Hey traders, it’s Bryce here.

Some of the most profitable setups in the market are breakout moves.

We see these patterns on stocks across the board: The chart will run to new highs, put in a top that defines the breakout level. Then it consolidates and breaks past the resistance to new highs.

These breakouts can be extremely explosive.

For example:

MSP Recovery Inc. (NASDAQ: LIFW)

LIFW chart multi-month, 1-day candles Source: StocksToTrade

Vistagen Therapeutics Inc. (NASDAQ: VTGN)

VTGN chart multi-month, 1-day candles Source: StocksToTrade

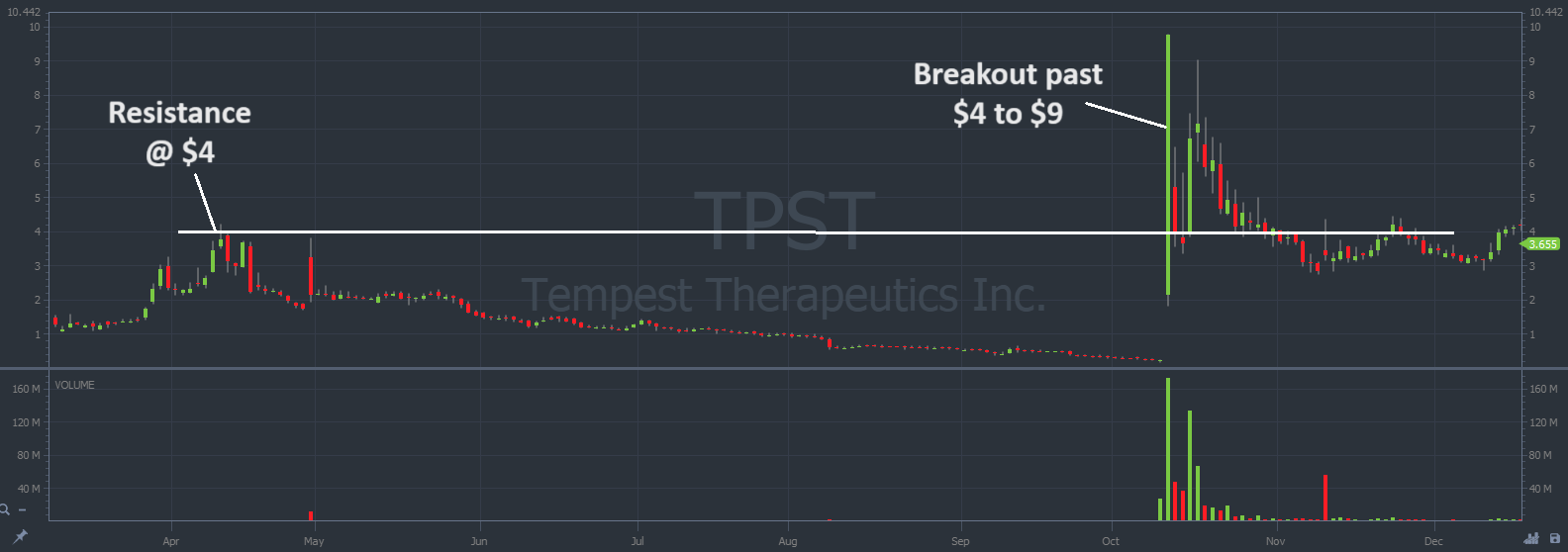

Tempest Therapeutics Inc. (NASDAQ: TPST)

TPST chart multi-month, 1-day candles Source: StocksToTrade

These aren’t coincidental spikes.

In each case, there’s a catalyst that causes these small-cap stocks to spike +100% even +1000% in some cases!

