Howdy, traders. It’s Bryce here.

I hope everyone’s week is off to a good start.

I know the indexes dropped yesterday as anxiety over the upcoming earnings season set in.

But if you traded Pliant Therapeutics Inc. (NASDAQ: PLRX) in the morning session or Kaspien Holdings Inc. (NASDAQ: KSPN) mid to late day, you probably didn’t even notice what the markets were doing.

Those two tickers each put in moves with well over 100% gains for the day. Congrats if you caught a piece of the action.

With earnings season coming up though, I thought I’d take a moment to talk about what can happen to stocks during earnings season and how it can affect your trading…

Which Stocks Tend to Move During Earnings Season?

If you’re a newer trader, you might’ve noticed that stock movement tends to change direction during earnings season.

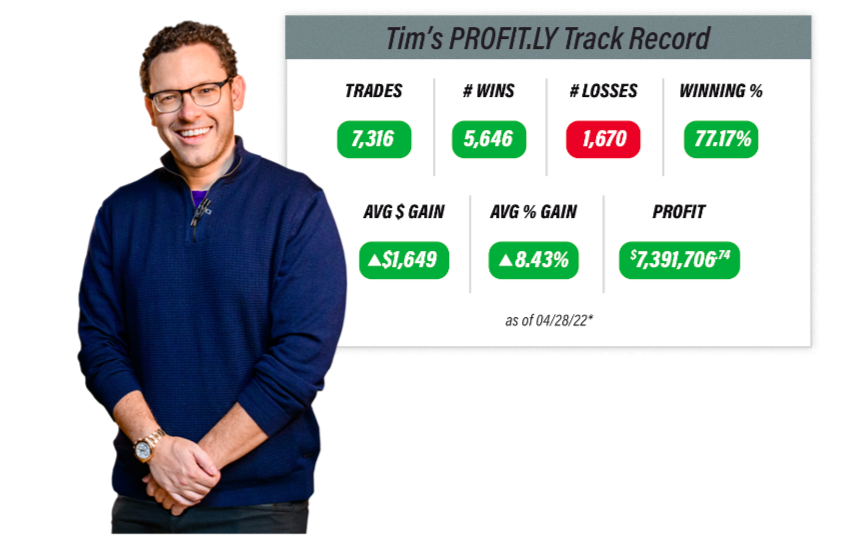

Learn the secret Tim used to turn a small investment into a fortune

But maybe you couldn’t quite put your finger on which or why…

The thing is, most traders want to minimize their risk, but they need volatility at the same time.

Most large-cap stocks don’t make large moves on any given day, with few exceptions — I’m thinking about you, Tesla Inc. (NASDAQ: TSLA).

Until earnings season arrives … companies start reporting their financials for the previous quarter and issuing guidance for the quarters to come.

So what happens? A lot of trading volume tends to move over to the specific companies that are reporting earnings that day or in the next few days, and small-cap stocks tend to get a bit quieter until earnings season subsides.

What to Look for When Trading During Earnings Season

Here are a few things to consider as we trade amidst earnings releases…

- What environment are we in? Right now, the economy isn’t so hot. We’re not expecting companies to make blowout gains. With earnings, what matters most is expectations.

- In a shaky market, traders tend to react more strongly to earnings than usual. If a company does better than analysts expected, it could make substantial upside moves as traders cling to the ticker with a glimmer of hope.

- At the same time, if companies just meet or fail to meet expectations, traders can be very unforgiving. Even large caps can see significant intraday drops.

- Where’s the volume? Earnings releases can come by sector. For example, one week all the major tech companies will report, and the next week it’ll be retail. If the first couple of companies in a sector does well, traders could bring momentum to the other companies reporting in the same sector.

- DON’T hold your position through earnings. Look, I did it once … I’m not proud of it. I took a gamble on Amazon.com, Inc. (NASDAQ: AMZN) and it went up after earnings, but other than that, I’ve never swung through earnings and had it work. And most teachers will warn you NOT to hold through earnings.

- DO keep your eyes peeled for PR releases. Companies sometimes drop hints about how they’re doing leading up to earnings through the press, setting up a classic ‘buy the rumor, sell the news’ type of situation.

- DO read the room. With fewer companies making outstanding gains, traders might choose to bottom-feed. They might turn to stocks with high short interests, looking for the one that actually beats its earnings estimates, even by just a smidge, to pile in for a short squeeze.

The bottom line here is that traders want action. But there has to be a justification for them to take it. So they’re gonna go to the stocks getting the most attention. That’ll naturally be the ones preparing to release earnings reports and forward guidance.

Conclusion

Being a full-time trader keeps you on your toes. You have to go where the action is … and that always changes. But that’s what makes it exciting, and it’s totally worth the effort.

Trading can change your life. I was recently reflecting on how I went from living in a van with my friend to living the laptop lifestyle my mentor Tim Sykes promotes so well.

It was his dedication to his students that helped lead me to where I am today and inspired me to start Small Cap Rockets. If you’re looking for guidance, community support, the answers to your questions, and the latest alpha on what’s working in today’s market, join us!

Growing A Small Trading Account? Check this Out

When multi-millionaire trader Mark Croock first started trading, he was an overworked and underpaid accountant…

So he knows what it’s like to start small while wanting to massively grow your wealth as quickly as possible.

That’s why he just recorded a step-by-step training that reveals what he believes is the best options trading method for someone trading with a small account.