What’s up, everybody? Bryce here.

If you survived the markets last week, congratulations. It’s brutal out there — saying anything less would be an understatement.

When the markets are bearish, it’s crucial to focus on only the best long setups.

In that spirit, Matt and I are limiting our watchlist picks to one each this week (plus a special honorable mention)…

But before we get to the picks, have you heard about the INSANE offer we’re running right now?

Don’t be the one to miss out! Check out our brand-new Small Cap Rockets trial now.

Bryce’s Pick

Now let’s get to the watchlist…

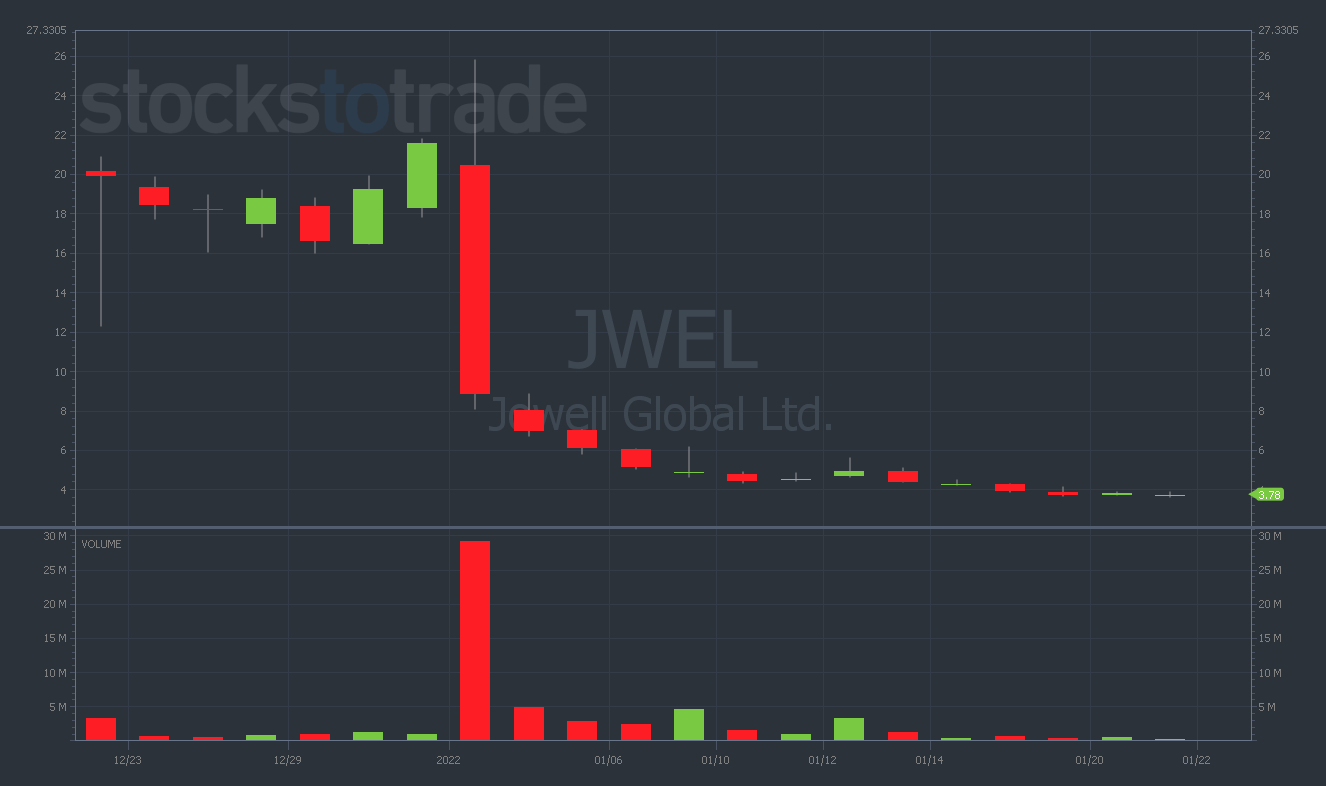

Jowell Global Ltd. (NASDAQ: JWEL)

JWEL is a Chinese e-commerce company that’s been getting serious juice on social media recently.

