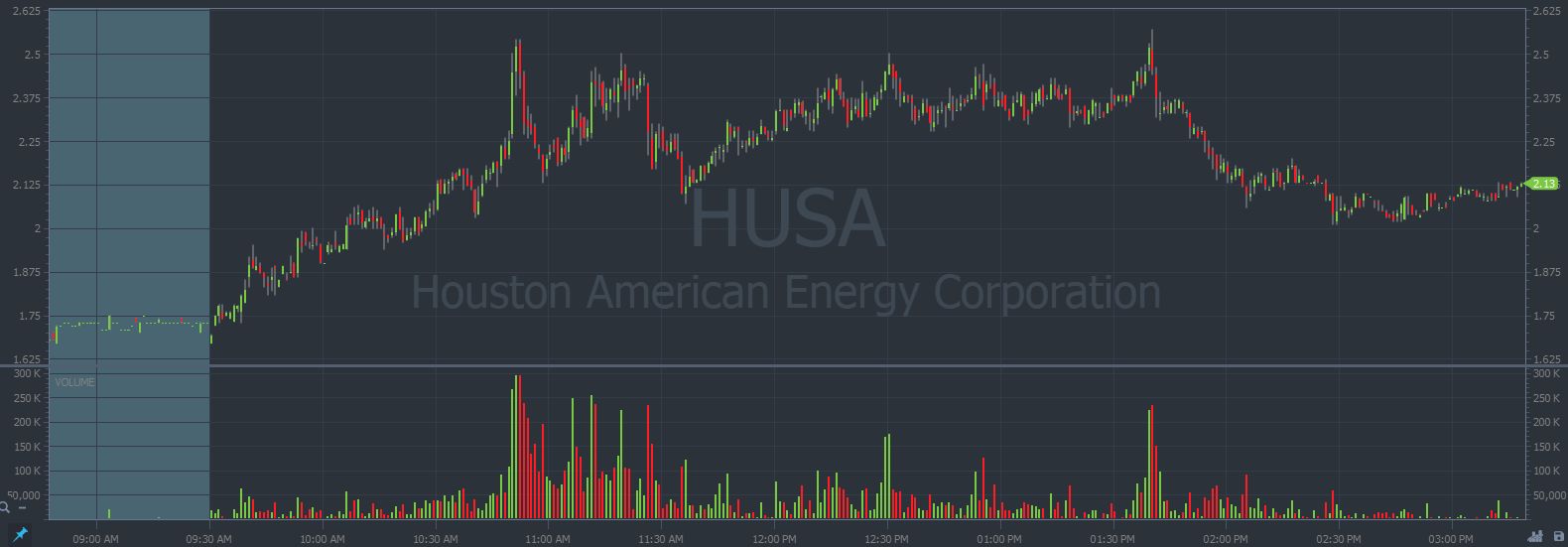

Houston American Energy Corporation (AMEX: HUSA) even managed its own spike of 60%.

Take a look at the one-minute candle chart below:

HUSA chart intraday, 1-minute candles Source: StocksToTrade

How To Trade These Runners

First of all, pay attention to the momentum.

If Monday comes around and the sector is trading lower, it’s possible the price will consolidate for a few days before pushing higher.

It’s dangerous to buy shares at random. I want to take the most predictable* part of the move.

The goal is to build a position above a major support level and ride the bull momentum higher.

Make sure you understand a stock’s support and resistance lines! This is a basic tool used by traders to build positions.

If prices fall below support we can sell to protect our account. But we’re hoping for the price to move upward to test the next resistance level.

Watch the video below for more instruction. This is my mentor, Tim Sykes:

Here’s why support and resistance are important: Volatile price action isn’t usually sustainable. We want to get in and out before the spike cools down.

And volatile stock can follow support and resistance due to the predictability of human nature. We get in. Get out. And move to the next runner.

It’s the same process every time. The only difference is the stock we’re trading: TPET, INDO, etc.

Monday is our next opportunity to profit, and I’m laser focused on oil & gas stocks.

Don’t leave your account up to chance!

Join me this weekend for a live stream. Or log on before the market opens on Monday. We’re outlining the hottest plays in real time.

I’ll see you in the chat!

Cheers,

Bryce Tuohey

Past performance is not indicative of future results*

Hidden Market Loophole = Incredible Gains?!

Ever wondered how to make money when the stock market is closed?

Tim Sykes has the answer, and it’s a game-changer … He turned $12,000 into $1.65 million while in college…

Now he’s sharing one of his favorite strategies with you today.

It’s a hidden loophole that regular folks are using to unlock incredible gains…

This isn’t your typical trading strategy — it’s revolutionary.