Hey traders, it’s Bryce here.

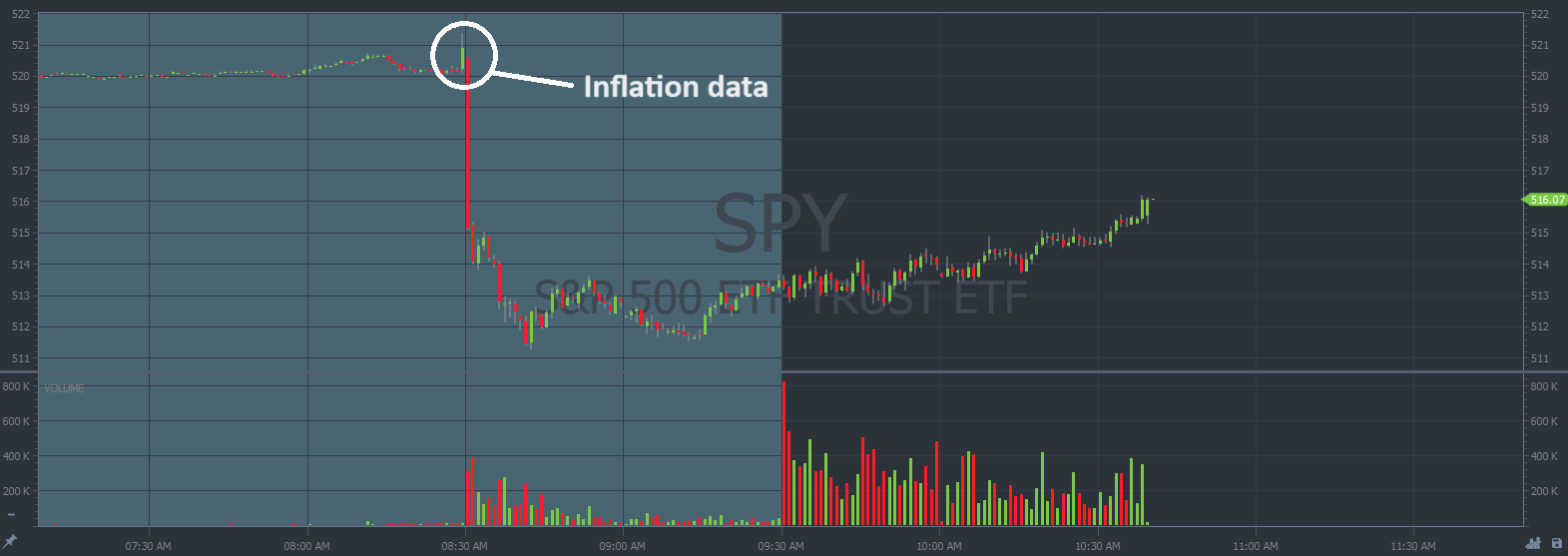

As of Wednesday, 8:30 A.M. Eastern, the larger market is operating with more fear.

That’s when we learned that the CPI inflation data for the month of March ticked higher.

Year-over-year, February’s data showed 3.2% inflation. Yesterday’ data showed March at a rate of 3.5%. Inflation is moving in the opposite direction. And it’s dashing hopes of an interest rate cut from the FED.

Below is a heading from yesterday’s publications:

Source: YahooFinance

The S&P 500 ETF Trust (NYSE: SPY) immediately sank at 8:30 A.M. Eastern after the news was announced.

On the SPY chart below, every candle represents one minute:

SPY chart intraday, 1-minute candles Source: StocksToTrade

Three out of four stocks follow the market. That means we’re likely to see fewer spikes if this bearish momentum continues.

Don’t worry, there’s always a profit opportunity in our niche.

But during overall bearish momentum, we have to be more selective.

The Strongest Runners

There are two main criteria that make a strong runner. We’re looking for a stock capable of spiking even while the larger market dips.

- It needs to have a bullish catalyst.

- There needs to be a reason for the run. Breaking News alerts us of the hottest news.

- It needs to have a low float.

- Stocks with a low float have a low supply of shares. The low supply helps prices spike higher when there’s a bullish catalyst.

We aim for a float count below 10 million shares.

But understand, this is an inexact science.

Today’s blog example spiked 220% with a bullish catalyst, but the float measures slightly over our goal at 16.9 million shares. That’s what I mean by an inexact science. In this case, 16 million shares was close enough to give us a really good spike.

The stock is called Marin Software Incorporated (NASDAQ: MRIN), the price launched 220% yesterday after announcing an enhancement of the company’s business while utilizing Microsoft advertising.

The price action is below. Notice how the stock announced news late in the day on Tuesday, spiked through after hours and premarket hours, and then pushed even higher intraday on Wednesday. Every candle represents 2 minutes:

MRIN chart multi-day, 2-minute candles Source: StocksToTrade

This next part is important:

If there aren’t any low floaters running with news, sit on your hands.

