Hey traders, it’s Bryce here.

Even the strongest bull markets will pull back eventually.

And that’s the fundamental flaw of the larger market:

Every day, there’s no way of knowing whether major indices will move green or red.

And it’s the reason I focus on better plays …

The larger market is ultimately driven by the newest economic data. And that information is only available to the public after it flows through newsrooms. Even then, the largest market players are paying for news before it’s published to us.

In other words, small-account traders have the lowest likelihood of profiting off of larger market movements. Even if they’re right about The S&P 500 ETF Trust (NYSE: SPY) or a stock like NVIDIA Corporation (NYSE: NVDA). Big assets like that will only swing a few percentage points every day.

Let’s say a trader has $1,000 in a stock like NVDA and it gains 3% on the day. That’s only a $30 profit. And they would have to time it perfectly. While working with late news.

Now, imagine a trader has $1,000 worth of stock and they pull a 30% gain off of a 100% daily spike.

- The percent gain is much higher, resulting in a $300.

- There’s more room for error because the entire move measured 100%.

There are stocks that spike +100% every day during this market. Yesterday we watched one launch 120% before noon …

You won’t find these stocks in larger hedge funds. Small-account traders don’t have to compete with Wall Street firepower.

It’s like a perfect little fishing hole shielded from the larger seafood industry.

Perfect Small-Account Stocks

We’re most interested in small-cap stocks.

They’re also sometimes known as penny stocks. These crappy assets get a bad rap. And for good reason …

They’re crap stocks.

But … Crap stocks can offer huge profit opportunities for traders who understand the price action.

See, Wall Street tells everyone that penny stock volatility is meaningless. But they’re wrong. We can track this price action using popular patterns. And we don’t have to compete with Wall Street because they’re small-cap stocks.

There’s not enough liquidity for a billion dollar hedge fund to profit 30% on 100% stock spike. Most of these companies only have a market capitalization of less than $100 million. Wall Street players with huge positions are at risk of getting stuck in a crappy stock.

But small-account traders like you and me, we can get in and out easily.

We can use $1,000 to make $300. And that sounds awesome to us!

To Wall Street $300 in one day is small peanuts. To them that’s not even one peanut. That’s like a microscopic peanut fragment.

Small-account traders can use this niche to grow wealth. And thankfully, it’s only scaleable to a point … If you start buying $1 million positions in the small-cap niche you’re going to run into liquidity issues.

But, if you had $1 million to put in the stock market you probably wouldn’t be trading small-cap stocks anyway.

Yesterday’s Runner

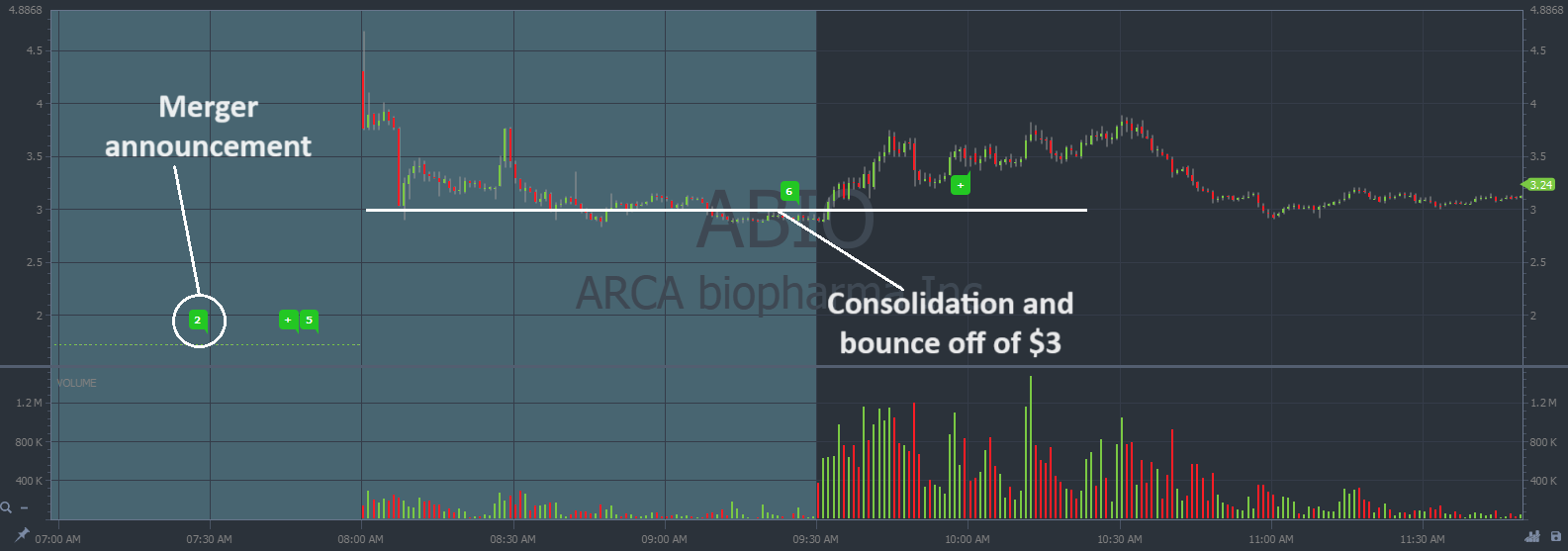

On Wednesday, March 3 we watched Arca biopharma Inc. (NASDAQ: ABIO) spike 120%. And the move came directly after an obvious news catalyst.

During premarket hours, ABIO announced a merger agreement with Oruka Therapeutics. Mergers are bullish catalysts because two companies are theoretically always more valuable than either company alone.

Take a look at the spike and dip-buy opportunity on ABIO from yesterday morning. On the chart below, every candle represents 1-minute:

ABIO chart intraday, 1-minute candle Source: StocksToTrade

Remember, we’re not trying to swing for the fences. We just want to focus on the most predictable parts of the spike.

Volatile stocks like ABIO can follow popular patterns because people are predictable during times of high stress. Which leads me to another point: Most of the people trading these stocks are an emotional wreck. Very few are approaching these plays like we are, with a calculated process for profits. That gives us an advantage.

And in 2024, we’re seeing plays like this every day.

The overall bullish momentum in 2024 trickles down into our small-cap market and helps these runners spike higher. Nevermind what the SPY did yesterday, the overall market momentum is causing +100% spikers in our small-cap niche.

Now is the time to act!

Figure out this process before the next big catalyst to hit the market …

Upcoming Buying Frenzy

There’s a $2 trillion government catalyst that’s about to hit the market.

And if you thought the momentum in 2024 was strong already … Just wait. It’s about to get nuts.

There are people speculating about a market pullback. I think that’s entirely possible within the next month, but once this catalyst hits there’s nothing to stop the market bulls. We have about a month to prepare.

Last time the government did this was after the 2020 COVID crash. As a direct result, major indices like the SPY rallied 100%.

The bullish momentum is just getting started. And now is the time to prepare.

There’s a LIVE market briefing session TONIGHT at 8 P.M. Eastern. It’s your last chance to capitalize on this huge catalyst that could be less than a month away!

Cheers,

Bryce Tuohey