Hey traders, it’s Bryce here.

It’s easier to profit when the market is hot!

Take a look at the S&P 500 ETF Trust (NYSE: SPY) chart below, we keep pushing to new all-time highs almost every week:

SPY chart multi-month, 1-day candles Source: StocksToTrade

Lay your foot on the gas pedal right now. When the market takes a break from this run, we won’t see as many plays.

We’re usually focused on small–cap runners that can spike +1000%. But that’s not always attractive for people. After all …

These are trash stocks.

The spike is based on hype. We know the price will crash eventually. We can use the market’s hottest patterns to profit in the short term …

But some people aren’t comfortable trading a stock like Rail Vision Ltd. (NASDAQ: RVSN). It spiked 2,000% in 2024 but the price ended back where it started:

RVSN chart multi-month, 1-day candles Source: StocksToTrade

Luckily, there is a way we can profit off the most valuable stocks in the market …

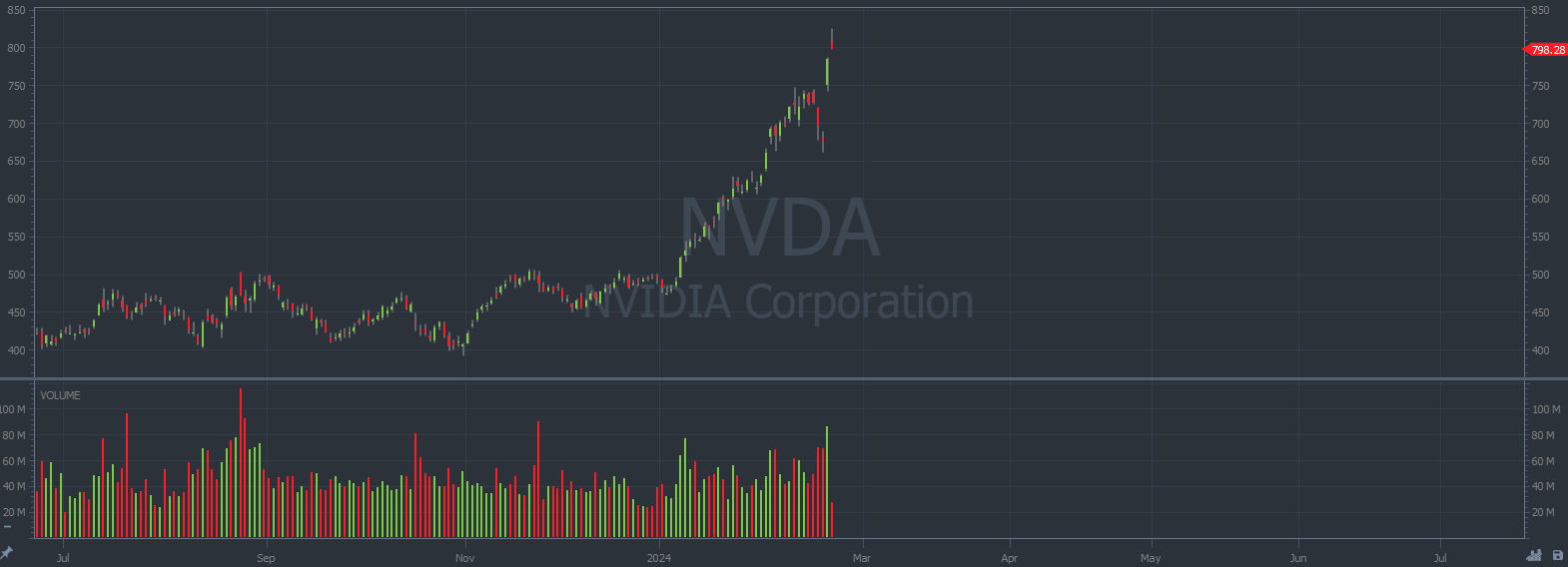

NVIDIA Corporation (NASDAQ: NVDA) is the star of the U.S. market. The recent surge is attributable to an equally strong tech sector from the AI boom that started in 2023.

This mega-cap stock is moving like a volatile penny stock:

NVDA chart multi-month, 1-day candles Source: StocksToTrade.

And it’s more attractive because it’s a “real company”.

Most of the runners that we see in the small-cap market are trash.

Conversely, NVDA is a business valued at $1.9 billion with multiple profitable connections in the tech industry and over 26,000 full-time employees.

The chances of NVDA failing are slim compared to a stock like RVSN.

And right now there are opportunities for small-account traders to take advantage of these mega-cap industry leaders!

Wall Street Plays

Everyone talks about getting in on the next big company to take over Wall Street.

