Hey traders, it’s Bryce here.

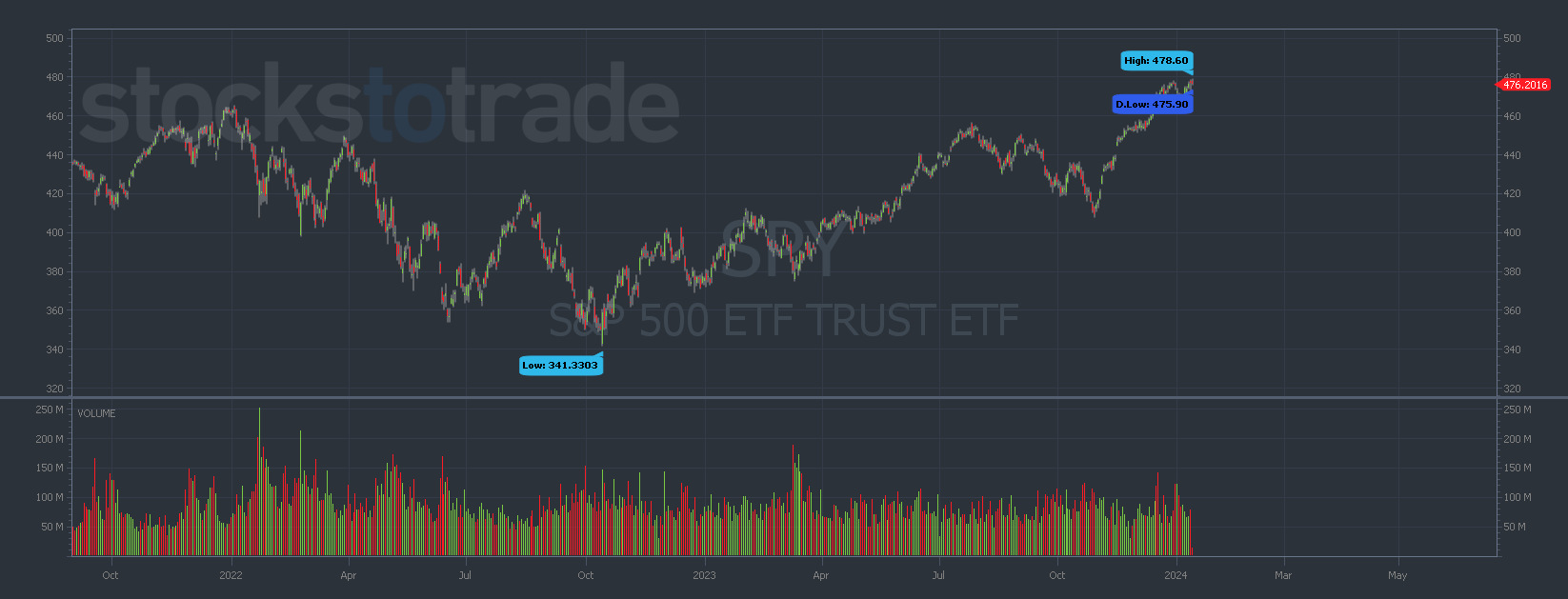

Well well well … The S&P 500 ETF Trust (NYSE: SPY) made new all-time highs this week.

That’s why we’re experiencing so many small-cap spikes right now.

When the larger market is bullish, our trade setups are stronger.

Take a look at this chart of the S&P 500 ETF Trust (NYSE: SPY) below. We’ve come a long way since 2022 …

SPY chart multi-year, 1-day candles Source: StocksToTrade

This next part is key:

I don’t know how long the momentum will last.

I don’t predict market movements. That’s nearly impossible. Anything can happen at any time and there are too many variables that influence the larger market. It’s much more safe to react instead of predicting.

Right now I’m REACTING to bullish stock momentum due to the larger market spike.

We’ll cover my Monday watchlist in today’s post.

But understand, the market could dip at any point. Even the strongest spikes will pull back now and then.

We have to take advantage of this momentum while it lasts.

Right now I have eyes on four of the hottest runners from Friday. This momentum could continue into Monday!

Keep reading …

Monday Watchlist

Like I said, we HAVE to take advantage of this momentum while it lasts.

Mondays and Fridays are the most volatile trading days of the week. That means my next BIG opportunity to profit is this coming Monday.

Technically I could take Tuesday, Wednesday, and Thursday off if I wanted to. But in the current market, I expect to see big opportunities throughout the week.

If you work a day job: Make sure to pay attention on Monday.

There’s no need to stress about week-long profits. The market will always be here.

My watchlist is below …

- Applied UV Inc. (NASDAQ: AUVI)

- Charge Enterprises Inc. (NASDAQ: CRGE)

- Atreca Inc. (NASDAQ: BCEL)

- Elevation Oncology Inc. (NASDAQ: ELEV)

There’s a specific trade plan for each of these runners.

They all fit within the broad 7-Step Framework. But where the stock is within the framework dictates which pattern I use to trade it.

It’s not confusing once you gain enough experience. But if you thought this was going to be easy, clearly you’ve never tried to trade stocks before.

There IS a specific process that we follow for profits. But it requires discipline!

Luckily, there’s a simple way that new traders can gain experience.

Follow The Hottest Plays

When the market opens on Monday morning, these stocks will likely whipsaw back and forth until they fit a popular pattern.

Don’t get caught in the wrong price action!

Every day, professional traders are holding livestreams. This is how I grew my account past $1 million …

Every chance that you have, tune in for a trading livestream. Watch the price action, and listen to the trader as they explain the strategy in real-time.

Hindsight is 20/20. You could check the market at the end of the day and think: “It’s easy. Buy here and sell here.”

But it’s not as simple when you’re trading it. You need to gain real-time experience.

There are live streams this weekend too.

If you want a specific trade plan on a stock I shared above, log in and drop it in the chat.

There WILL be an opportunity to profit on Monday.

The question is whether you’ll be there to catch it.