Happy Tuesday, traders. It’s Matt here.

I hope everyone enjoyed some spectacular fireworks this past weekend. If there’s something the fourth of July reminds me of, it’s good old-fashioned capitalism.

I mean, aren’t free markets a hallmark of democracy and independence?

But there’s a funny thing that happens as companies grow. They seem to become a little less free. They trade that freedom for stability. Remember when Alphabet Inc. Class A’s (NASDAQ: GOOGL) Code of conduct said: “Don’t Be Evil”?

There’s a similar dilemma going on in cryptocurrency right now. As exchanges teeter on the brink of insolvency, there’s a crypto-made billionaire buying up some troubled assets.

Will he save the day or become the de facto Federal Reserve Chairman of what’s supposed to be decentralized finance?

Who is Sam Bankman-Fried?

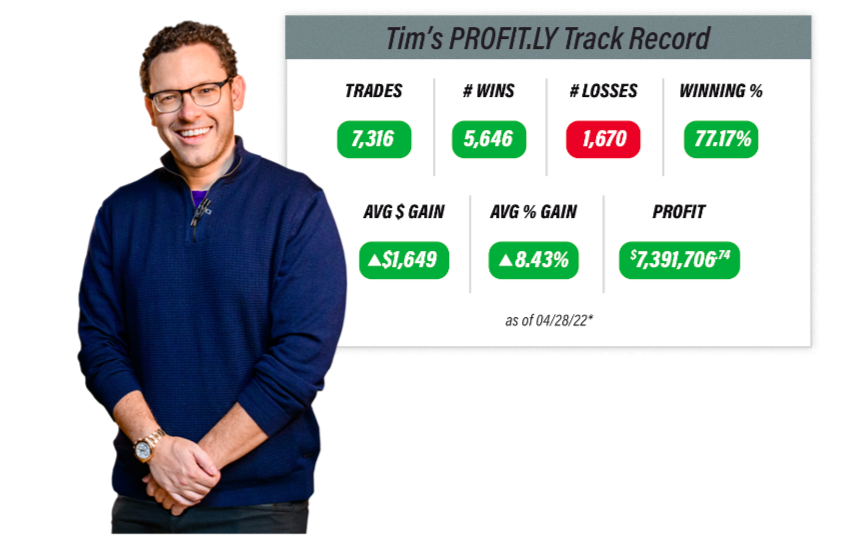

Learn the secret Tim used to turn a small investment into a fortune

Sam Bankman-Fried is also known as SBF. He started the FTX exchange after finding that many cryptocurrency exchanges were not to his liking. They were “glitchy, unsafe, and had next to no customer support.”

BSF felt like he could do better, and he did. FTX was founded in 2019 and ballooned to a valuation of over $30 billion in roughly three years.

So what’s a crypto billionaire to do when his industry’s in disarray? Start acquiring the little guys that can be saved. And that’s where things start to get tricky.

Within a couple of weeks of each other, BSF’s companies signed deals to bail out two firms: BlockFi (a crypto bank of sorts) and Voyager Digital (a digital asset brokerage).

But BSF isn’t out to put every beleaguered crypto company on his balance sheets. After all, he can’t print crypto money like the Fed prints fiat currency when in a bind. So he has to enforce some standards.

He walked away from a potential deal to acquire Celsius. The issue? He identified a $2 billion hole in the Celsius balance sheet.

Word went around that he had his sights set on a mega fintech: Robinhood Markets Inc. (NASDAQ: HOOD). But BSF said there were no active talks to buy the company, only the exploration of partnership possibilities.

So what does all this mean for crypto? It’s too soon to tell. In the short term, this could be a good thing. Crypto needs a good bailout to keep things afloat.

The question is: how can a decentralized token stay decentralized if the companies that run it start merging into one big monopoly? Once that happens, things can get pretty “evil”.

I kid. But it certainly gives BSF a lot of power to control the digital markets. Keep your ears peeled for how he intends to influence the industry because this mover and shaker could definitely have an impact … and soon.

Conclusion

The mood can change real quick in crypto land. Small changes can have a dramatic effect. And bigshot players can really sway public opinion on crypto’s value.

That’s why I created the Crypto War Room. It’s the tactical place to be when you want the latest crypto alpha. This stuff is my passion. I wouldn’t teach it if it weren’t.

I send my students the latest trade alerts, share the latest news, and offer strategies for where and when I think crypto opportunities will pop up. I hope to see you on the next webinar!