Hey traders, it’s Bryce here.

Yesterday we watched an AI stock launch 180% … I’ll show you in today’s blog post.

This market is still red hot! Take a look at the S&P 500 ETF Trust (NYSE: SPY) this year. The bullish momentum pours over into our small-account sector:

SPY chart multi-month, 1-day candles Source: StocksToTrade

And AI is still our number one focus right now.

Monday’s runner is still in play this week. But it’s important to get eyes on these stocks right when they start to spike. And there’s a simple solution to find them.

See, all of the best spikes in the market start with a specific catalyst. And we can see the price obviously react to the catalyst.

I’m not guessing which stock will spike, I’m waiting for the spike to come to me.

Yesterday’s move was 180%. If I can recognize the move early when it’s still around a 20% spike, I have more than enough time to plan a trade. And the trade plan is key!

A lot of new traders have a tough time because they don’t actually have a trade plan. Here’s why that’s so dangerous:

These spikes are ultimately unsustainable in the long run.

You should be wary of any stock that spikes +100% within a day. That’s a crazy move. And we can trade it for a profit, but we don’t want to get stuck on the wrong side of the price action.

How To Get Ahead

Some of the best spikes come from morning catalysts.

Maybe the company announces a bullish press release during premarket. Then the price spikes as the news circles throughout the day. That’s exactly what happened to CXApp Inc. (NASDAQ: CXAI) yesterday.

I got alerted at 9:07 A.M. Eastern, before the market opened for regular hours. And then we had all day to plan a trade. Take a look at the announcement below:

142% GAIN off of $CXAI 🔥

Retweet & favorite if you caught a piece of this move! 📈

Get the Next Alert 🚨 https://t.co/ucPzK66wGy #BreakingNews #StocksToBuy #StockMarket #Mondayvibes pic.twitter.com/uyGd2S40fo

— Stt Breaking News (@sttbreakingnews) April 1, 2024

The stock is definitely still in play. Prices closed near the highs on Monday. And the low float hints at a possible follow-up move.

A low float is described as anything below 10 million shares. The low supply helps prices spike higher when demand increases. Like when CXAI announced a Google Cloud partnership on Monday morning.

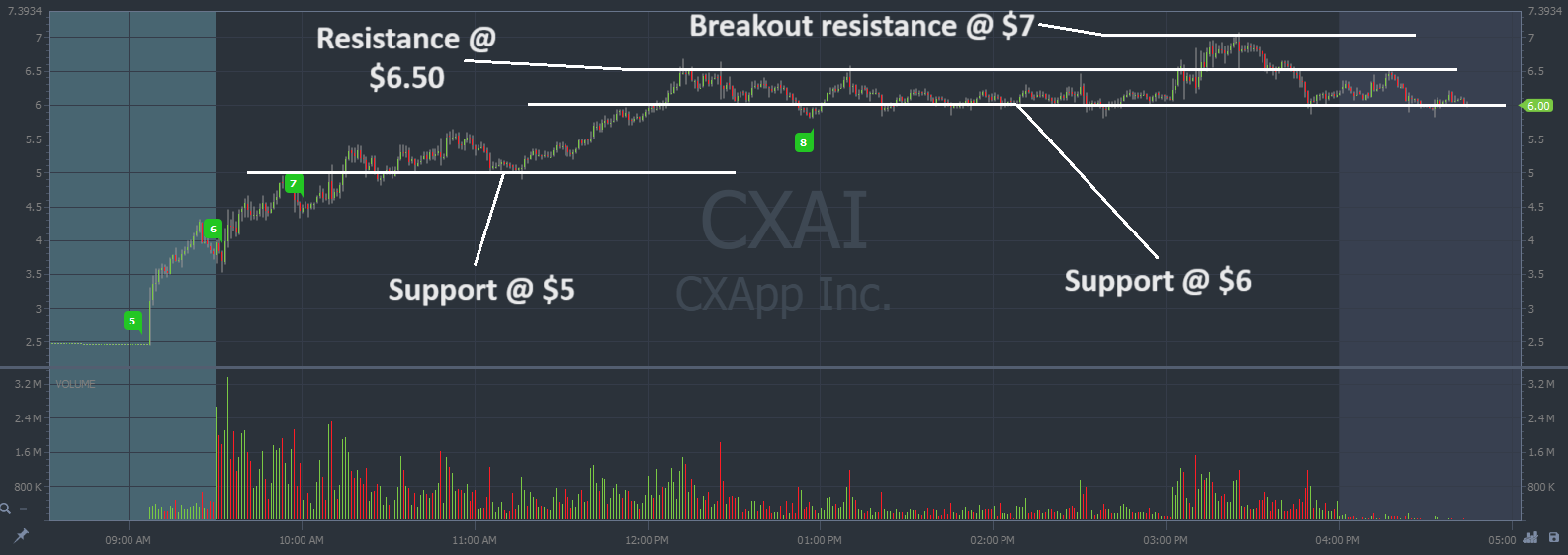

Below is a chart of the move as it stands now, I also included major support and resistance lines. Every candle represents 1 minute:

CXAI chart intraday, 1-minute candles Source: StocksToTrade

Pay attention to these lines as it moves on Tuesday. Support and resistance help us build positions with proper risk and reward.

Here’s what that means: We only take the best trades. Setups where the potential profit outweighs the potential loss.

And as you can see … The potential profits are larger if we see this trade early.

Use Breaking News the next time you trade.

It’s an easy way to get ahead. Just sit back and wait for the next alert.

Here are more examples of winners that Breaking News caught:

42% GAIN off of $IBIO! 🔥

Favorite/retweet if you caught a piece of this move!📈

Get the Next Alert 👇🚨https://t.co/ucPzK66wGy#BreakingNews #stockstobuy #StockMarket pic.twitter.com/U4PzjP8z5d

— Stt Breaking News (@sttbreakingnews) March 27, 2024

11.82% GAIN off of $RDDT!🔥

Retweet & favorite if you caught a piece of this move!📈

Get the Next Alert 🚨👇https://t.co/ucPzK674w6#Reddit #RedditIPO #StocksToWatch #BreakingNews pic.twitter.com/rBOLO9GaFY

— Stt Breaking News (@sttbreakingnews) March 21, 2024

There’s no shortage of runners! And if you think the market is hot right now … You’ve got a month to prepare for the real volatility.

Government Catalyst

There’s a $2 trillion catalyst about to hit the market.

This isn’t a catalyst we can find on Breaking News … We use Breaking News for individual stock spikes. The upcoming government catalyst is different: It’ll shock the whole stock market.

And all evidence points toward an insane buying spree.

This hot market is about to turn hotter.

There’s still time to profit in 2024! These first few months were just a taste of what’s to come.

Everyone who has FOMO from missing the profit opportunities that we’ve already seen, use that FOMO to influence your preparation.

We’ve got about a month until this catalyst kicks off. And the only briefing session is this Thursday, April 4 at 8 P.M. Eastern.

- A $2 trillion market catalyst.

- The most likely stocks to spike.

- How to trade the unexpected runners. And how to recognize that momentum …

Reserve your spot for this week’s market brief, Thursday at 8 P.M.

Cheers,

Bryce Tuohey