Happy Thursday, traders. It’s Bryce here.

Today I’m gonna share my top three strategies for recovering after a big loss. If you’re committed to becoming a successful trader, you have to accept that losses are part of the game.

What you do after a big loss determines whether you come back to the trading screen ready to win again or drag yourself into a losing streak.

Because losses can shake your confidence and put you in the wrong head space. In trading, having the right mindset is everything.

But how do you take the right actions to get there? Click below for the three steps I take after a losing trade that help me come back ready to win again!

Check Your Size

I recently took a pretty large loss on AeroClean Technologies Inc. (NASDAQ: AERC). It was a bummer, especially since so many traders profited from this ticker.

FOMO (fear of missing out) never helps — you have to stomp it out of your mind whenever it creeps in. Instead, focus on something concrete that you can control.

The thing is, I went into that trading day with a plan to take some large risk on Redbox Entertainment Inc. (NASDAQ: RDBX) but I switched things up at the last minute.

And while I like the plan I improvised for AERC, I just had way too much size. In markets like this, size matters. If the markets are choppy, if you’re trying something on the spot, or any time you don’t have an absolute conviction on a trade, SIZE DOWN! Losses will hurt much, much less.

Step Away from the Screen — Clear Your Head

After my loss, I knew I needed to step away from trading the next day. I wanted to clear my mind.

Taking a deep breath and walking away helped my mind feel loose and free again. If thoughts came up about the loss, I focused on other things to get a new perspective.

Watch This BEFORE 9:30AM!

Have you seen what Tim Bohen has been up to EVERY morning between 9:29 and 9:30am?

If not, click here now because he’s getting ready to do it again.

Do NOT wait to see this.

You don’t want to jump back into trading after a big loss right away. If you do, you might be going into the markets with revenge in mind — a strong desire to make it all back right away.

That kind of mentality can actually lead to further losses if you’re not careful. You want to make sure you’ve completely let go of the loss and are ready to look at your next trade with brand new eyes.

When You Come Back To Trading, Ask Yourself This First…

Once you’ve cleared your head, it’s important to come back to your trading desk, even if it’s just to watch the markets. You don’t want to lose your edge by staying away too long.

But before you take a trade, ask yourself this, ‘What’s my motivation?’ Why are you back in a trade? Are you secretly hoping to get something out of it?

We all prefer to win, but it’s important to go into a trade following our plans without feeling like we need to win. This attitude is what turned my trading around this year.

I started 2022 with some significant red action, but I took a step back and came back strong. In the grand scheme of things, my roughly $10,000 loss on AERC wasn’t a huge setback, but as a veteran trader, I want to make sure I stop losses in their tracks.

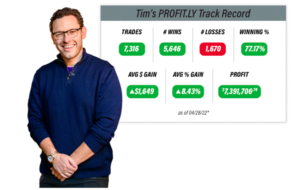

Learn the secret Tim used to turn a small investment into a fortune

I hope you can learn to do the same! Let’s get back to it better than ever.

Conclusion

Trading is one of the best challenges and opportunities I’ve ever taken on. It changed my life. But like with all things in life, it’s not always perfect, and that’s okay.

It’s what we do when things don’t go the way expected that can really take us to the next level. Are you learning from your mistakes or repeating them?

I want every trader to have the opportunity to come back from setbacks smarter and stronger than ever. I want you to be a resilient trader. That’s why I started Small Cap Rockets. When you get the full inside scoop and step-by-step instructions on the top strategies successful traders use under your belt, trading feels more real. You start to believe that you can do this too. That’s what got me started. I’d love to show you how you can make your trading dreams a reality!