Hey traders, it’s Bryce here.

There’s a lot going on.

And today is the final day of trading this week. Tomorrow, March 29, markets are closed in observance of Good Friday.

I expect today’s volatility to be insane! Market players are trying to pad their wallets before the long weekend. And there’s already been a lot of volatility this week.

The small-cap sector is red-hot right now. Every single day there’s a new stock spiking. And the biggest stories in the business world are adding gas to the flames.

We cover the biggest stories in today’s blog post. You’re going to want to read this. The stock market is SO entertaining right now.

Forget about your favorite Netflix show. In this week’s episodes of real life:

- Krispy Kreme is partnering with McDonalds.

- Trump’s new stock is named after himself … and could garner meme momentum.

- The Warren Buffet indicator is signaling a market pullback.

Before we dive into details, I need to share with you the framework we’re using right now.

Yes, the market is hot. But we can’t buy volatility at random. There’s still risk involved as stocks spike higher.

We have to pay attention to the right plays.

The Best Spikers

We want low float stocks with news!

- The low float helps prices spike higher. A low float means there’s a low supply of shares. We aim for anything below 10 million shares.

- The news ensures there’s a reason for the spike. We don’t want to buy random bullish momentum.

Take yesterday for example:

- iBio Inc. (AMEX: IBIO) spiked 180% before noon.

- The float shows 3.4 million shares.

- The company announced $15 million in private placement. At the time, the company’s market capitalization was only $4 million.

The news came out during after hours on March 26, the price started to spike and held up all through premarket. It spiked even higher when the market opened for regular trading hours.

Here’s a chart of the spike with the news catalyst. Every candle represents two minutes:

IBIO chart intraday, 2-minute candles Source: StocksToTrade

Here’s another one from yesterday:

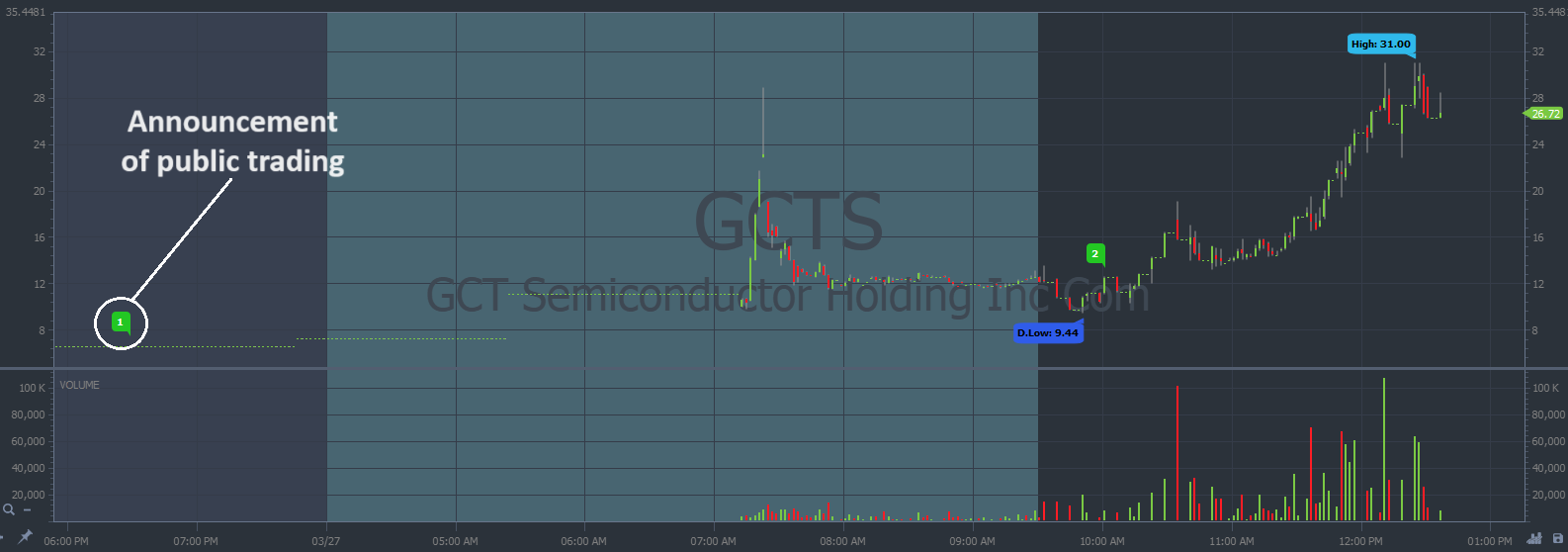

- GCT Semiconductor Holding Inc. (NYSE) GCTS spiked 370%.

- The float shows 12.5 million shares. That’s close enough to 10 million.

- The semiconductor company started trading publicly on March 27. The news came out the night before. It’s worth noting that the semiconductor sector is red-hot right now. It’s running with AI and tech momentum.

Here’s a chart of the spike, every candle represents two minutes:

GCTS chart intraday, 2-minute candles Source: StocksToTrade

Today, Thursday, March 28, keep an eye out for low float spikers with news. They give us the best setups for trading profits.

Now, for the hottest stories of the week …

DNUT Spike

Krispy Kreme will start serving donuts in McDonalds nationwide by the end of 2026.

My mentor, Tim Sykes, wrote a blog post about it yesterday. All the details are right here.

