Hey traders, it’s Bryce here.

Matt and I sent out a watchlist on Sunday …

The stock at the top of our watchlist was Indonesia Energy Corporation Limited (AMEX: INDO). On account of the rising tensions overseas …

It was Tim Sykes’ and Jack Kellogg’s top stock too!

The price already spiked 100%* last week. As a result of Iran’s missile strike on Israel and Israel’s vow of a retaliatory response.

Oil prices rose while this was happening …

And since INDO is an oil and gas stock with a history of spiking, it’s not a surprise that we saw bullish volatility last week.

This week, everyone’s still on edge, waiting for the Israeli response.

Already, on Monday we watched INDO push 35% higher.

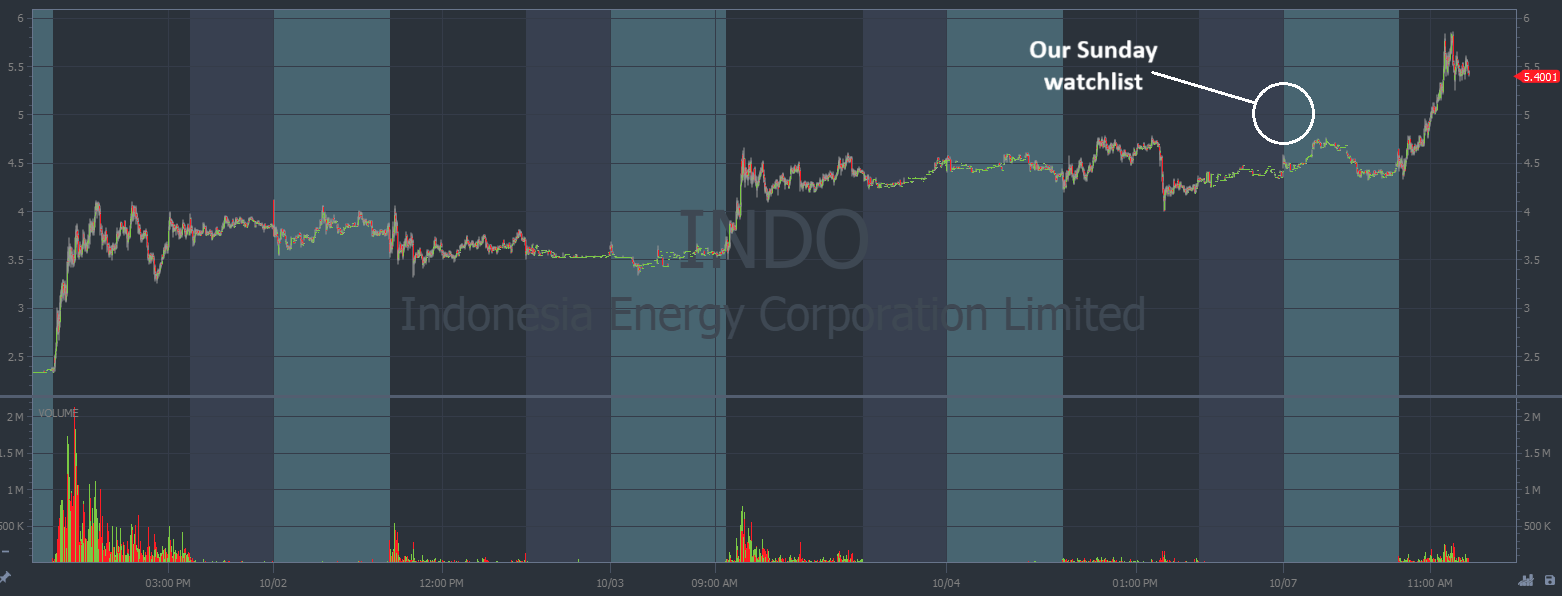

Take a look at the full chart below:

INDO chart multi-day, 1-minute candles Source: StocksToTrade

As I’m writing this, Israel has yet to respond.

And let me be clear: I’m not hoping for more violence in the world.

But, these global events can impact our opportunities to profit. As traders, we have to be prepared for a follow-up spike on INDO.

How To Trade INDO

The traders in our community, we’re not trying to time this price action perfectly.

The stock spiked 140%* since tensions started to build last week. But there’s no way we catch all 140%* …

Instead, we focus on key areas of support and resistance to take the meat of the move.

For example, on Monday, INDO showed us a decent breakout-trade opportunity.

On the chart below, you can see the previous day’s highs were $4.75. That’s a key level that we watched for volatility.

On Monday morning, the price bobbled around that level before pushing higher.

Every candle represents one trading minute:

INDO chart multi-day, 1-minute candles Source: StocksToTrade

We have textbook trade patterns that we can use to build positions on these runners.

For example, INDO showed us a perfect breakout trade. This pattern is part of my overall trading framework.

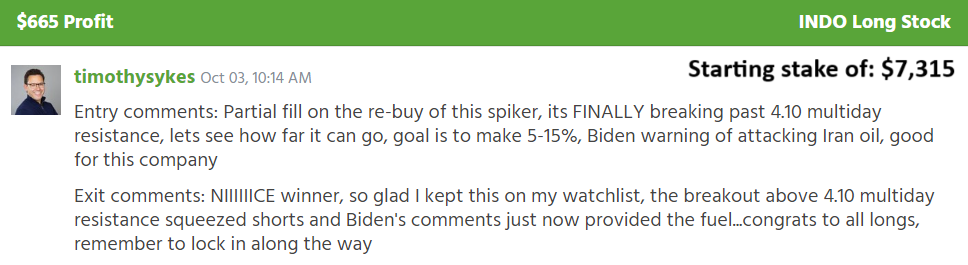

In fact, it was a very similar setup to Tim Sykes’ breakout trade on INDO from just a few days earlier, October 3 … You can see his trade notes below:

Source: Profit.ly

The most volatile stocks in the market, like INDO, can follow our trading framework because people are predictable during times of high stress.

That’s why these patterns repeat.

In fact, the stock movements are so similar, we even trained an AI bot to track these setups!

The newest traders in our community can enter their favorite ticker, and the AI will spit out a trade plan that follows our framework!

👉 Try It With INDO & This Week’s Hottest Runners

Cheers,

Bryce Tuohey

*Past performance does not indicate future results