Hey traders, it’s Bryce here.

Always remember that 3 out of 4 stocks follow the market.

- When the market is hot we can trade more aggressively.

- When it’s slow we need to play it safe.

Case in point, last Friday the market made a substantial dip after a strong rally earlier in the week. Take a look at the S&P 500 ETF Trust (NYSE: SPY), the chart below shows 1-day candles …

SPY chart multi-month, 1-day candles Source: StocksToTrade

And multiple stocks showed similar dips in price action:

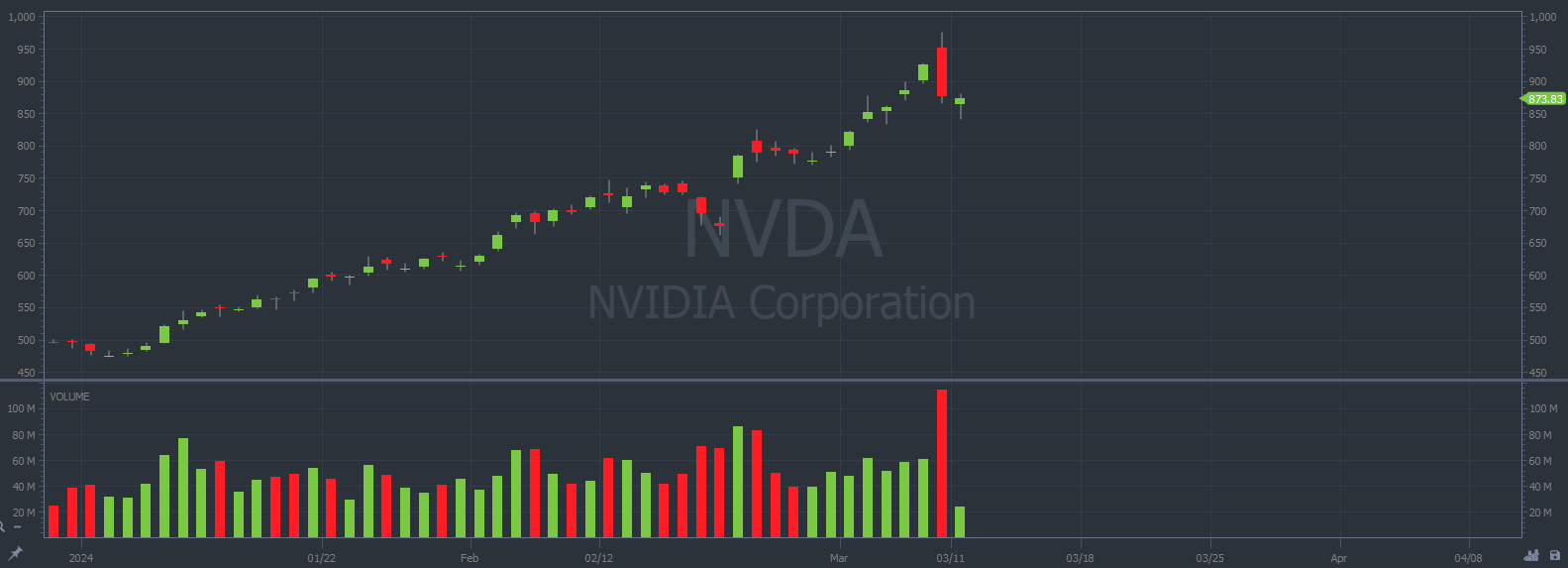

NVIDIA Corporation (NASDAQ: NVDA):

