How’s your Thursday going? It’s Matt here.

The volatility in the markets lately is making some traders very excited. But do they have what it takes to succeed in an unpredictable market?

Two recent studies by Morgan Stanley and Goldman Sachs called the average retail trader’s bluff. They found that most of the retail traders who made their gains on meme stonks are officially in the red.

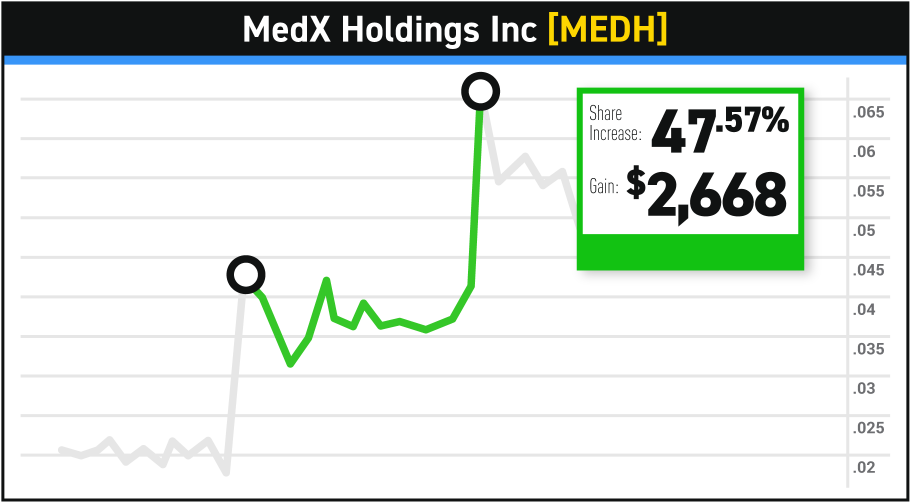

So, is that it? Did Wall Street beat Main Street? Not if my buddy Bryce and I have anything to say about it. I’m so proud of him for switching his strategy to capital preservation and posting some exciting stats about his gains.

My biggest trading flex is no longer making boatloads of cash, it's that I'm down 2.9% off of highs while ALL small caps $IWM are down 29% from highs, $SPY down 17.3% off highs, and the $NASDAQ is down 26.8% off highs.

Capital Preservation is the currently the name of the game. https://t.co/qqJtjuifnd pic.twitter.com/h6Wqw30MG7

— Bryce Tuohey (@TraderBryce) May 10, 2022

Meanwhile, the so-called ‘stablecoin’ TerraUSD (UST) suffered a major drawdown that had ripple effects on other crypto assets.

Let’s take a closer look at what went down — and how to protect your trades from the chaos…

How Did Stablecoins Become So Unstable?

In the crypto world, stablecoins were all the rage for a hot minute. Who wouldn’t want an asset that claims to be, um, stable … and produce annual percentage yields (APY) of up to 20%?

There’s just one problem with the whole stable part. UST is supposed to peg itself to $1 and maintain that rate, but yesterday, it crashed to a low of 26 cents. The broader crypto market sell-off triggered the UST algorithm into a panic sell, and poof … its value evaporated.

And the damage didn’t stop there…

UST’s sister coin, Luna (LUNA), lost around 98% of its value as a result of its association with the troubled coin. The move didn’t go unnoticed by Treasury Secretary Janet Yellen, who’s now calling for stablecoin regulation by the end of 2022.

Remember how the Federal Reserve had to backstop the U.S. economy during the whole pandemic crash? And how the government has money-printing powers that it uses in times of distress?

Well, UST and LUNA are attempting to mimic that process in the decentralized world. Do Kwon, the creator of UST, says he’ll increase the amount of new Luna minted each day in hopes that they’ll be consumed and help UST return closer to its $1 peg.

This is an unprecedented experiment in the crypto world. Traders should watch the results closely. We talked about the importance of the $30,000 key level for Bitcoin (BTC) yesterday, and how breaking it could lead to incredible buying opportunities.

Amid the UST and LUNA madness, BTC briefly dipped below that key level yesterday. I think the wisest thing for traders to do right now is to protect the capital they have, exercise patience, and wait for the real bargains to arrive.

Conclusion

Everywhere you look, the markets are going berserk right now. This is the best time to watch them, get to know them better, and strike when the opportunity presents itself.

I learned that from my mentor, Tim Sykes. He’s seen dozens of market cycles over the past few decades, and he has a feel for how they move, why they move, and what comes next.

That’s what excites me about being a part of his NFT Club — the opportunity to see history being made through the eyes of a veteran trader. Learning Tim’s skills — and applying them at the right time — made me more successful than I could imagine. And now, I get to help him help YOU level up as a trader. If you want to learn how to ride the next big opportunity to the moon, join us in the Tim Sykes NFT Club.