One look at Twitter or StockTwits is all it takes to notice retail traders’ enthusiasm around this name.

Sometimes, this level of FinTwit chatter is all it takes to get a small-cap going. But let’s consider the technicals as well…

Leading up to the new year, JWEL had been trading consistently between $17 and $20…

But on January 3, JWEL stock got completely decimated — from a high of $25.75 to a low of $8.

I mean, that’s insane. The stock lost 65% of its value in one single trading day!

“If you liked it at $25, you’ll love it at $4!” But seriously … I like it at $4.

I could see JWEL potentially pulling off a SOPA-style run over the next week.

Bottom line: It’s VERY difficult to find seriously juicy small-cap setups — like JWEL — in this bearish market. With that in mind, I’ll keep this one high on my watchlist.

Matt’s Pick

Greetings from the bear market, traders! Here’s my pick…

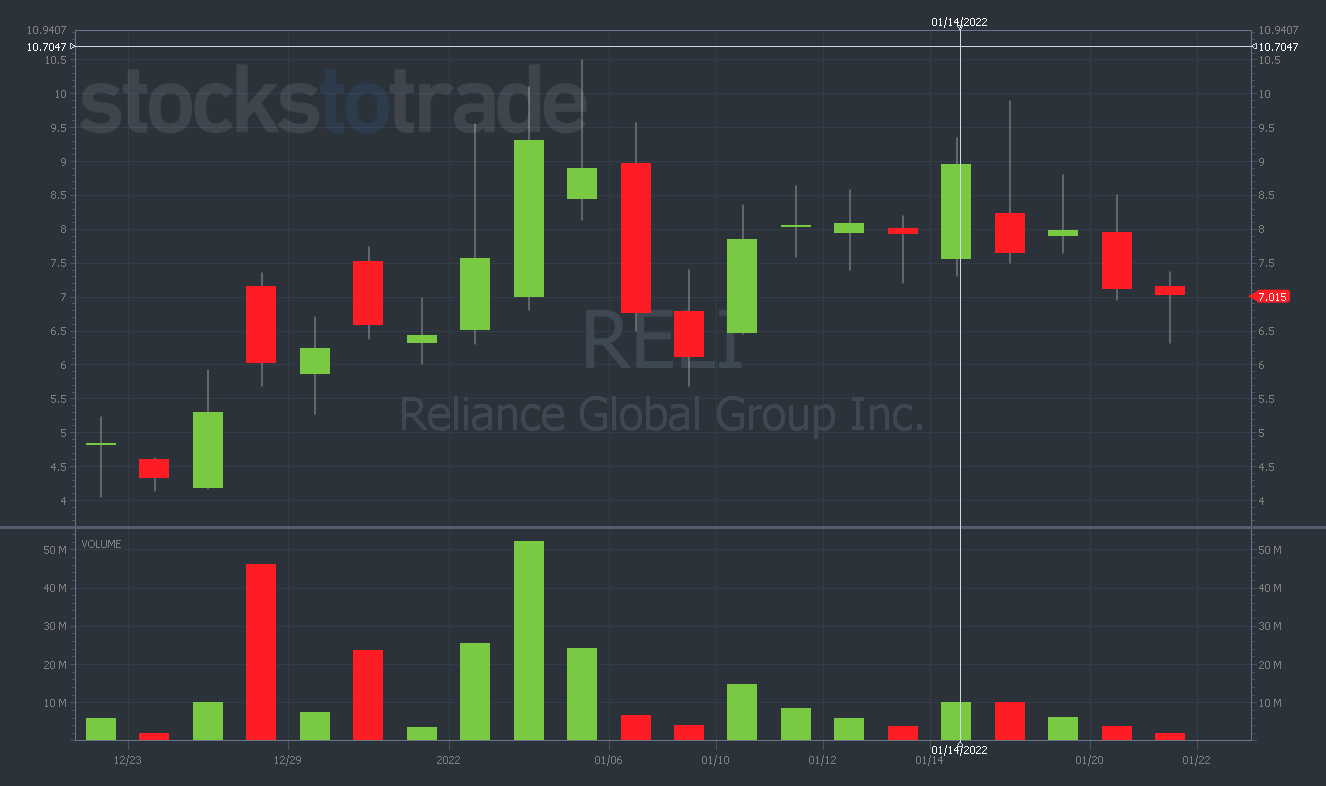

Reliance Global Group Inc. (NASDAQ: RELI)

Last week, I mentioned a low-float runner with the potential for a big boost — RELI.

Specifically, I called out the $9.50 level as the area to watch.

Sure enough, RELI made a swift move from $8.27 to $9.89 on Tuesday, the first day back after a long weekend. Congrats to anyone who banked on this!

Since then, RELI’s dropped over 30%, landing right back at support in the $6.35 area.

Now, a similar setup to last week’s could be emerging. I’m marking $6.50 as support and $9.50 as resistance.

