Happy Tuesday, traders. It’s Bryce here!

Today, I’m doing something a little different. I’m putting my money where my mouth is. I’m walking my talk. I’m … you get the idea.

I always say that traders should see slower markets as an opportunity to discover new trading strategies and practice, practice, practice.

So I’m gonna help you do that by showing you how I trade step-by-step, just like we do in Small Caps Rockets.

Let’s take a close look at the trading strategies I’m using in THIS market! And how you can apply them to your future trades…

How Should You Trade in Today’s Market?

Let’s go over a few key things to consider when you start your trading day…

How Many Tickers Can You Watch?

You might notice on my video that I’m watching six stock charts at once. For some people, that’s a lot. In fact, one of my best mentors, Tim Bohen, tends to prefer to watch only two to three tickers at a time.

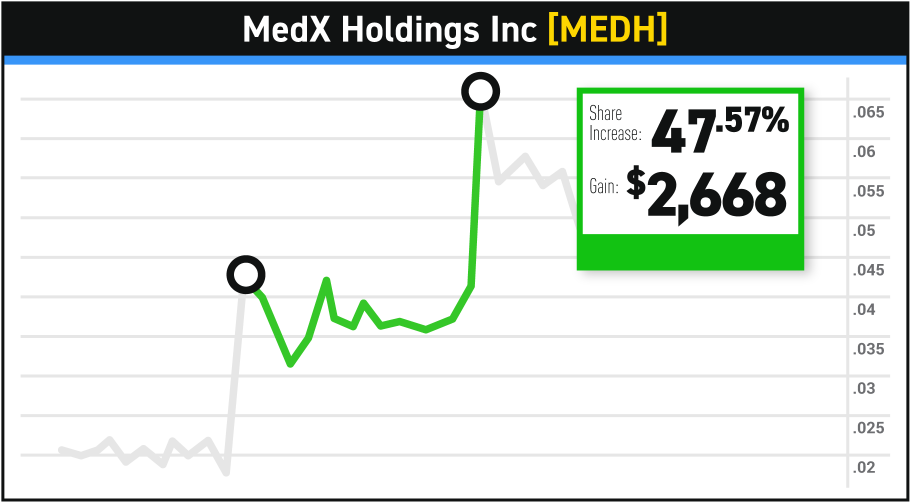

Are You Missing Out On Epic Trades?

StocksToTrade’s Breaking News Chat could be what’s missing in your trader toolbox…

You get two financial analysts feeding you stock news and alerts often before anywhere else while joining a community of traders like yourself.

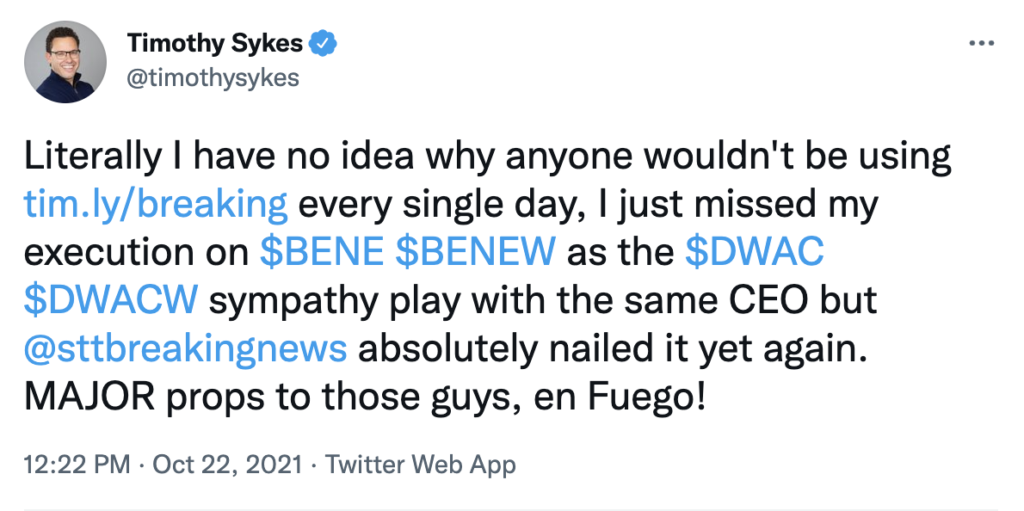

Tim Sykes encourages his students to use Breaking News Chat every day:

It’s all a matter of personal preference. You should experiment with this. If having too many charts open at once distracts you from making winning trades, cut down how many tickers you watch. If you can work with more though, go for it!

Know the Potential Catalysts Affecting Your Stock

As traders, we tend to jump on a stock breaking out on positive news. Whether it’s a buyout, an FDA clearance, or just a good earnings release, it pays to be quick when traders move in on a stock.

But do you know what news might affect your stock in the near future? In my training video, I go over one company’s potential to exercise warrants. Other times, a company might make an offering that causes the price to drop suddenly. You want to be able to anticipate these events when you’re in a trade.

Is the Stock Being Manipulated?

You can’t always see what’s happening behind the scenes, but there are clues. If you watch stocks for a long time, you’ll get a feel for how they move. Naturally, you’ll become suspicious when some stocks move in uncommon ways or don’t move much at all.

It’s easier to manipulate stocks with low liquidity. If a stock only has 6 million shares and a fund buys 4 million of those shares, they can buy half-long, half-short, box their trade, and force a small upside or downside move. Basically, they’re in control, and it’s best to get out of the way.

There’s SO much more to trading, and I go over some other key things to consider during my trading webinar. Watch until the end when one of my strategies left me screaming with joy!

Conclusion

Like any profession, there are many ins and outs to discover when it comes to trading. And one of the best ways to get ahead is to have someone who can show you the ropes.

That’s what helped me reach success at such a young age. I tried so many strategies and fell flat on my face until I followed in Matt Monaco’s footsteps and took on the Tim Sykes Millionaire Challenge.

Taking the Challenge provided the foundation I needed to build my own trading strategies with confidence. In the program, I found support, tons of informative material to discover, and the inspiration I needed to really light a fire under my behind. There’s no time like now to start your new trading career!