Hey traders, it’s Bryce here.

Happy Saturday!

Last week was nuts …

- On Monday KULR Technology Group Inc. (AMEX: KULR) spiked 100% to continue a multi-day move that started on March 14.

- The company announced a new contract of $865,000 with Nanoracks for space batteries.

- On Tuesday Mesoblast Limited (NASDAQ: MESO) gapped up after news stating the FDA recognized its promising phase 3 trial data.

- The multi-day spike currently measures over 140%.

- On Wednesday iBio Inc. (AMEX: IBIO) spiked 250%.

- The company announced a $15 million private placement. At the time of the announcement it had a market capitalization of only $4.6 million.

- On Thursday Avalo Therapeutics Inc. (NASDAQ: AVTX) spiked 620%.

- The day before, during after hours, the company announced an acquisition and private placement of “up to” $185 million.

- The market was closed on Friday.

And this coming week I expect similar volatility.

Here’s Why:

The larger market is booming. Consumer sentiment is rising. Market players feel good about the pace of the FEDs incoming interest rate cuts.

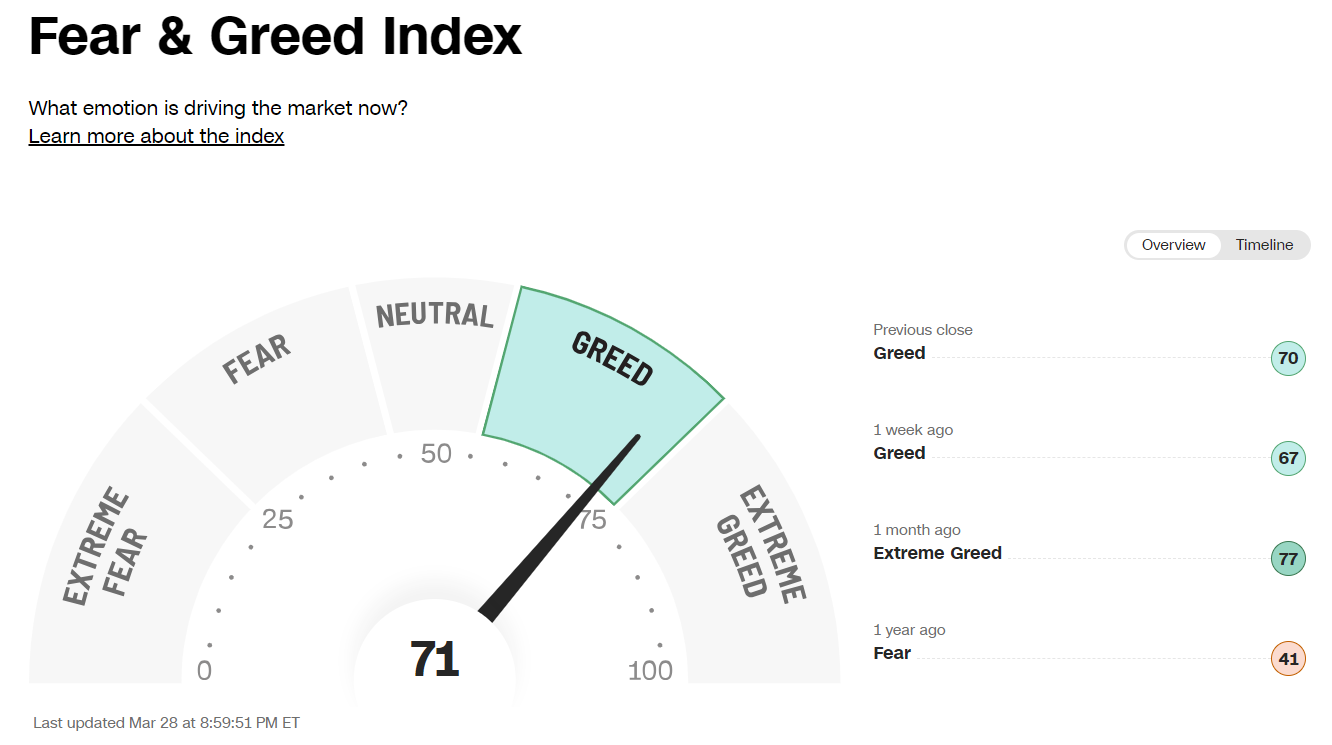

Just look at the index below, the market is currently driven overwhelmingly by greed:

Source: CNN

And major indices reflect that strength.

Here’s a chart of the S&P 500 ETF Trust (NYSE: SPY) in 2024 where every candle represents one trading day:

SPY chart multi-month, 1-day candles Source: StocksToTrade

Three out of four stocks follow the market. When the market is bullish, we see more long-biased profit opportunities among our favorite small-cap stocks.

We focus on small-cap stocks for two reasons:

- Cheap shares give small-account traders the ability to build large positions.

- The low price helps the stock spike higher from a percentage perspective. That’s how small-account traders can build wealth at a faster rate.

- Most blue chips stocks move 5% per day, if you’re lucky. A 5% move on a $1000 position is only a $50 profit.

- Our small cap stocks can spike +100% intraday. Let’s say we take 50% of that move. With the same $1000 position that’s a $500 profit.

Now, there are still lingering fears that the market is overextended. Some people would caution you against trading. Here’s what you need to know about that:

There’s always lingering fear in the market. Just like there’s always lingering greed.

Right now we see an overwhelming amount of greed. And we have to act on the data that we’re given. Plus, we see daily spikers in our small-cap niche, that’s another sign of overall bullish momentum.

Don’t let the naysayers get to you. Stick to your trade plan and stay disciplined.

Now is the time to prepare.

Because contrary to what the naysayers preach … There’s a huge catalyst on the horizon that’s set to send the market to new highs.

Government Intervention

The last time this happened, it was 4 years ago and the stock market rallied 120% after a COVID crash.

On the SPY chart below, each candle represents one trading day:

SPY chart multi-month, 1-day candles Source: StocksToTrade

Some people forget … The rally after that global pandemic was meteoric.

Fast forward to today, there are people worried that the market is already overextended in 2024. But from what I see … The sky’s the limit.

In 2020 we had little to no warning about the impending government catalyst. COVID threw everything off. Yes, traders still had insane opportunities to profit in the following months, but imagine if we had time to prepare.

That’s why this time is different.

The wheels are already in motion, and analysts value this upcoming event as a $2 trillion shock to the market. Another bullish shock.

I’m talking about a move like the post COVID rally without the COVID crash.

We’ve got about a month to prepare. But the market brief is this coming week on April 4th at 8 P.M. Eastern.

You don’t have to do anything until Thursday. Unless you don’t have a brokerage account yet …

Make sure you’re set up and ready to go. Because once the market starts running, you don’t want to waste time playing catch up.

Cheers,

Bryce Tuohey