Bryce here.

Have you ever noticed that right when you settle into a good routine, something starts to change?

You’ve learned your favorite patterns. You’re comfortable with your trading plans. You’re taking care of your mind and body. You’re solid … right?

So why do you feel like things could be better if you just changed this or improved that?

And how do you know when it’s the right time to stick to your plan and when it really is time for a change?

Today we’ll explore how trading with a growth mindset can have a positive impact on your trading game and your life…

3 Ways a Growth Mindset Can Make You a Better Trader

Let’s take a look at the benefits of changing your routines at the right time.

1. Be Willing to Change Your Trading Goals

When I started out as a trader, I wanted to prove myself. I wanted to catch up with my mentors and I definitely wanted to become a million-dollar trader.

I was a start-up trader. And I got used to that high-intensity life fueled by dreams, ambition, and loads of caffeine.

Now, it’s time for me to approach the markets like a more established trader — like a seasoned pro would.

My main goal in trading was once exponential growth. But exponential growth is NOT always attainable. My goal now is steady growth and capital preservation. I NEVER want to blow up, and I'm extremely proud of myself for learning when to step away/use small size – it's underrated. pic.twitter.com/a87B3ztSsk

— Bryce Tuohey (@TraderBryce) April 12, 2022

Someone with a fixed mindset believes that the world should adapt to them. But the world doesn’t work like that. Circumstances change. And sometimes that’s a blessing in disguise.

Want to be alerted to hot trade ideas before anywhere else?

Breaking News Chat is the alert service that traders can’t get enough of. Two former financial analysts scour the Stock Market and news for stocks that could potentially spike and alert the room allowing you the chance to get in on the action.

Check out the alert for DWAC on October 21st:

This is a tool you’ll want in your trading toolbox.

A growth mindset can help you recognize when it’s time to change your mind and your game. I’m happy to be a medium-octane trader these days. At least until the markets take off in full force again.

Learning from the lessons of today keeps me profitable and in good spirits.

2. Try New Strategies and Routines

I had a rough time trading back in February, and it was frustrating. I had to take a closer look at my trades and mental capital to find out what was going wrong.

That’s when I realized that morning trades in this environment wasted a lot of my time and energy. If I suffered a downswing in choppy morning trades, I’d spend the rest of the day trying to make back the losses.

Even if I made back the losses, I wasted the most valuable thing: time. No more of that!

For the time being, I’ve switched to afternoon trading only. I’m giving stocks the time to prove themselves before I jump into a trade.

Waiting until the afternoon to trade has led to one of my most consistent months in a LONG time, despite a pretty ugly overall market. Let the best names prove themselves, set levels, and trade accordingly. Trading does NOT need to be stressful pic.twitter.com/kNFlCIZsbF

— Bryce Tuohey (@TraderBryce) April 12, 2022

I feel better about my trades and I’ve regained something priceless … my peace of mind!

3. Success Is a Big-Picture Game

When our minds get stuck in a certain pattern, it’s easy to lose sight of the big picture. We can get too focused on specific wants instead of listening to what we really need.

I kind of joked about this here…

By the age of 24, I never believed I’d have any of this:

• 8-figs in trading profits

• 3 houses, fully paid off

• 1 girlfriend who I love with all my heart

• 2 dream cars (Lamborghini and Rover)And I was right, I have none of it.

— Bryce Tuohey (@TraderBryce) April 9, 2022

The truth is I’ve already made a lot more money than many people my age. And more than that, I feel grateful that I had the time, money, and resources I needed to become a full-time trader.

Also, shifting to afternoon-only trading added work/life balance to my life. Now I get a healthy amount of sleep, go to the gym, and have more time and energy for being social (IRL).

My family’s visiting me in Austin this week! Sharing your good mood and success with the people you care about is a huge part of success, in my opinion.

Conclusion

The only way to stay successful as a trader is to learn and grow. That never stops, no matter how many gains you’ve made or how many years you’ve been in the game.

My mentor Tim Bohen knows that. He’s an OG trader who loves to read, learn, and improve a little bit every day.

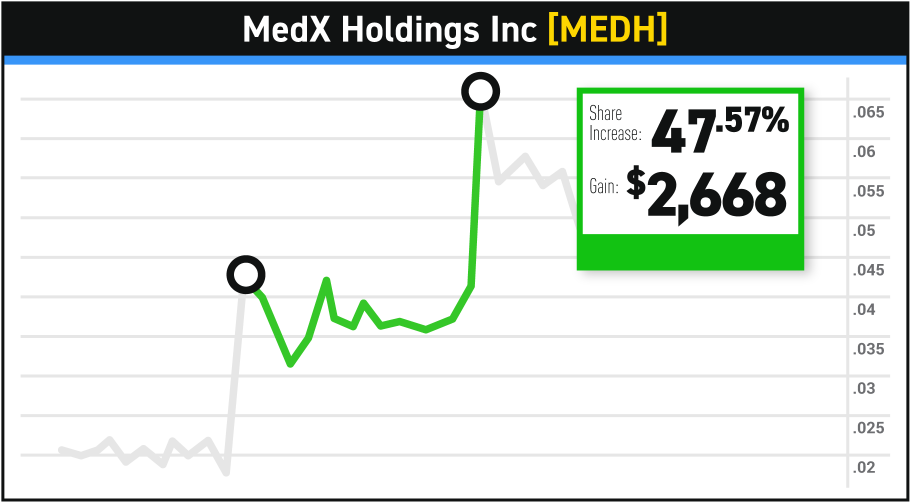

And us traders are in luck because he’s applied those skills to his newest project. He’s breaking down one of my all-time favorite and repeatable patterns for afternoon trades.

He’s nailed down a method that’s been so predictable for him, he calls it a “2 p.m. cash appointment.” And it’s backed by a unique algorithm designed to front-run the Wall Street fat cats who bring massive volume to this special afternoon pattern. Don’t miss this opportunity to learn how to spot this unusual pattern — sign up now!