Now is not the time to make unnecessary trades. We have to wait for confirmed strength on the best setups. Then we trade the price action using popular patterns.

Top Trade Patterns Right Now

The hottest stocks in the market can follow popular patterns because human beings are predictable.

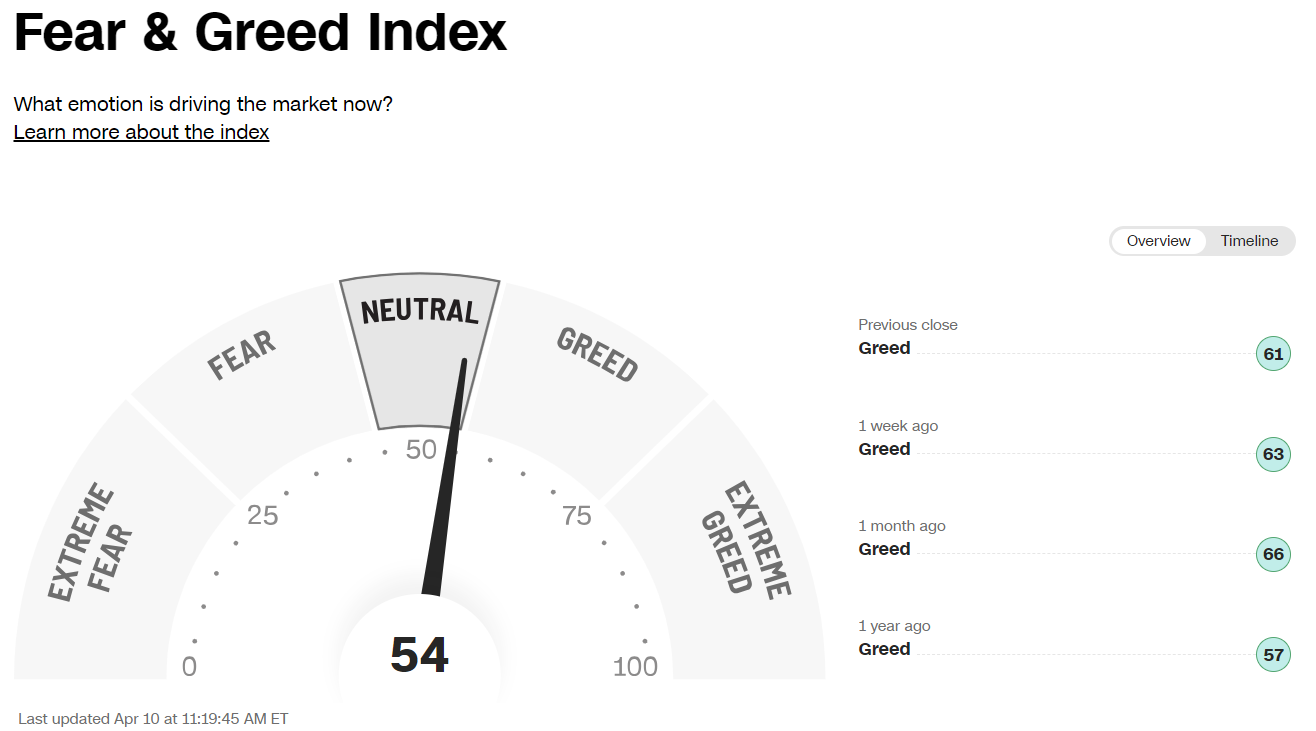

As a group, we’re especially predictable during times of high stress. Like when people are holding thousands of dollars worth of a volatile penny stock. It’s all because fear and greed move the markets. Both of those emotions can evoke A LOT of stress.

Here’s a look at the fear and greed index from yesterday. Before the CPI announcement the needle pointed further to the right:

Source: CNN

To capitalize on these emotions, we have to understand how they manifest in the market.

It’s not as confusing as you might think.

This is one of the most important tools that we use to map fear and greed in the market: Support and resistance lines.

Volatile stocks like to trade between key lines or levels because … People are predictable. For example, a nice whole number like $2 is more significant than a number like $1.93.

Now, there are a few different ways to capitalize off of these levels. But there’s one pattern that’s working really well right now. My mentor, Tim Sykes, details the entire strategy in the video below:

Now is the PERFECT time to learn this process.

When the market cools down, we get to hone our trading skills. And then once it inevitably heats up again, we’re in prime position to bank!

I know the inflation data looks a little bleak. But count it as a blessing. We’ve got some time right now to hone our trading skills while the market winds up for another push higher.

At some point, sooner or later, the government has to drop this catalyst. And when it happens, everything points toward an all out buying spree.

Prepare now so that you don’t have to play catch up!

Cheers,

Bryce Tuohey