Hey traders, it’s Matt here.

Last week we saw a lot of great trade opportunities.

Bryce included them in his blog post yesterday.

But hindsight is 20/20.

There’s no telling which stocks will spike this coming week. Unless …

There IS a way to ensure we’re looking in the right place. I can’t give you the exact ticker symbol to watch because the stock hasn’t spiked yet.

But I can show you what it will look like.

At any given time in the market, certain stocks are hotter than others. For example, thanks to AI, the tech sector is on fire right now.

Stocks like Meta Platforms Inc. (NASDAQ: META), NVIDIA Corporation (NASDAQ: NVDA), and Microsoft Corporation (NASDAQ: MSFT) are surging to new all-time highs.

But I’m not interested in those stocks.

Even though we’re in a bull market, blue-chip stocks only move a couple of percentage points each day. That’s not enough meat for me.

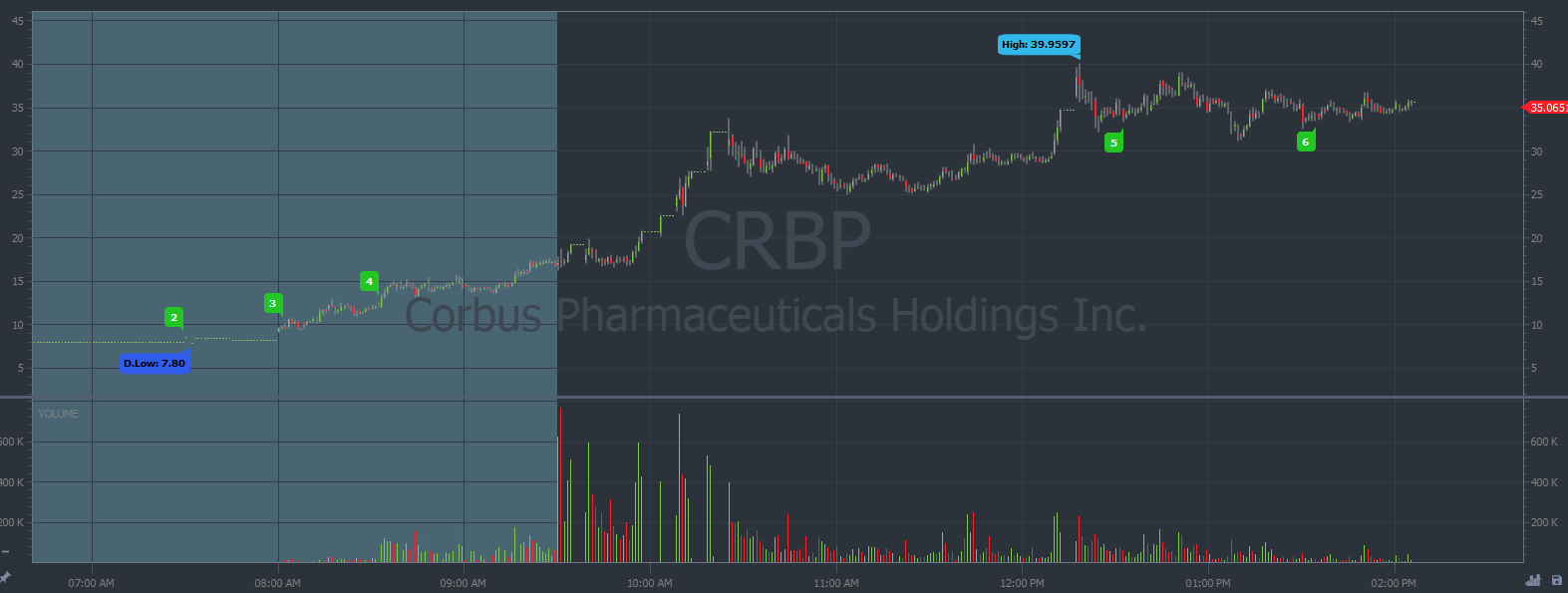

I want to trade stocks like Corbus Pharmaceuticals Holdings Inc. (NASDAQ: CRBP). The price spiked 370% on Friday. A trader could get in and out of that with a cool 20% and go enjoy their weekend.

CRBP chart 1-day, 1-minute candles Source: StocksToTrade

I’ve got news for you: We’re about to see more opportunities like $CRBP every day next week.

When the market opens on Monday, there’s a very specific stock that I want to trade.

Sympathy Plays

Sometimes, when there’s a big runner in the market, we see other stocks spike to try and copy the momentum.

$CRBP was easily the biggest runner in our niche on Friday.

I’m watching for Monday spikers that fit a similar description.

- A biotech stock.

- Former runner.

- Trading below $10.

- With a float below 10 million shares.

- Spiking with cancer-related news.

But there’s an important aspect of this that we need to discuss.

Monday’s spiker might not run as high as $CRBP. The price action might look different too.

These setups are like snowflakes. Every chart is a little unique.

Most traders fail because they don’t know how to recognize popular patterns on different charts. It’s an issue of experience.

Here’s a great analogy:

- Someone who’s never seen a bike before probably stinks at biking.

- Someone who’s never seen a perfect dip-and-rip pattern probably stinks at trading.

You need experience if you want to navigate the market.

But don’t worry: There’s still a chance to catch Monday’s hottest setup.

Monday Opportunity

I used to be a new trader, just like you.

I started learning in college.

And honestly … This process can be difficult!

I spent hours looking at charts and reading pattern tutorials. But things really started to click when I watched trading live streams.

The difference is that traders get to watch professionals operate LIVE as they track the market’s hottest stocks.

I told you: Hindsight is 20/20.

To grow as a trader, we need to experience these spikes in real-time.

There are live streams every day this week. Follow along and take notes.

Our small-cap niche is on fire right now. Don’t want to miss this week’s profit opportunities!

Cheers,

Matt Monaco