Hey traders, it’s Bryce here.

Everyday we’re focused on the most profitable stocks for small account traders.

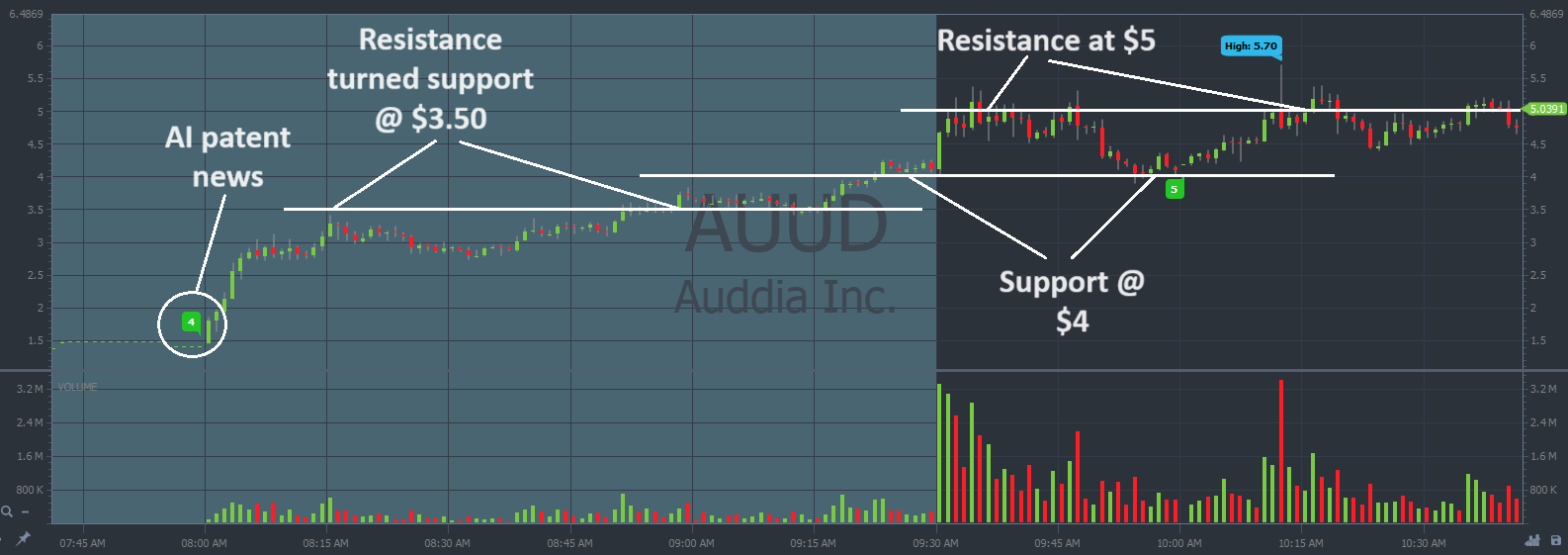

Yesterday it was Auddia Inc. (NASDAQ: AUUD). The company announced AI news during premarket on Monday morning and spiked 290%.

- Auddia was awarded an AI patent from the U.S. Patent and Trademark Office.

For a small-cap stock, any positive affiliation with the government is huge news.

And you didn’t need to be a professional trader to find this runner. Anyone subscribed to Breaking News saw it from a mile away. We got an alert!

See the chart below:

AUUD chart intraday, 1-minute candles Source: StocksToTrade

We’re still watching AUUD today, Tuesday, April 9.

The price could pop again. After all, AI news combined with a U.S. patent is a great catalyst for bullish momentum.

I’ll show you how to approach this stock today. But first, we have to talk about the HUGE interest rate catalyst that’s looming this week.

Understand: Our small-cap sector isn’t directly linked to the larger stock market. But there is an indirect relationship. When the larger market is strong, there are more setups among our low-priced niche. And the setups are stronger.

Thus, depending on how the market reacts to this week’s catalyst, we should either …

- Trade more conservatively.

- Or put our foot on the gas pedal.

When the market is hot, that’s the time to push it. We have to take advantage of bullish momentum while it lasts.

And this week there’s a huge catalyst that’s sure to influence the entire market.

High Interest Rates

The stock market is battling high interest rates right now.

Higher interest rates make it more expensive for businesses to take out loans and expand their operations. Thus, high interest rates tend to put a damper on the stock market.

The #1 Company Leading the Biggest Energy Breakthrough of the Decade

Self-made millionaire Tim Bohen is giving you an inside look at the megatrend that’s going to change everything.

It will change how you live… work… and it will even change how your neighborhoods are built.

The reason why interest rates are so high is because the FED uses rates to influence inflation.

Perhaps you noticed that inflation is also high.

As a result, the FED tries to put a damper on the economy using interest rates in an effort to lower demand. And when demand lowers, suppliers/businesses have to lower prices to meet the new demand. Theoretically, that’s how it all works.

The market wants the FED to lower interest rates. But we need inflation to drop first.

We’re aiming for an inflation rate between 2% and 3%. A little inflation shows good growth. But too much is a bad thing.

Now, there are a lot of different ways to measure inflation, but for the average joe and jane, the most impactful and relevant measurement is the consumer price index (CPI).