NVDA chart multi month, 1-day candles Source: StocksToTrade

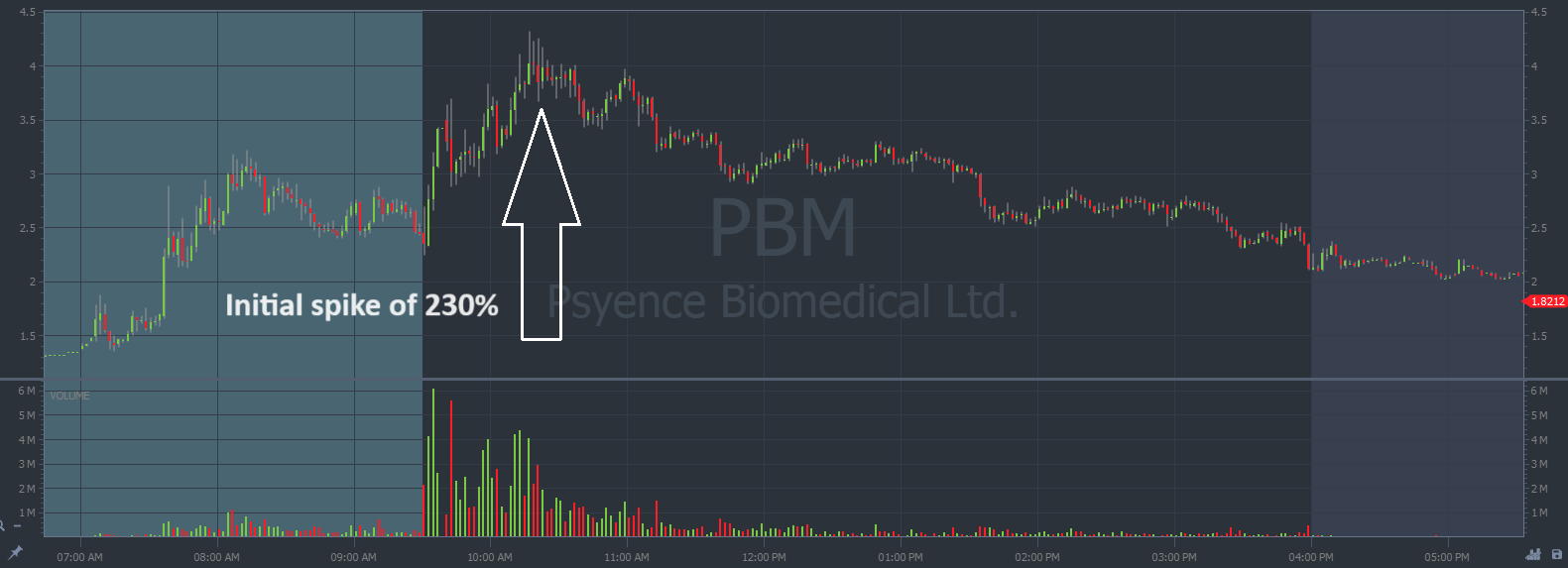

Psyence Biomedical Ltd. (NASDAQ: PBM) was on a CRAZY run Friday morning. But it couldn’t continue the momentum into the end of the day.

You’re seeing premarket hours, regular hours, and then after hours trading from left to right:

PBM chart intraday, 2-minute candles Source: StocksToTrade

Our favorite setups don’t follow the market perfectly. It’s more of an indirect relationship.

If we follow the momentum of the larger market, we’re more prepared to capitalize on setups for low-priced stocks.

And that’s where small-account traders can make a lot of money …

Major Events This Week

There’s a FED meeting scheduled for March 20.

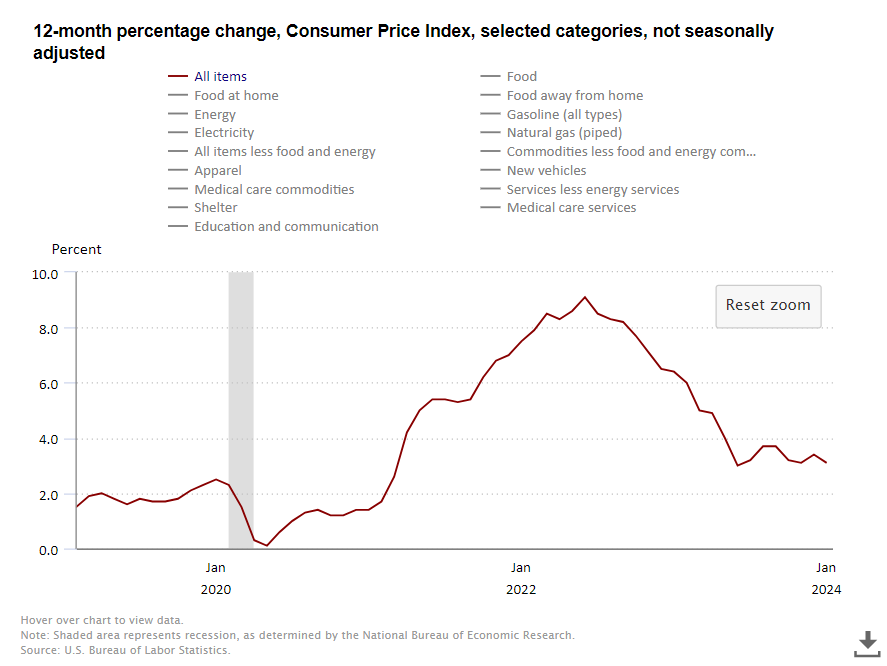

The market wants to see confirmation that the FED is ready to lower interest rates. But before that happens, the FED needs confirmation that inflation is slowing.

Today we learn the Consumer Price Index (CPI) for February, it’s a popular measure of inflation.

Below is a chart showing the monthly history of the U.S. CPI data. We’re aiming for a CPI close to 2%. And January showed CPI inflation of 3.1%.

Source: BLS.gov

Later in the week we learn data for U.S. retail sales and consumer sentiment.

These are also good indicators of the inflation level in U.S. … We’ve got a week chock full of data that WILL move the market. And next week we have the FED’s announcement.

But don’t buy shares in anticipation of this news.

It’s safer to react instead of predicting.

No one knows what the CPI inflation data will look like. Same goes for retail sales data and consumer sentiment data.

Once we identify the direction of the momentum, we can build a position with more confidence.

Top Plays

Whatever happens, pay attention to low-float runners.

These are stocks with less than 10 million shares in the float and spiking at least 20% on the day.

- The low float (AKA the low supply of shares) helps prices spike higher when demand increases.

- Friday’s runner, PBM, had a float of 790k.

- Monday’s runner, TS BioPharm (Holdings) Plc (NASDAQ: TCBP) spiked 190% with a float of 2.3 million shares.

- If a small-cap stock can spike 20%, it can spike higher.

We only want the best plays. And this is how we find them.

There are thousands of stocks moving every day.

Inexperienced traders lose because they focus on the wrong setups.

Sign up for the next trading live stream and follow along LIVE.

Don’t leave your account up to chance.

There are profit opportunities every single day. Live streams help new traders understand which plays are GOOD and which plays are WORTHLESS.

Cheers,

Bryce Tuohey

How to Find the Biggest Breakouts in the Market

Do you recall HOLO gaining $1,565 in 12 hours… or when BMR gained 784% in 2 hours?

Those were “Dark Breakouts” and unfortunately, most investors don’t see them until it’s too late.

Want to know the secret to spotting (and trading) these breakouts?

Ignore the stocks most investors are focused on and…