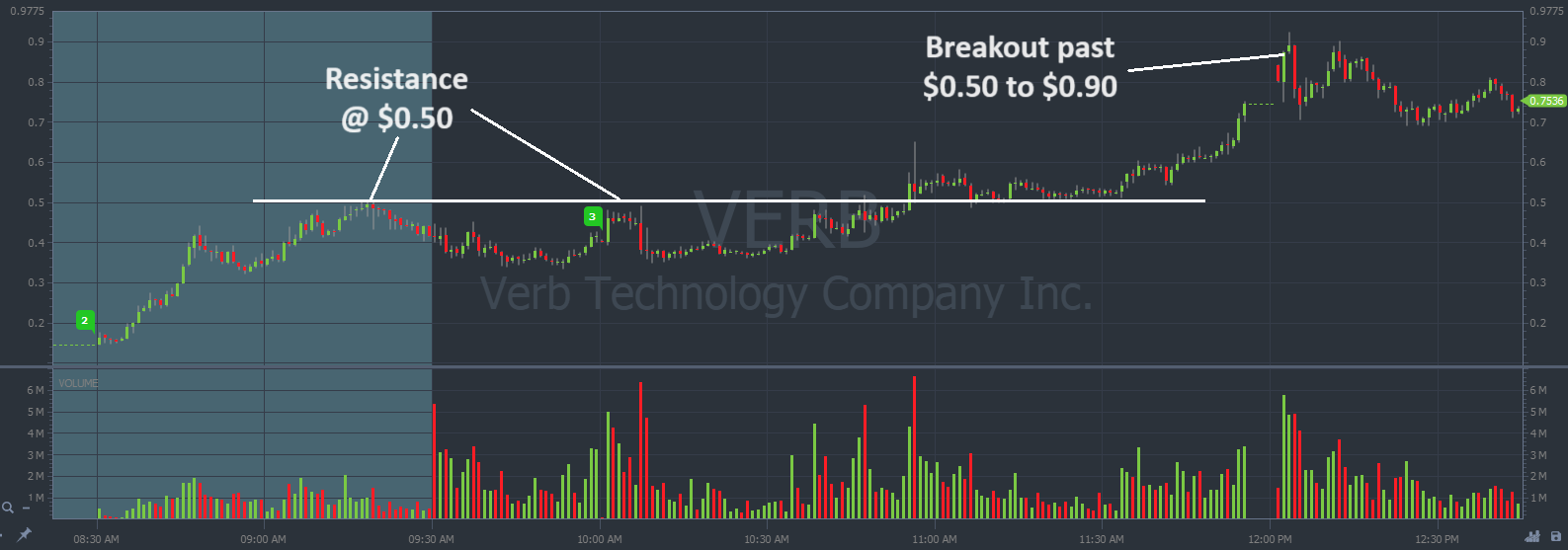

We even see these moves intraday.

Yesterday, Friday, March 15, Verb Technology Company Inc. (NASDAQ: VERB) launched past $0.50 resistance to highs at $0.90.

It was a $0.40 cent move, but due to the low share price, that translates to an 80% intraday breakout.

The company announced a catalyst during premarket. The stock’s entire intraday move measured +550%:

VERB chart intraday, 1-minute candles Source: StocksToTrade

There will be more profit opportunities like this next week. But you won’t find them on YahooFinance or CNBC. Wall Street doesn’t know how to find these runners.

That means the spikes are largely reserved for small-account traders …

The Biggest Small Account Opportunities

We’re following penny stocks for a few reasons:

- The shares are cheap.

- We can load up on our positions with less money.

- The low price helps the percent gain.

- A $2 gain on a stock that starts at $1 is a 100% gain. A $2 gain on a stock that starts at $35 is only a 5% gain.

- Penny stocks are too illiquid for Wall Street.

- That keeps the competition low.

Yes, penny stocks can be sketchy.

But for traders who understand the price action, there are real profit opportunities.

We know that the price will eventually crash. Refer to the three first examples I shared at the beginning of this blog:

- LIFW

- VTGN

- TPST

They all fell back toward the level they started at. At the very least, they couldn’t hold gains above the breakout level.

Don’t get married to these stocks. We’re just trading the volatility.

It helps if traders have eyes on the spike early. VERB’s spike was alerted during premarket trading hours on Friday:

156% GAIN off of $VERB!🔥

Retweet & favorite if you caught a piece of this move!📈

Get the Next Alert🚨👉https://t.co/DV5c1Ke7gO #FridayFeeling #FridayVibes #StocksToWatch pic.twitter.com/nd3LE16vI8

— StocksToTrade (@StocksToTrade) March 15, 2024

But finding the stock is half the battle.

We still have to trade these huge runners.

Self Sufficient Trading

Focus on personal growth! Don’t rely on social media for your stock picks.

There’s a real process for profits. And it’s not rocket science.

I take it one trade at a time. I follow the rules. And so far I’ve pushed past $1 million in trading profits.

All thanks to Tim Sykes and his trading framework.

There are a few trading patterns we can use within the framework. But breakouts are some of the most lucrative opportunities in the market.

And they’re pretty easy to spot. That’s what makes them so popular for new traders.

Make sure to catch next week’s small-cap breakouts. This is the pattern to use.

Don’t see a play on Monday that matches our setup? Close your laptop and go fishing.

There’s no need for undue risk in this 2024 market.

Cheers,

Bryce Tuohey

This “Loophole” is So Powerful

There’s a renegade day trader who discovered a powerful “weekend loophole” in the stock market.

It allows him to place trades on Friday afternoon…

And open up his laptop on Monday to potential green.

He’s used this “loophole” to make $8,780, $9,177, and even $69,962 all over the weekend.

And he claims with the right amount of hard work and dedication, ANYONE can learn how to use it too…