Howdy traders, it’s Bryce here.

Today we’re expected to get an inflation update for the month of January 2023.

Inflation data is still one of the largest catalysts in the market.

Which means, if traders like what they see, we could experience a huge bullish Tuesday.

Three out of four stocks follow the market … first determine market direction, then search for the hottest plays. And if prices are spiking, feel free to get aggressive.

Inflation has been slowing for the last few months. Here’s a chart …

Source: Statista.com

Today I’ll show you how to capitalize on Tuesday’s top catalyst.

Complete with the hottest tickers and a game plan to find more …

Volatility

I saw a few tickers spike yesterday. I’m watching them Tuesday morning for continued moves …

TOP Ships Inc. (NASDAQ: TOPS)

Low-float tickers with news are still the hottest runners week to week.

TOPS has a float of 10 million shares.

And today it announced a new contract as well as a bullish revenue update.

The price gapped up and spiked +60%.

But if you missed that move, late this morning it consolidated around $1.80 and then pushed back toward the highs. Already, the trade would have offered another +15% …

TOPS chart 1-minute candles Source: StocksToTrade

Another ticker that popped up mid-day …

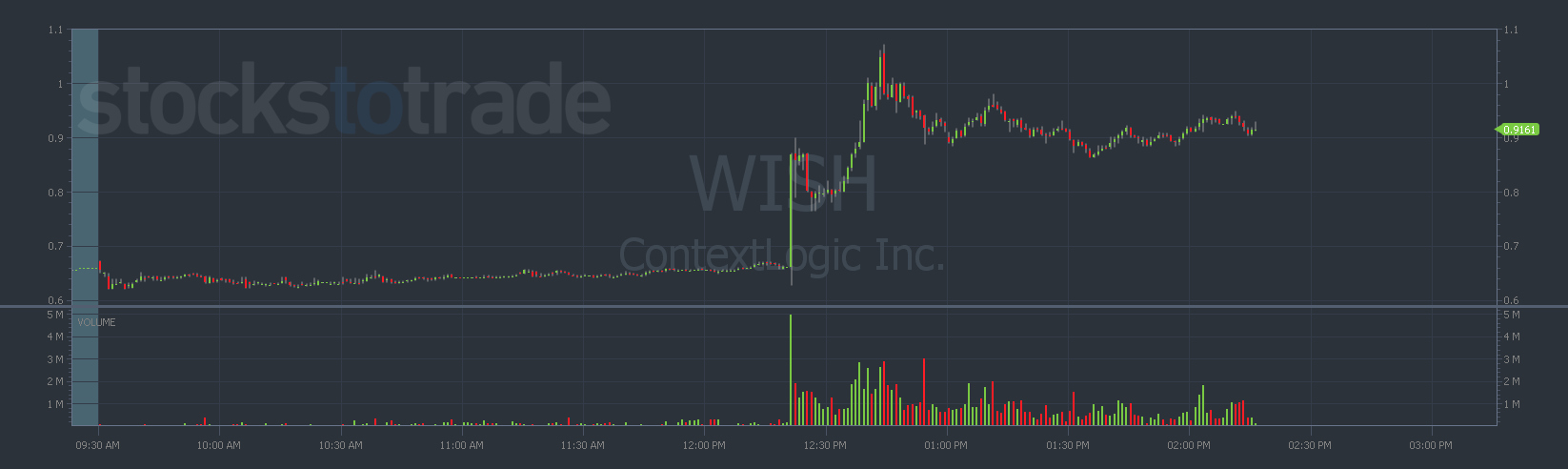

ContextLogic Inc. (NASDAQ: WISH)

This stock has a bit of a higher float. There are 640 million shares outstanding.

But the volume shows +120 million shares traded.

And the price is running due to a bullish Tweet from Citron Research …

1/ We were reluctant to mention $WISH until we saw the Super Bowl. The $Wish business model seemed terminal….and then everything changed!!! It has now become the most assymetrical opportunity in the market

— Citron Research (@CitronResearch) February 13, 2023

“The most asymmetrical opportunity in the market.”

- Citron Research

Those are some pretty big words …

So far it’s managed a +60% spike. And the price is consolidating …

WISH chart 1-minute candles Source: StocksToTrade

Notice, right after the Tweet came out, the price shot up.

These plays can be fast …

It’s great for traders because it means we can make +10% in a few minutes. There’s less market exposure because the trade doesn’t last very long.

The rest of the time, I sit in cash waiting for the next play.

But it also means I need to be watching the screen all day long. Or does it …

That’s how I used to trade.

It works, but it’s not very good for my eyes, my back, or my stress levels.

So instead, I subscribe to a breaking-news service that notifies me whenever there’s news ready to push prices higher.

Want to be alerted to hot trade ideas before anywhere else?

Breaking News Chat is the alert service that traders can’t get enough of. Two former financial analysts scour the Stock Market and news for stocks that could potentially spike and alert the room allowing you the chance to get in on the action.

Check out the alert for EPAZ on February 14th:

This is a tool you’ll want in your trading toolbox.

It’s the ultimate way to trade.

Sometimes the news doesn’t work out. They’re not all home runs. but the main point is, I’m on time and able to decide for myself whether or not to trade it.

I get there early so I have the option.

Lots of other traders show up late … and they’re out of luck.

That’s how I’m finding new spikers in this market. Especially today, inflation-data day.

I’m ready to catch the next big fish!

I’ll see you in the next letter.