The stock already spiked 40%, higher if you count after hours. On the chart below each candle represents five minutes:

DNUT chart multi-day, 5-minute candles Source:

Prices are consolidating around the $15 level right now. It’s possible the stock will rally from this support. Keep an eye on the price action.

A bigger squeeze could be building!

DJT Spike

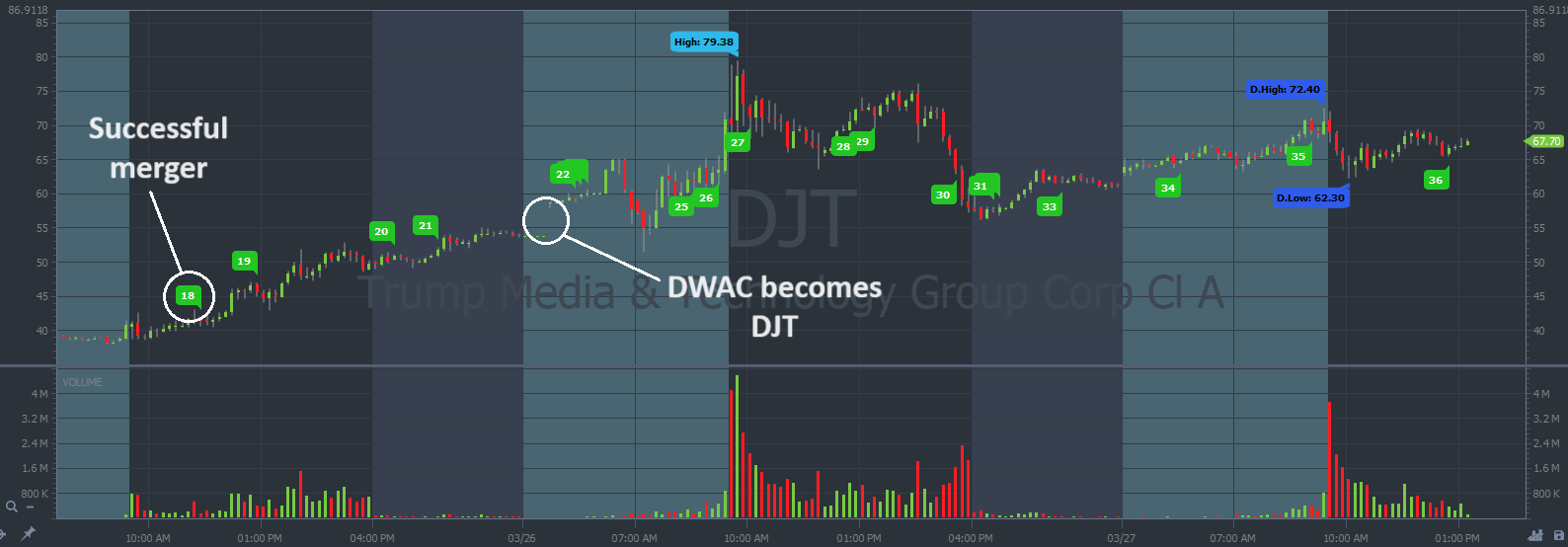

Trump’s Truth Social finally merged with the SPAC formerly known as Digital World Acquisition Corp that traded under the ticker symbol DWAC.

As of Tuesday the company started trading as DJT … As in Donald J. Trump, lol.

We don’t talk politics here.

But you gotta admit, it’s pretty funny that he named the stock after himself. It’s not the first time either. The last company he took public also traded under the DJT symbol between 1995 and 2004. Then it went bankrupt and delisted.

The current volatility on Trump Media & Technology Group Corp (NASDAQ: DJT) can offer profit opportunities. That’s what makes this price action so interesting.

After the successful merger, share prices spiked 50%. And the stock is currently consolidating under an $80 breakout level.

Take a look at the chart below, every candle represents ten minutes:

DJT chart multi-day, 10-minute candles Source: StocksToTrade

If your account is big enough to load up on shares, DJT is a viable stock to trade.

But remember: The price action is almost all due to hype. Truth Social is a struggling social media company. Don’t overstay your welcome!

Warren Buffet Indicator

Even amidst all of this bullish momentum, there are still people afraid of a pullback. I can understand the sentiment, but small account traders don’t need to worry as much.

There are new spikers in our niche every day.

The momentum is unsustainable and prices will crash eventually … But that’s why we TRADE these plays, we’re not INVESTING.

Remember GCTS from earlier, prices spiked 370% yesterday. We can snag a cool 10 to 20% profit from a spike like that. Then we move to the next play …

Maybe there will be another opportunity to profit from GCTS, but we’re not going to hold shares at random. We need a trade plan.

There’s a process for profits in this niche.

I’ve already used it to pull more than $1 million from the stock market. It’s the same process that Tim Sykes and the rest of his millionaire students use.

It’s not rocket science, but you won’t learn everything that you need to know in this blog post.

Sorry. I’m good at writing … But no one’s that good.

When I started trading, the tool that helped me the most were Sykes’ trading webinars. New traders get to watch the process happen in real time. All while professional traders track the market’s hottest stocks.

Don’t worry about the larger market!

Yes, Warren Buffet’s indicator is signaling an overpriced market. The indicator compares the U.S. stock market value with U.S. GDP. It’s fairly straightforward. And right now the indicator shows the market is overvalued compared to U.S. GDP.

But I’m not worried about a market pullback …

Either way, I’ll be in the small-cap sector riding the best setups for huge potential gains. You’re welcome to join me!

Cheers,

Bryce Tuohey