Howdy, traders. It’s Bryce here.

Last week the markets made an incredible bounce off of support. There were even a few swing trade possibilities.

Check out the gap-up on Pineapple Energy Inc. (NASDAQ: PEGY) …

PEGY chart 1-day candles Source: StocksToTrade

And it was fun while it lasted. But the market’s back down by lows. So it’s time to prepare for a price dive.

Do you know what that means? No swing trading!

We’re not sure which direction the market will go. And that will determine the strength of spikes in our niche.

Now, since we’re on high alert, it’s important to only focus on day trading.

Stick to the patterns and get out before the closing bell. Overnight is a crap shoot.

Let’s go through an example of a runner already this week. If I want to profit on a stock, I’ve gotta know what to look for.

Ready?

Let’s go …

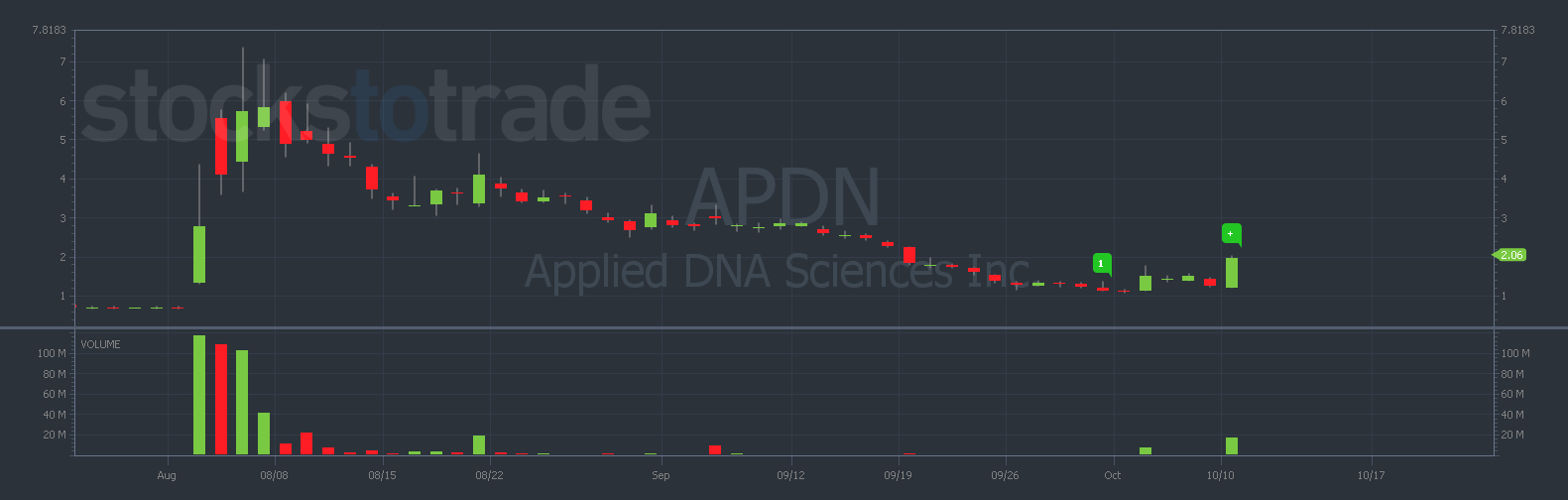

Applied DNA Sciences Inc. (NASDAQ: APDN)

First of all, let’s pay homage to the age-old saying … past spikers can spike again.

When I look for a stock to trade. I need evidence that it can go higher. And past spikes are a sign that a stock is capable of big moves.

Take a look at this daily chart of APDN …

APDN chart 1-day candles Source: StocksToTrade

Already great to see.

Then, I look a little closer and see some recent news.

What’s this? Applied DNA announces the largest order for LinearDNA™ in company history!

Things are starting to heat up …

The stock has a float of only 12 million shares. A low float like that indicates a small supply. And when demand goes up when there’s a small supply, prices skyrocket …

On Monday it spiked +70% and broke out over resistance from a spike on October 4, 2022. It traded 16 million shares of volume, making a whole float rotation.

These are the kinds of stocks we want!

- History of spiking

- Hot news

- Low float

- High volume

Don’t sleep on these stocks. Even though swing trading is risky, there’s plenty of intra-day opportunity.

Focus on the patterns. If you don’t see a setup, don’t trade.

I know you have questions about PEGY. Let’s go over the basics …

Pineapple Energy Inc. (NASDAQ: PEGY)

Right off the bat … this thing is overextended.

I’m actually glad to see the gap down last Friday.

There are only 1.5 million shares outstanding. Basically an ultra-low float.

But there’s not a lot of news to go off of. It’s basically just a semiconductor/solar play.

At the end of the day, we’ve got to respect the price action and the strength. If this thing keeps bouncing off support and consolidating sideways, there’s a chance it breaks out again. But it’s definitely a riskier play.

At the very least, study the chart and vow to do better during the next market bounce …

PEGY chart 5-minute candles Source: StocksToTrade

Conclusion

Market prices might slip through support.

If that happens, continue the day-trading setups. It’s possible to make money during bear markets. We just have to adjust the strategy.

That’s one of the biggest things I learned from Sykes.

Anyone can get lucky and profit in the market. But if you want to consistently profit. You’ve got to understand our market condition and focus on the appropriate part of the framework.

Sykes created the trading framework over 2 decades ago. It basically tracts fear, greed, and human psychology. That’s why it hasn’t changed all these years later.

Once I understood the framework I could apply it to any market. And that’s why I’m still a trader today.

Want to achieve consistent profits?

Tim Sykes showed me how … and I’m almost at $1 million.