I’ll be watching this channel next week, as any move within this range could be fair game for RELI.

WARNING: This company’s pretty sketchy, and this is a purely technical play.

But, man, can RELI run when it wants to — just look at what it did in February 2021 for some evidence of this.

NOTE: This is another example of why knowing your history is SO important!

Because I have a clear idea of what RELI has done in the past, I have more confidence in potentially trading the setup this time around.

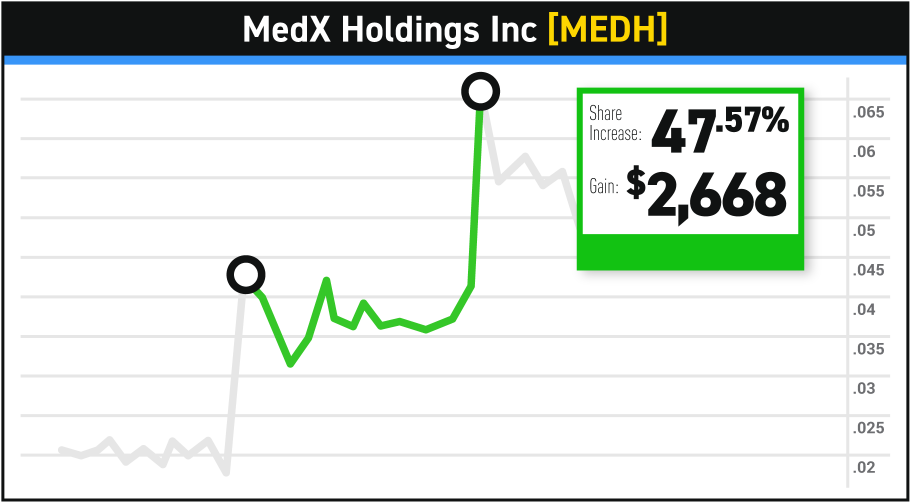

Honorable Mention: Why I’m (Still) Watching NFTs

I’m sure you witnessed bitcoin (BTC) crack below $40K and ethereum below $3K.

Just like a lot of tech stocks … cryptos are getting destroyed.

Believe it or not, there’s an inverse relationship between NFTs and cryptos.

When the crypto market is in the gutter, NFTs are rocking.

In fact, it’s been a record-breaking month for NFT sales.

Projects I’m currently watching include Azuki, HAPE Prime, WVRPS by WarpSound, and CryptoBatz

Final Word

This is not a very forgiving market.

Have a plan and trade it.

Stick to your trading rules.

Be nimble and agile.

Keep an open mind for new opportunities. If you’re struggling to find your way, don’t be afraid to try something else.

So if you haven’t done so already, make sure to register for Tim Bohen’s 24-Hour Rockets Trading Summit on Wednesday, January 26 at 8 p.m. Eastern.