There was a Netflix mania when video first transferred to streaming platforms. The Amazon surge is another example (remember when Amazon only sold books? lolol). And Tesla fits the pattern as well.

All of these stocks started trading at low share prices, and because hindsight is 20/20, people kick themselves and think: “If only I bought shares of NFLX in 2009 when it was still trading below $10.”

Don’t beat yourself up.

Nobody knows which companies will succeed and which will fail.

Once a company reaches a certain point, we can trust it more than the average penny stock. But that’s when the share prices are already out of bounds for average traders.

We’re left out of the all-star club because we don’t have a $1 billion hedge fund portfolio to buy thousands of shares at +$100.

Thus, the rich get richer on the backs of consumers.

It’s time to break the cycle.

It’s 2024, baby! There ARE ways for traders like you and me to capitalize on the market’s most valuable stocks.

This is music to my ears because NVDA is surging to new heights. It’s passing other huge tech companies like Meta Platforms Inc. (NASDAQ: META) and Alphabet Inc. (NASDAQ: GOOG).

And NVDA isn’t the only mega-cap runner moving like a penny stock:

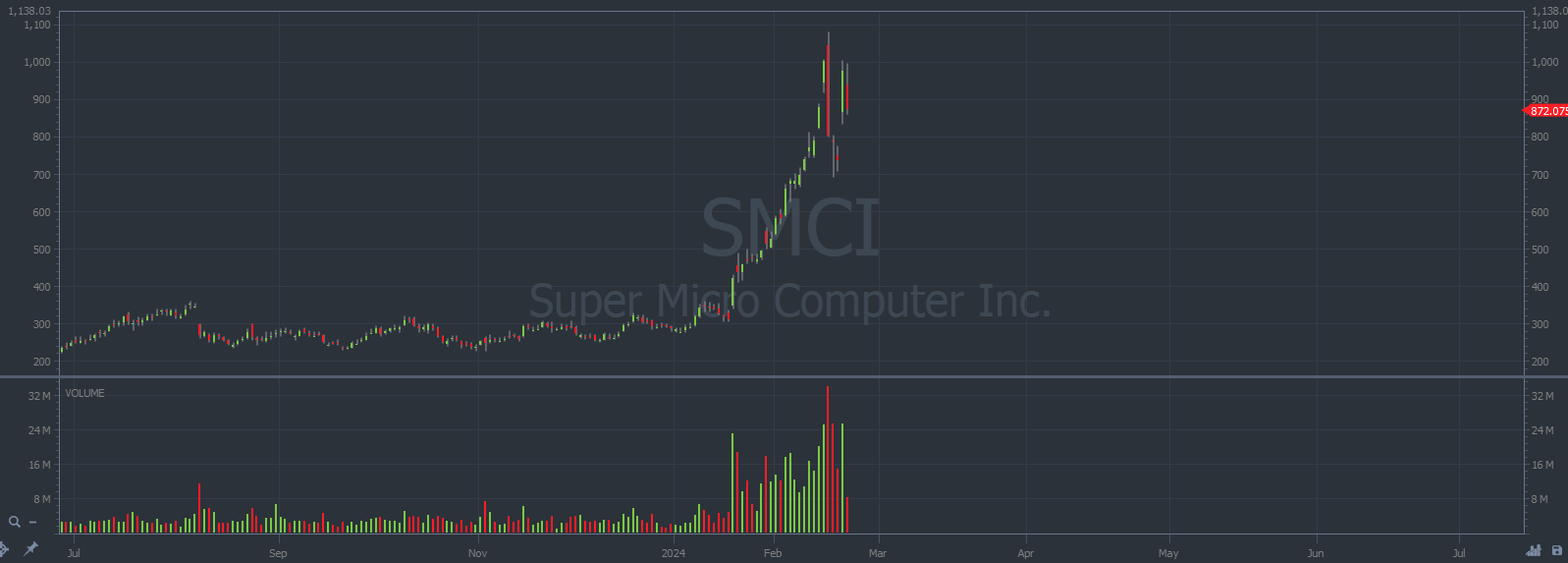

Super Micro Computer Inc. (NASDAQ: SMCI)

Look at this insane move:

SMCI chart multi-month, 1-day candles Source: StocksToTrade.

The company provides high-performance cloud data systems. This is a sector directly related to AI because new computer programs require more sophisticated data storage and usage. And the price is surging toward the highs after a decent pullback.

I’m watching for a breakout.

Wall Street is BANKING off of these plays.

Don’t sit and cry about it …

Here’s how small-account traders are hopping on board!

If you can’t beat ‘em, join ‘em.

Hedge funds are pulling in cash hand-over-fist. We deserve a slice of that pie.

Cheers,

Bryce Tuohey