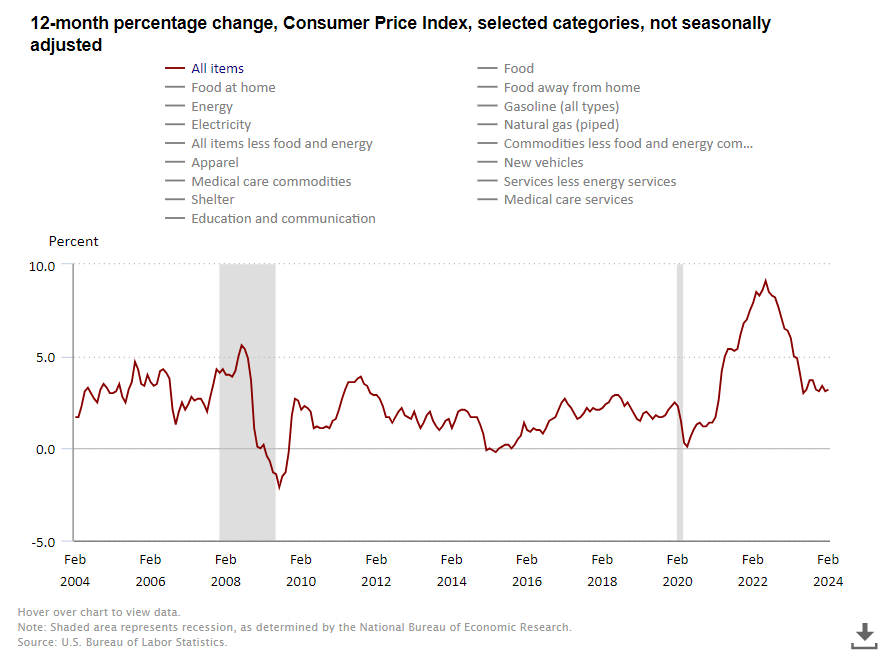

There’s a chart below that shows where we’re at …

Source: bls.gov

Most recently, we saw that February’s CPI showed 3.2% inflation year-over-year.

It’s close to the 2% – 3% goal. But the FED won’t lower interest rates until they’re confident inflation is under control.

That brings us to this week’s catalyst: On Wednesday at 8:30 A.M. Eastern the U.S. Bureau of Labor Statistics will announce the CPI data for March.

If the market likes what it sees, it could spike. If not, prices could dip.

It’s possible that major market indices trade sideways today in anticipation of the news. But once the data drops on Wednesday, we’re likely to see a volatile price reaction.

Which direction? Nobody knows.

React To The Price Action!

We can’t predict what the market will do.

That’s why it’s safer to react.

Using tools like Breaking News and StocksToTrade’s real-time market data, we can identify a direction before most “retail traders” in the industry.

The price action is unmistakable. Especially when we look at a chart with the news overlaid. Take a look at AUUD’s spike yesterday. The stock reacts immediately after the news comes out.

There’s a chart below where every candle represents one minute:

AUUD chart intraday, 1-minute candles Source: StocksToTrade

I didn’t have to predict that AUUD would run.

Instead, I wait until the stock falls into my lap. Then I plan a trade using Sykes’ framework.

Over the years, I’ve used this framework and trading process to pull $1 million in profits from the stock market. And it’s the same process that Sykes’ other millionaire students use.

These stocks can follow similar patterns because people are predictable during times of stress. And when it comes to the stock market, that stress manifests as fear and greed.

There will always be fear and greed in the market. And thus, there will always be a common framework.

These plays can spike higher when the market is bullish. And the patterns stay the same.

Follow Breaking News for the next big runner.

And keep an eye on Wednesday’s CPI announcement.

The market’s biggest catalysts can cause huge spikes in our sector. Like the spike on AUUD yesterday.

Tuesday’s AUUD Play:

We want to see the chart hold some of its gains.

That’s a hint that the stock could continue higher. We call it consolidation around support.

Support and resistance are the levels that we use to trade volatile price action. Support can become resistance and vice versa.

We see an example of this on AUUD’s chart from yesterday morning.

There are a lot of lines on the chart below. To simplify it, make sure you read the price action from left to right as if the stock was moving in real time:

AUUD chart intraday, 1-minute candles Source: StocksToTrade

There’s a chance it pushes higher today.

The larger market momentum has already shown us countless multi-day runners in 2024. And AUUD has a great catalyst!

But if you miss the move on this runner, don’t worry. There’s a new opportunity to profit in our niche every day. It’s all thanks to the early 2024 bull market.

More stocks spike when the market is hot. That’s why we have to keep an eye on big catalysts like the CPI.

The Other BIG Government Catalyst Ahead

In the short term, we’re watching for March’s CPI data tomorrow.

But there’s a bigger catalyst looming.

The government is racing against the clock. And we could see them make a decision within the next month or two.

You NEED to understand this catalyst.

Analysts estimate the total market value of the announcement at $2 trillion. And everything points to an all-out buying spree.

That momentum is sure to light a fire in our small-cap sector. Which means …

We’ve got about a month or two to prepare for some INSANE bull-market momentum.

There’s always something happening in the stock market. But I don’t know the next time we’ll see a catalyst like this. Make sure you’re briefed NOW. Because when it hits, everyone else will have to play catch up.

>> Here Are All The Details <<

Cheers,

Bryce Tuohey