Howdy traders, it’s Bryce here.

Despite the market choppiness this week … I’ve been able to find ample profit opportunities.

Bushels of opportunities. Barrels even!

Don’t listen to the doom and gloom from the media. All it takes is a peek through some rose-colored glasses. Want to try them on? Go ahead …

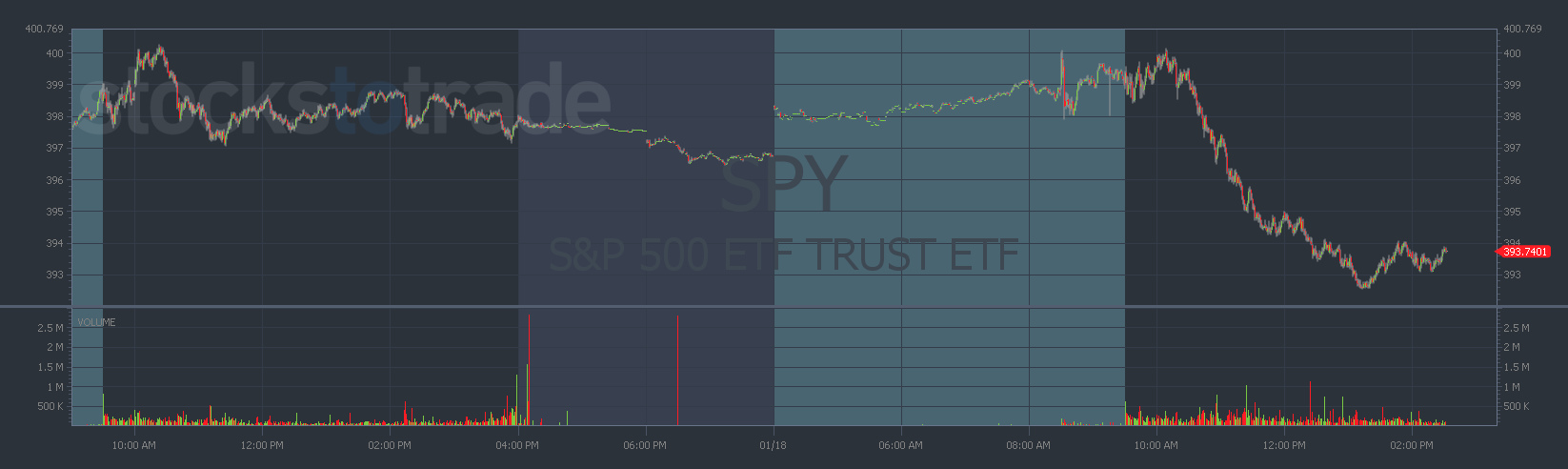

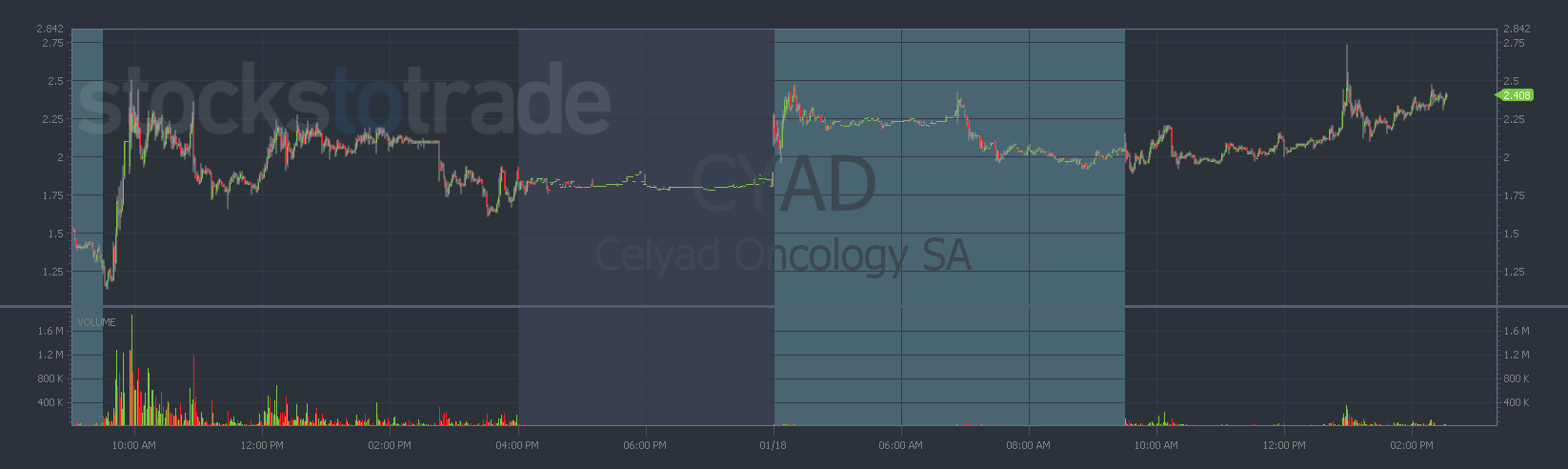

The past two days without glasses …

The past two days with glasses …

Celyad Oncology SA (NASDAQ: CYAD) is up +100% since Tuesday morning and it’s inching higher …

What you need, is your own pair of glasses.

After this letter, you’ll be able to find plays every single day.

Here we go …

Daily Profit Opportunities

Let me preface this by saying; I don’t trade every day.

Sometimes I don’t see a pattern I like, maybe I don’t see a safe enough opportunity, and sometimes I just don’t have time.

Also, trading all day every day would be exhausting. It’s good to take a step back and go outside for some oxygen every now and then.

So don’t feel like you’ve got to commit your life to this stuff.

Take a peak through the glasses, if you don’t see anything you like, go do something else.

That’s why trading is a great side hustle.

To find these opportunities, we focus on tickers that are already spiking.

Start a scan for stocks that spike more than 20% on the day.

Stocks that have already spiked can keep spiking.

And there are a few other things to add to the scan …

- Tickers below $5 spike higher because the price starts out so low.

- We want to trade plays with high volume, more than 1 million shares traded on the day. It shows liquidity and interest.

- A low float helps. Stock floats show overall supply. And a low supply will spike prices higher. A float below 100 million is a good start.

That’s it, four simple factors that you can plug into any free scanner.

I use StocksToTrade, it allows me to add a few more factors like breaking news and specific sectors.

The software also allows for seamless broker integration so I can see all my scans while I trade.

Once we’ve found the stock, we’ve still got to trade it.

That’s where patterns come in handy.

Trade Safely

Most newbies b uy a hot stock right when they find it.

They don’t wait to analyze the price action or create a trading plan. And that’s a recipe for disaster.

These tickers move hundreds of percentage points. It’s easy to get stuck on the wrong side and sell for a loss before the price spikes higher. Easy if you’re undisciplined and trading without a plan …

Rule #1 (Sykes taught me this): cut your losses quickly.

All traders lose. But the pros control losses so that the profits outweigh them.

I know on every trade there’s a possibility it falls apart. So I create a trading plan with that in mind.

If things get bad I know where I’m going to sell. Even if it’s for a loss.

Even the pattern Mark Croock shared last night, he enters each trade with a possible loss in mind.

Crook learned from Sykes too, as a result, we all have similar mindsets in that regard.

If you missed last night’s live stream, there’s a replay available.

Some of it was review for me, after all, we have the same trading mentor. But I learned a lot as well. About Mark, his strategy, and potential opportunities I’d like to explore.

Definitely check it out.

And next time the market shows you carnage. Make sure to put on your rose-colored glasses.

See you next time.